Introduction

Bioenergy is a source of renewable energy that is produced when biomass fuel is burned. Biomass fuels are made from municipal waste, agricultural and forest residues. Forest biomass, which includes all parts of the tree such as the trunk, branches, leaves, and roots, is the most used biomass feedstock.

Wood pellets are produced in a pelletisation plant, where wood residues such as saw dust or wood chips are combined and screened for quality. Following the quality check, the wood residues are heated to reduce moisture content and then converted into a fine powder before being pressed through a grate at high pressure to form a solid, short, dense wood pellet.

This report will primarily focus on wood chips and wood pellets because they are increasingly being used as inputs in the production of renewable heat and power.

Consumption

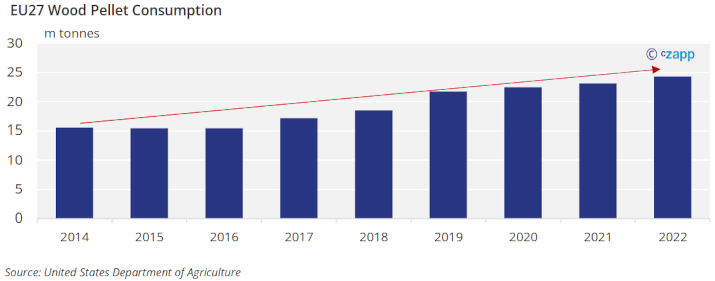

The EU is the largest consumer of wood pellets in the world consuming approximately 23.1 million tonnes per year. Wood pellets can generate power in the same way that coal does, allowing both the residential and commercial sectors to transition to renewable energy sources. Wood pellets can be used for heating at homes, or they can be used as a zero-carbon fuel in the industrial and commercial sectors for heat generation and industrial production.

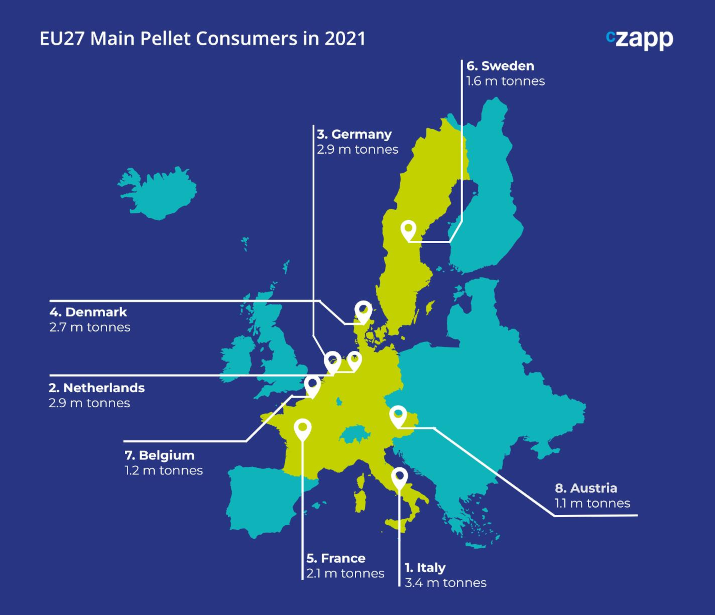

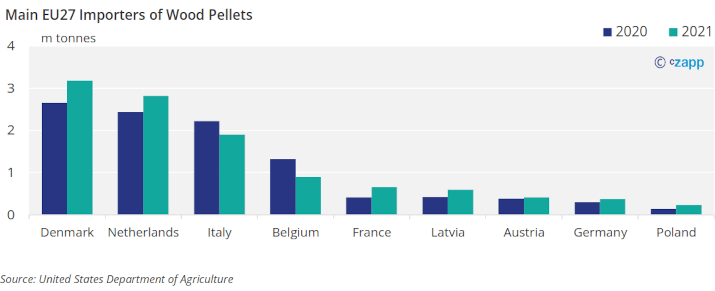

The top five wood pellet consumers in the EU are Italy, Netherlands, Germany, Denmark, and France consuming 3.4, 2.9, 2.9, 2.7, and 2.1 million tonnes respectively in 2021.

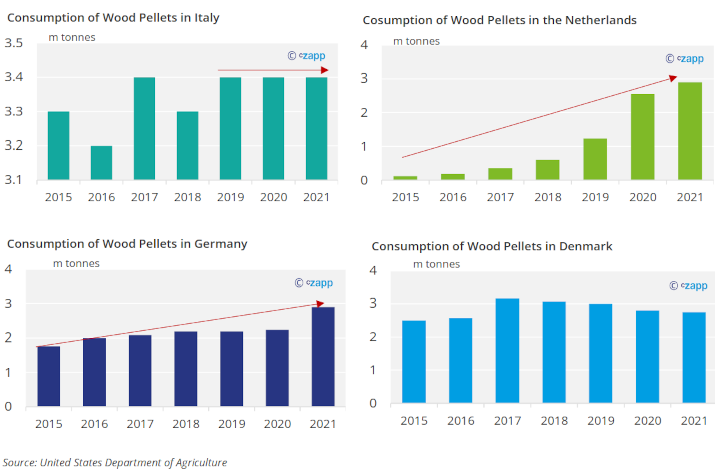

In the EU woody biomass is the most significant renewable energy source. The countries with the highest percentages of wood and wood products in their gross inland energy consumption were Latvia (29%), Finland (24%), Sweden (20%), Lithuania (17%), and Denmark (15%). The demand for wood chips in the Netherlands and Germany has grown significantly in the last five years. Meanwhile, consumption in Italy and Denmark has remained stagnant but still at high volumes. The largest consumers of bioenergy in the EU are Germany, France, Italy, Sweden, and the United Kingdom.

