Welcome to the third and final instalment of Czapp’s course on the futures markets.

In the first episode we looked at what futures markets are and what goes into a futures contract.

In the second, we looked into how futures markets are used to facilitate global trade and how they can be used to speculate on commodity prices.

In this final part of this series, we will look into the futures contracts used to trade sugar globally.

How is Sugar Traded?

Sugar is an agricultural product, there is a large time lag between the decision to plant the crop and when it is harvested.

Sugar producers would like to be able to lock in the price of their crop in advance of the harvest to avoid being exposed to any price drops by the time it comes to harvest, reducing their revenue.

Likewise, consumers would prefer to lock in their price far ahead of when the product is required such that they are not exposed to any adverse upwards price movements, increasing their costs.

Since producers and consumers are continuously making and buying sugar this is an ongoing process, there is a constant stream of sugar that needs to be bought/sold.

This means that like many other agricultural commodities, sugar is traded on a futures market.

What are the Contract Details for Sugar Futures?

There are two main futures contracts that underpin the world sugar markets, (plus a third for the US domestic market only).

The New York No.11, traded on the ICE US market is the benchmark for raw sugar trading. The London No.5, traded on the ICE Europe market is the benchmark for refined sugar trading (and the No.16, the benchmark for US-grown or foreign origin duty paid, raw cane sugar). These contracts are physically settled.

The main difference between the No.11 and No.5 is the quality of sugar eligible, the No.11 is for raw sugar, an industrial product made from partially processed sugar cane, this is not fit for human consumption.

Source: Shutterstock

The No.5 is for refined sugar, the fully refined food-grade product you could buy in a supermarket.

Source: Shutterstock

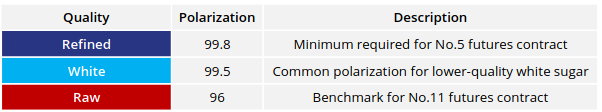

The quality of sugar is determined by its polarization and colour, which measure the level of impurities.

Polarization is a measure of how much the quality of a sugar sample interferes with a beam of light shone through it, (degree of optical rotation of plane-polarized light).

The lower the degree of rotation, the higher the polarization, the purer the sugar is (higher sucrose content). Since raw sugar contains more impurities, it has a lower polarization number than refined sugar. Pure sucrose would have a polarization of 100.

The term colour refers to a wide range of complex and molecular components that contribute to the overall appearance of sugar. Based on the measurement of the yellowness of the sugar, the colour is dependent on the residual molasses that are not removed in the refining process.

Colour is measured in ICUMSA (IU), the lower the number the purer the sugar, thus raw sugar has a higher ICUMSA grade than refined sugar:

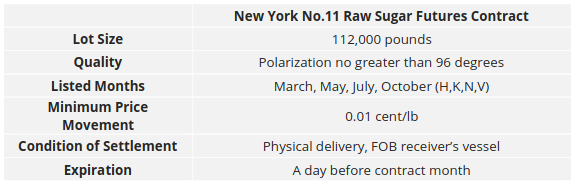

New York No.11 Raw Sugar Futures Contract

The No.11 is traded in lots equal to 112,000 pounds of raw sugar (around 50.8 metrics tonnes).

The price of a contract is denominated in US cents per pound, with the minimum price movement of the market set at 0.01 of a cent. There are no price limits or circuit breakers.

Raw sugar is an industrial product, therefore quality restrictions for the No.11 are not too strict. Sugar can be delivered with a polarization up to 99.5 (above this it is considered refined), though the benchmark grade is 96 degrees.

There are price penalties for sugar delivered below 96 degrees and price bonuses added for sugar delivered above 96 degrees, this is called the polarization premium. One major grade of raw sugar is Brazilian VHP (Very High Polarization) which has a polarization of 99.3 degrees, and thus receives a price bonus.

There are no formal restrictions on colour.

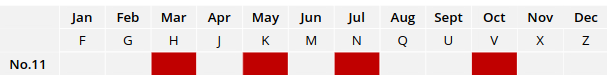

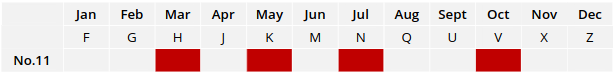

The No.11 contracts are listed against 4 months of the year: March, May, July and October (H, K, N, V).

