Explainer Focus

- The fundamentals of the global wheat markets.

- Where they are and how they function.

- How they facilitate the physical wheat trade.

Introduction

In The Basics of Wheat Part 1, we discussed the fundamentals of what wheat is, the types, where it is grown, who uses it and where the world’s stocks are held.

Here in Part 2, we are going to look at the markets where wheat is traded and how they work.

Markets

The Wheat Futures Markets

Agricultural product futures were the first derivatives markets in the world to actively trade. Their primary function, as is still the case today, was to allow producers, traders and users the ability to:

- Buy or sell their chosen product.

- At a specified price

- For a defined period of time in the future.

This ‘futures’ buying, or selling, allowed all parties to mitigate their risk, or ‘hedge’, their business against unforeseen and potentially volatile price movements.

Ultimately the wheat futures contracts can, for most markets be made available for collection or delivery, depending upon whether you are a buyer or a seller.

In the current world of trading, the majority of contracts are ‘closed out’ prior to the actual time of expiry.

This means that a buyer will usually sell his contracts back to, or a seller will buy theirs from the market prior to collection or delivery.

Thereby accepting the financial difference, or ‘cash settlement’, between the purchase and sale prices.

Some futures markets are based upon physical markets, but physical collection or delivery does not occur. In these markets, contracts must be ‘closed out’ and ‘cash settled’ prior to the date of contract expiry.

The type and quality of wheat on which trading is based

We have outlined, in ‘Part 1’, the main differences in wheat types, whether ‘Winter’ or ‘Spring’, ‘Hard’ or ‘Soft’. These descriptions are of importance in understanding the various markets.

The principle of each market is to represent the value of the type of wheat grown in that geographical area.

The main wheat futures markets traded around the world are here below. This is a simple and basic overview of the various markets. It is not intended to be a complete list or explanation of all contract specifications and/or details.

Minneapolis Hard Red Spring Wheat

- Contract unit: 5,000 bushels (approx. 136 metric tonnes)

- Price quotation: US dollars and cents per bushel

- Delivery months: March, May, July, September and December

- Physical specifications: USDA No. 2 or better Dark Northern or Northern Spring Wheat with a protein content of 13.5% or higher, with 13.0% to 13.4% protein deliverable at a discount.

- Settlement method: Physical delivery

Kansas Hard Red Winter Wheat

- Contract Unit: 5,000 bushels (approx. 136mt)

- Price Quotation: US dollars and cents per bushel

- Delivery months: March, May, July, September and December

- Physical specification: Deliverable grades of HRW shall contain a minimum 11% protein level. However, protein levels of less than 11%, but equal to or greater than 10.5% are deliverable at a ten cent (10¢) discount to contract price. Protein levels of less than 10.5% are not deliverable.

- Settlement method: Physical delivery

Chicago Soft Red Winter Wheat

- Contract unit: 5,000 bushels (approx. 136 metric tonnes)

- Price Quotation: US dollars and cents per bushel

- Delivery months: March, May, July, September and December

- Physical specification: No. 2 Soft Red Winter at contract price, No.1 Soft Red Winter at a 3cent premium, other deliverable grades listed in Rule 14104

- Settlement method: Physical delivery

Paris Milling Wheat

- Contract units: 50 metric tonnes

- Price quotation: Euro and Euro cent per metric tonne

- Delivery Months: September, December, March, June such that 12 delivery months are available for trading

- Physical specification: 15% moisture, 76 kilograms per hectolitre weight (kg/hl)

- Settlement method: Physical delivery

London Feed Wheat

- Contract units: 100 metric tonnes

- Price Quotation: Pounds and pence per metric tonne

- Minimum price fluctuation: 5 pence per metric tonne

- Delivery months: January, March, May, July, November such that 10 delivery months are available for trading

- Physical specification: 15% moisture, 72.5kg/hl

- Settlement method: Physical Delivery

Black Sea Wheat

- Contract unit: 50 metric tonnes

- Price quotation: US Dollars and cents per metric tonne

- Contract months: 15 consecutive months listed

- Physical specification and pricing basis: The Floating Price for each contract month shall be equal to the arithmetic average of the “FOB Black Sea wheat (Russia, 12.5%)” price assessment published by Platts for each day that it is determined during the contract month. The Floating Price shall be rounded to the nearest $0.01.

