Insight into focus

China imported 220,000 tonnes of liquid sugar and 100,000 tonnes of premix powder in Q1’24. But customs have now decided to regulate whites imports in bonded area for liquids and premix. Could it affect China’s white sugar demand?

On April 18, the General Administration of Customs, together with the National Development and Reform Commission, the Ministry of Finance, the Ministry of Agriculture and Rural Affairs, the Ministry of Commerce and the State Administration of Taxation jointly issued the Announcement on Adjusting the Administrative Measures for Sugar in Special Customs Supervision Areas and Processing Trade Outside the Region (Announcement [2024] 44), effective July 1, 2024.

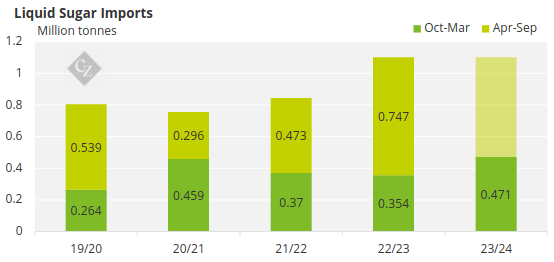

Q1 Imports of Liquid Sugar and Premix Powder Reach Record

With 100,500 tonnes of liquid sugar imports in March’24, total imports in the 2023/24 season reached 471,000 tonnes, a record for the period. This is equivalent to 315,600 tonnes of white sugar.

Source: China Customs, Czapp

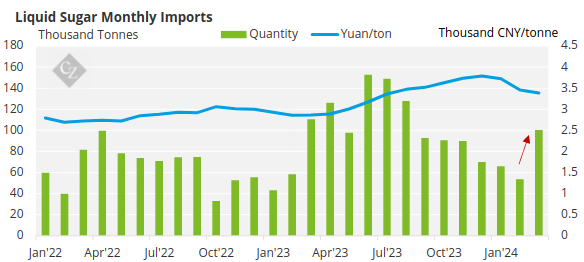

The import CIF price continued to fall to CNY 3,387/tonne, a decrease of 10.7% from its peak last December. This means a reduction in import costs and an improvement in profit margins.

Source: China Customs, Czapp

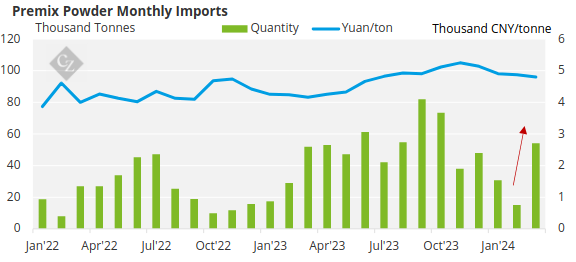

The import of premix powder also picked up in March, bringing the cumulative imports of 23/24 season to 260k tonnes, 125k tonnes higher than what it was last season.

Source: China Customs, Czapp

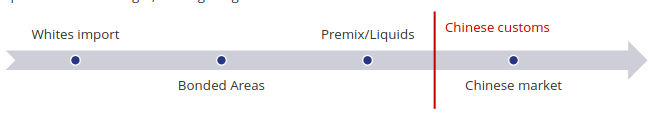

Whites Imports for Liquid and Premix Restricted in The Bonded Areas

One of the rumours has finally landed. Last week, China customs announced it would restrict re-exports of premix powder and liquid sugar from bonded areas to the Chinese domestic market, as of July 1 , 2024.

A quick reminder: importers used to import white sugar into bonded areas, process it into liquids or premix, and then ‘re-export’ it to the Chinese market. In this way, they could avoid the requirements of quotas or AILs on sugar, and high sugar tariffs.

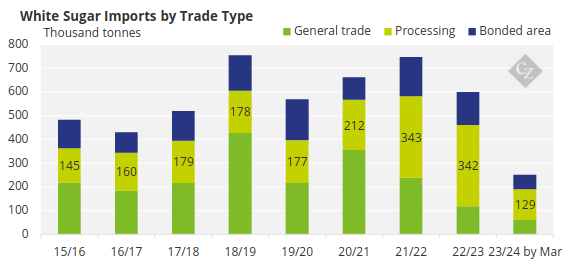

This process is no longer viable once the new regulations take effect. This should affect whites imports under processing trade and bonded trade. We think Chinese demand for white sugar imports could fall by around 150,000 tonnes.

*Jan-March

Source: China Customs, Czapp

China Remains One of the Largest White Sugar Buyers

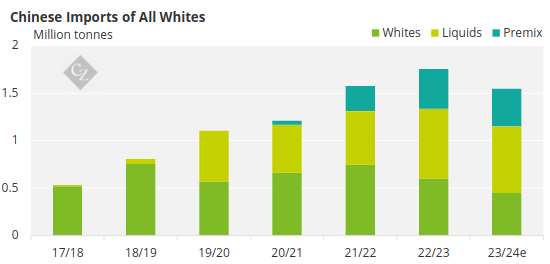

The reduction in sugar imports will not be enough to have a significant impact on the market unless there are controls on direct imports of liquid sugar and premix powder. In the 2023/24 season, Chinese demand for world market whites (Including indirect demand via liquid sugar and premix powder) should be around 1.5 million tonnes.

Source: China Customs, Czapp, dry weight equivalent