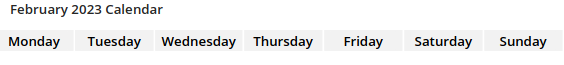

Trading for each contract ends the last working day before that month commences. For example, the March contract can expire as late as the 28th February, or 29th if a leap year).

Once the contract has expired, the shipment window for the sugar traded in the contract will open for 75 days, (e.g. 1st of March through to the 15th of May for the March contract).

Delivery of raw sugar can only come from a number of specified countries approved by the exchange.

The deliverer must make the sugar available at their port of choice from the exchange-approved list during this time frame, and the receiver must nominate a suitable vessel at the port at the same time. As well as this a load rate of at least 4k tonnes per day must be achieved.

The No.11 operates using the FOB Incoterm, the risk transfers to the buyer once the sugar is aboard the vessel.

Deliverable raw sugar must be loaded in bulk (poured loose into the hull of the vessel).

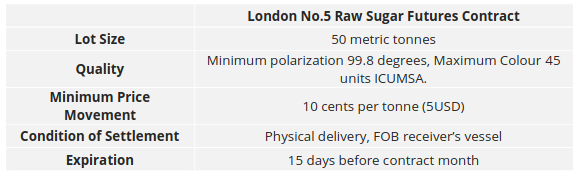

London No.5 Refined Sugar Futures Contract

The No.5 is traded in lots equal to 50 metric tonnes.

The price of a contract is denominated in US dollars per metric tonne, with the minimum price movement of the market set at 10 cents.

Since refined sugar is a food-grade product, quality requirements for the No.5 are much stricter. Sugar must have a minimum polarization of 99.8 degrees compared to 96 degrees for the No.11.

Additionally, the sugar cannot have a colour greater than 45 ICUMSA.

The No.5 is listed against 5 different months, March, May, August, October, and December (H, K, Q, V, Z).

This means for March, May and October it trades alongside the New York No.11 raw sugar contract.

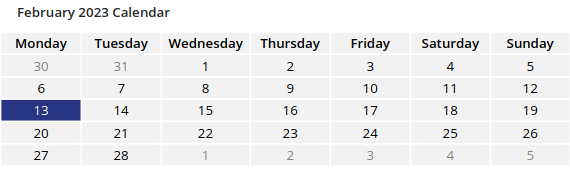

Unlike the No.11, a No.5 contract will expire 16 days before the contract month (if this is not a working day the nearest working day preceding it). This is usually around the 13th of February for the March contract.

Once the contract has expired the shipment window opens on the 1st day of the contract months and lasts two months (e.g., for the March contract the window is open throughout March and April).

Similar to the No.11 there are lists of suitable countries from which sugar can be shipped from, yet any appropriate port can be used. The receiver must nominate a suitable vessel at the port at the same time.

The No.5 also operates using the FOB Incoterm, the risk transfers to the buyer once the sugar is aboard the vessel.

Sugar must be packed in double lined Poly-propylene bags, it is then loaded into the hull of the vessel since the No.5 is a breakbulk contract. If the receiver and deliverer mutually agree, the transaction can be taken off-exchange and then containerised instead.

Sugar White Premium

Whilst many market participants only trade in either the No.11 or No.5 contracts, some actively trade in both.

For example, some sugar refineries buy raw sugar using the No.11 contract, refine the sugar to food-grade refined sugar, then sell it back to the world market using the No.5 contract.

It is therefore useful to understand the arbitrage (price difference) between both markets, called the white premium.

The white premium can help inform these refineries how profitable it will be to operate. A larger white premium should encourage these refineries to increase their production of refined sugar to the world market.

For other market participants and observers, the white premium can therefore be used to indicate the relative supply and demand conditions in the raw and refined sugar markets.

To calculate the white premium, subtract the current price of a No.11 contract from the current price of a No.5 contract. Remember the No.11 is traded in c/lb so first this price will need to be converted into USD/tonne (multiply the c/lb price by 22.0462 to calculate the USD/tonne price).

For example, if the March 2023 No.5 contract is trading at 560USD/mt, and the March 2023 No.11 contract is trading at 450USD/mt (20.41c/lb) then the white premium is 110USD/mt.