Insight Focus

The decline in urea prices has come to a temporary halt mainly due to uncertainty over the confusing export restriction policy in China. Other fertiliser markets are quiet. Ammonia could gain some temporary support from a Ma’aden plant shutdown.

Urea Awaits China News

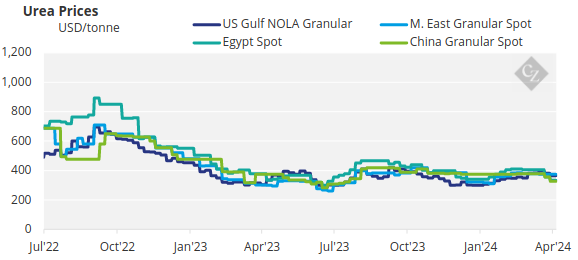

Rapid price declines in the urea market seem to have come to a pause. Since the beginning of the month, Middle East spot values have lost around USD 50/tonne with those in Egypt and Southeast Asia down USD 30-35/tonne.

Many FOB benchmarks have declined by as much as USD 100/tonne since the February peak. They are lingering close to the floor levels seen in mid-2023, a period that was followed by supply cutbacks and firming European energy values. The question now is whether prices will continue on the downward slide.

This week saw Qatar Energy sell prilled urea reportedly at USD 290/tonne FOB with the cargo going to an eastern market. Middle East urea is said to be hovering around the USD 280-285/tonne FOB level with little interest from prospective buyers. Iranian granular urea, which supposedly is sanctioned, was sold at around the USD 250-255/tonne FOB mark.

Offers from Brazil were around the USD 290-295/tonne CFR range. Prior to this, Brazil appeared ready to accept USD 315/tonne CFR.

The bright spot this week was the tender in Indonesia which saw about 85,000 tonnes of granular urea committed from Indonesian producer Kaltim, the majority of which is said to be for Australia. Freight to eastern Australia should be around the USD 25/tonne mark.

The major buying season for urea in Australia is between March and September, with around 80% of annual imports taking place over this period. The same applies to Thailand – and between the two, in a regular year, imports would be up to 5 million tonnes.

Again, the big question is China. The policy on export restrictions is at best confusing and there are rumours of potential tweaks or modifications to implementation on the back of increased domestic prices.

The uncertainty is not appearing to have much of an impact on the market yet. However, once China starts exporting at full force by the end of May and beginning of June, we might see some pressure on prices. For now, the irregular day to day Chinese export restriction situation has been priced into the market.

In major trading activity this week, Ethiopia’s EABC tendered for lots of 50,000 tonnes and prices received were USD 290/tonne FOB Egypt or USD 317/tonne CFR. The government of Pakistan is also considering importing around 200,000 tonnes of urea for the upcoming Kharif season which is between April and October.

The outlook for the urea market is soft to stable.

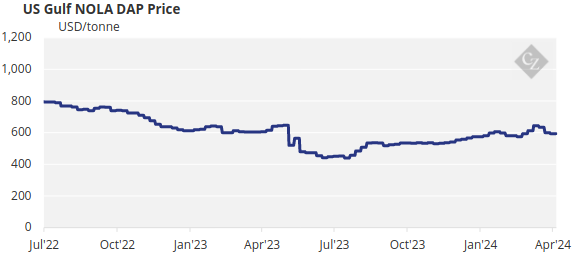

Processed Phosphate Sells Lower

Processed phosphate prices are under enormous pressure with Chinese DAP sold to India at below USD 530/tonne CFR. This is on the back of Chinese producers’ intention of not breaking a floor price of USD 530/tonne FOB – but market forces are imposing pressure.

It will be an interesting few months ahead with demand for processed phosphates waning in global markets. However, we may see Brazil come to some sort of rescue.

Chinese producers’ apparent average break-even is around the USD 475/tonne FOB mark. It is very likely that Chinese DAP could be sold sub USD 500/tonne in the next couple of months. The Chinese allocation for exports of DAP and MAP for the period May 1 to September 30 is set at 5.6 million tonnes and traders are aggressively selling at ever lower prices.

Prices for MAP barges in the US have collapsed USD 150/short ton (USD –/tonne), or 24%, over the past month amid a seasonal drop in demand.

The outlook for the processed phosphate market is bearish with price declines continuing over the next couple of months on the back of increased Chinese supplies.

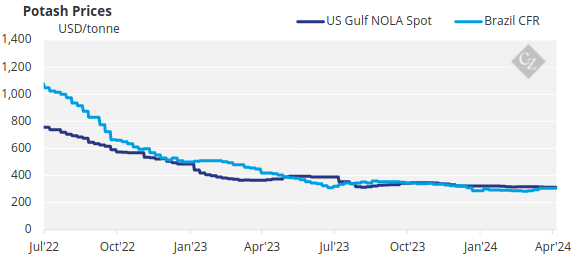

Potash in Holding Pattern

The international potash market has maintained the same pattern this week as last. Brazilian prices are holding between the USD 300-315/tonne CFR range and pressure is building on prices east of Suez.

The only exciting thing happening this week was BHP launching a takeover bid for Anglo American. The latter is in the process of constructing a rainbow potash project in the UK called Polihilite, and it will be interesting to see if BHP has any interest in this project with a view towards its own mega Janzen potash project in Canada.

Potash prices may continue to trend downwards in Southeast Asia and the US market, while Brazilian prices struggle to reach higher levels. European MOP prices are likely to soften as demand remains quiet.

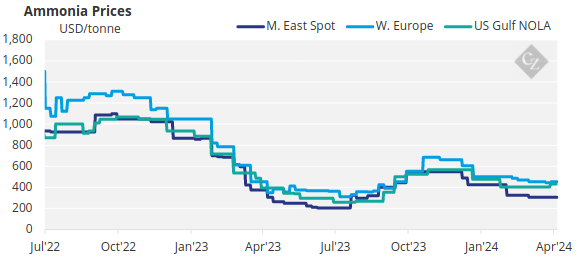

Potential Support for Ammonia Prices in East

The international ammonia market this week saw conflicting pricing with prices in Taiwan and China in the region of USD 375-430/tonne CFR while Iranian suppliers are said to be offering in India at sub USD 300/tonne.

Supply issues in relation to the Ma’aden maintenance of its 1.1 million tonne annual capacity plant would remove some volume from the market and assist in stronger prices in the east. Concurrently, the market is looking for price guidance towards Tampa for the May contract price between Mosaic and Yara.

The outlook for the ammonia market over the next few weeks could see prices in the East remain firm on the back of supply issues whilst western hemisphere prices could decline due to seasonality.