- Settlement method: Financially settled

Australian Wheat Futures

- Contract units: 50 metric tonnes

- Price quotation: US Dollars and cents per metric tonne

- Contract months: 12 consecutive months listed

- Physical specification and pricing basis: The Floating Price for each contract month is equal to the average price calculated for all available price assessments published for “APW Wheat FOB Australia” by Platts during the contract month rounded to the nearest $0.25.

- Settlement method: Financially settled

How the futures markets facilitate the physical wheat trade.

Traders and the Global Futures Markets

The trader’s position in the supply chain can perhaps be best described as the ‘Facilitator’.

Traders will buy from the producer, collecting from the farm. They will deliver to the user/processor buyer. This may involve a lorry from farm to processing plant, or it may also include storage and shipping.

To facilitate the pricing for each party, traders will often use the wheat futures markets to manage price risk, or ‘hedge’. This enables the producer to sell when they wish, while the buyer purchases at their will, as in the example below.

A producer will likely sell wheat for the ‘future’ when they see a price that is likely to return their business a profit over and above the costs incurred to grow the wheat.

A user/processor will likely buy wheat for the ‘future’ to lock in margin on sales of product.

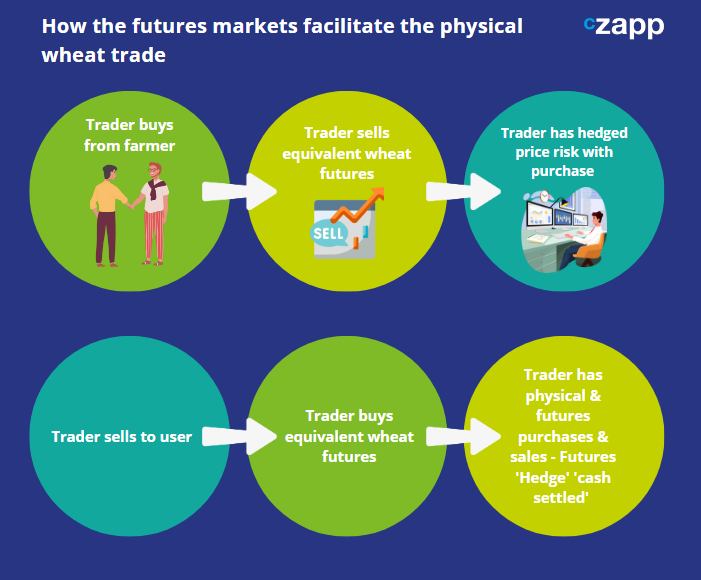

A trader may use the futures market to ‘hedge’ his physical contracts. By way of example:

- The trader buys ‘physical’ wheat from a farmer and sells an equal quantity of ‘futures’ contracts.

- On another day, the trader sells this quantity of ‘physical’ wheat to a user/processor and buys back the appropriate ‘futures’ contracts.

- The trader has a purchase and a sale of ‘physical’ wheat. The ‘futures’ contract has become ‘cash settled’ and was a mechanism for mitigating his price risk between the time of purchase from the producer and sale to the user.

A user/processor will likely buy wheat futures to mitigate their risk when selling their final processed product, thereby reducing exposure to price fluctuation in a similar way to that of the producer.

The wheat futures markets have, over time, established themselves as an integral part of the food supply chain from farmer producer to end user/processor.

The ‘futures’ markets enable a complex system of purchase, sale and delivery to be simplified and thus be significantly more transparent than could be achieved without their existence.

Conclusions

- Futures markets initially existed and continue to allow the pricing of wheat on any business day to manage price risk.

- Traders can hedge their risk, using the futures markets relevant to the types of wheat they buy and sell.

- Using these hedging mechanisms is fundamental to the smooth and profitable running of businesses in the wheat trade.

- Producers can sell and users can buy on days to suit their needs, while passing the price risk to the traders in the middle. In turn, traders use the futures markets to determine price and hedging.

- While futures markets may seem complicated to many, they are the lifeblood for price transparency and hedging allowing the smooth running of our food supply chain.