Consumption of wood pellets in the EU has been growing over the past decade as more homes and industries switch to renewable energy sources. The main factors that impact consumption for wood pellets in the EU are the weather and the prices of other energy sources.

The weather has a significant impact not only on the trees themselves, but also on the environment in which the plants, trees, and agricultural crops grow. Reduced soil moisture, for example, as a result of changing rainfall patterns, will have an impact on various plant and tree species in terms of growth and quality, affecting the production of forestry biomass. The price of other types of energy sources, such as oil and coal, affect the demand of forestry biomass. If prices for oil and coal increase, then demand for wood chips increases and vice versa. Currently in Europe, the increasing costs of electricity has led do high demand for renewable energy sources, meaning that there is high demand for wood chips at the moment.

Production

Production has been growing in the past decade to follow the growth in consumption as more homes and industrial producers switch to renewable sources of energy.

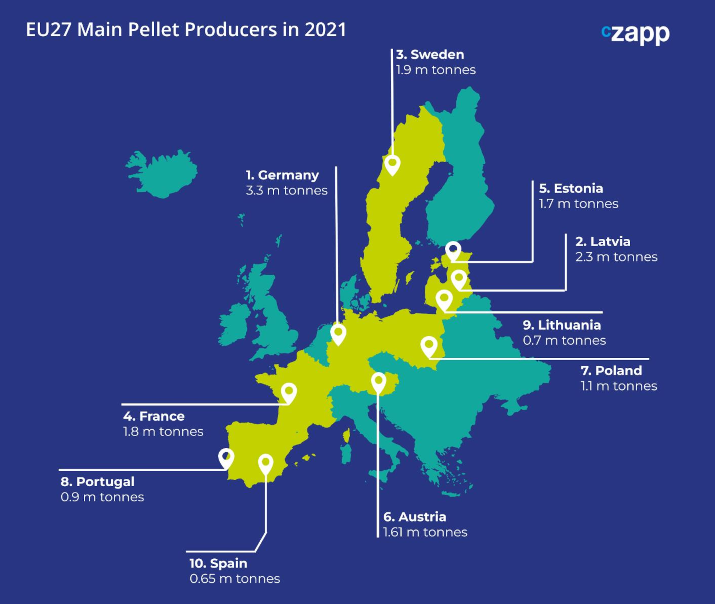

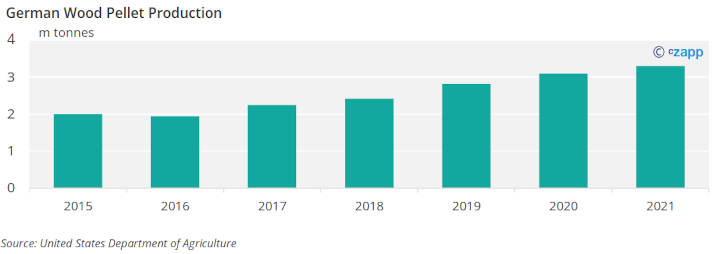

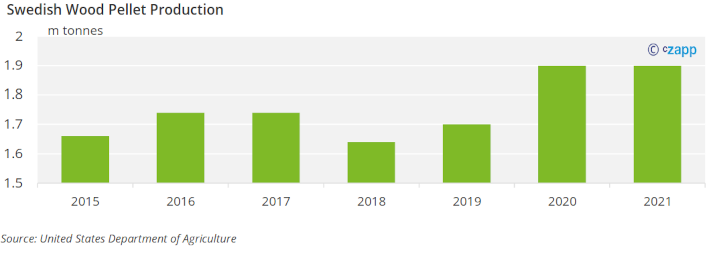

Wood pellets have emerged as a significant energy source used primarily for heating and electricity generation. The top five wood pellet producers in the EU are Germany, Latvia, Sweden, France, and Estonia producing 3.3, 2.3,1.9, 1.8 and 1.7 million tonnes respectively.

Due to increasing energy prices, demand for wood pellets has increased all over Europe meaning that the volumes countries would usually export are now being used to cover domestic demand.

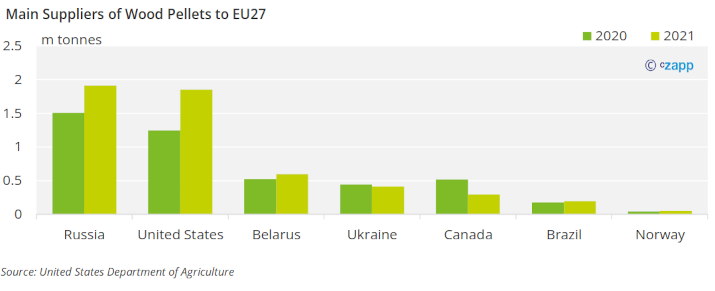

With 1.9 million metric tons, Russia was the largest supplier of wood pellets to the EU last year, followed by the United States with over 1.8 million metric tonnes and Belarus with 594,000 metric tons. However, after Russia’s invasion of Ukraine, imports of wood pellets from Russia, Ukraine, and Belarus have decreased significantly.

On April 8, 2022, the EU approved punitive measures against Russia, one of which included import restrictions. As a result, wood pellets from Russia are no longer permitted to enter the EU market. This ban puts pressure on the EU wood pellet market to meet demand. In addition, as energy prices rise, countries are consuming wood pellets rather than exporting them. As a result, countries that rely heavily on imports, such as Italy and the Netherlands, must find alternative ways to meet their wood pellet demand, such as through transatlantic trade. However, if transatlantic trade in wood pellets increases, quality standards and sustainability concerns may arise.

Wood pellet production in Germany, Latvia, and France has remained stable over the years, with the number of pellets produced increasing slightly year-on year. However, Sweden has seen a significant increase in the number of wood pellets produced over the last two years, which could be attributed to the implementation of the Swedish carbon tax, which has gradually increased over the years, causing industries and households to shift away from fossil fuels and toward renewable energy sources. Since, January 2018, bioenergy companies pay the same Swedish carbon tax as households and the service sector, which is around 130 €/tonne CO2. As a result, many businesses have switched from heating oil, propane, or natural gas to biofuels, including bio-oils and pellets.

Carbon Tax

According to the World Bank, Sweden has the highest carbon tax rate at €116.33 (US $137) per tonne of carbon emissions, followed by Switzerland and Liechtenstein (€85.76, $101) and Finland (€62, $73.02). Poland (€0.07, $0.08), Ukraine (€0.25, $0.30), and Estonia (€2, $2.36) have the lowest carbon tax rates in the EU.

Wood Pellets Trade Flows

Denmark and the Netherlands are two of Europe’s top importers of wood pellets importing around 3.2 and 2.8 million tonnes respectively. The Netherlands is one of the fastest growing importers of wood pellets, with 1.2 million metric tonnes imported in 2019 and 2.4 million metric tonnes imported in 2020. In the past year, Denmark imported more than 3 million metric tonnes of wood pellets from the US, Canada, the US, and Europe. Most of this wood is used to generate heat.

This increase in imports could be attributed to an increase in coal phase-outs in many European countries, as the EU strives to cut emissions by 55% by 2050. As a result, renewable energy sources such as forestry biomass will become more prevalent.

Furthermore, Denmark aspires to be one of the world’s most environmentally friendly countries, and in 2019, its Parliament passed a new climate law aiming to reduce greenhouse gas emissions by 70% below 1990 levels by 2030, with net zero emissions by 2050. This is a more ambitious target than the EU’s target of 55% reduction in emissions over the same time, which explains the increased use of wood pellets in recent years.

Sustainability Certifications and Concerns

As biomass wood pellets gain popularity as a commercial fuel source for residential and industrial heating, pellet quality certification standards emerge. In the EU, no sustainability certifications are currently required to produce biomass wood pellets. However, there are certifications available, and some consumers require them to ensure that the pellets are sourced in a sustainable manner:

ENplus (European Norm) Certification

Wood pellets are a renewable fuel made primarily from sawmill residues. Wood pellets are used as a fuel in both residential heating systems and industrial burners. They are a refined fuel that can be damaged during transport. As a result, quality management should extend throughout the supply chain, from raw material selection to final delivery to the end user. For this reason, ENplus provides certifications for:

- Producers

- Traders

- Service Providers

DINplus (Deutsch Industry Norm) Certification:

DIN stands for Deutsch Industry Norm. DIN CERTOCO pioneered the DIN Plus certification scheme for high-quality wood pellets in 2002. DINplus testing and certification for wood pellets ensures not only the production of high-quality wood pellets, but also the testing of products in qualified and recognised laboratories. The following properties are tested:

- Water content

- Bulk density

- Fine fraction

- Calorific energy

- Mechanical strength

- Chemical contamination

SGS Certification:

SGS certification is a certificate or report issued by SGS for compliance or testing services performed by SGS on a product or organization according to a country’s standards, regulations, or customer requirements. By combining global coverage with local knowledge, unparalleled experience, and expertise across virtually every industry, SGS covers the entire supply chain from raw materials to final consumption. Services provided are as follows:

Inspection: SGS provide testing and verification services such as checking the status and weight of traded goods during transit, helping to control quantity and quality, and meeting all relevant regulatory requirements in different regions and markets.

Testing: SGS has global network of test facilities that is staffed by knowledgeable and experienced people that can help reduce risk, reduce time to market, and test the quality, safety and performance of products against relevant health, safety and regulatory standards.

Certification: Through certification, SGS can prove whether a product, process, system or service meets national and international standards and regulations or customer-defined standards.