Insight Focus

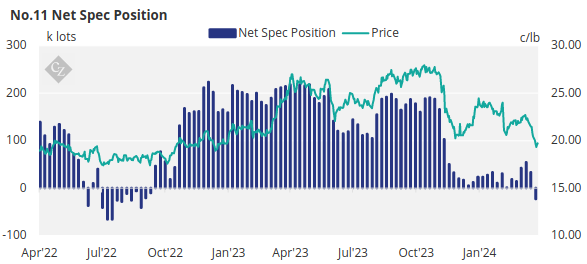

Raw sugar futures have dropped below 20c/lb for the first time since March 2023. This weakness has been accompanied by significant speculative selling. Speculators are now net short raw sugar for the first time since October 2022.

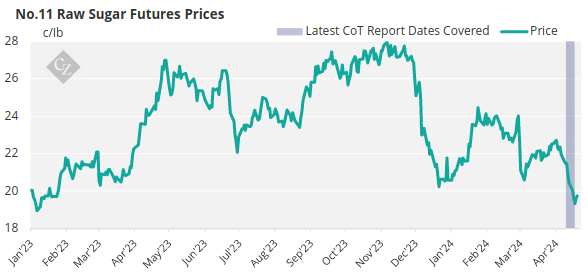

New York No.11 Raw Sugar Futures

No.11 raw sugar futures fell below 20c/lb in the last week, closing at 19.7c/lb on Friday. White Premium (Arbitrage)

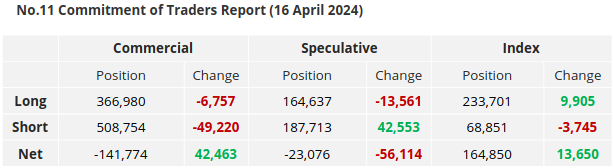

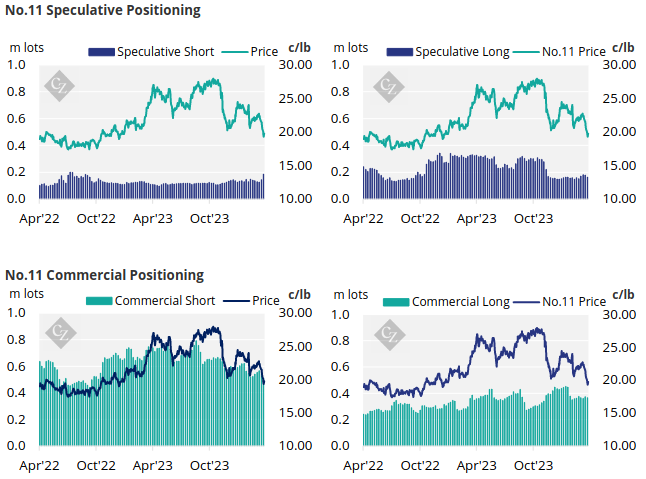

Speculators have opened a significant number of short positions, adding 42.6k lots after prices dropped below 20c/lb. This has resulted in the net spec position being short for the first time since October 2022, when the market was last in the 18-20c/lb range.

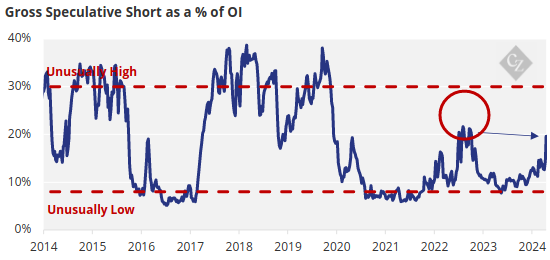

This is also the first time since August of 2022 that the gross spec short as a percentage of OI has hit 20%.

Looking at the commercial participants, producers have closed over 49k lots of short positions. Likewise, consumers have also closed 6.7k lots of recently opened hedges.

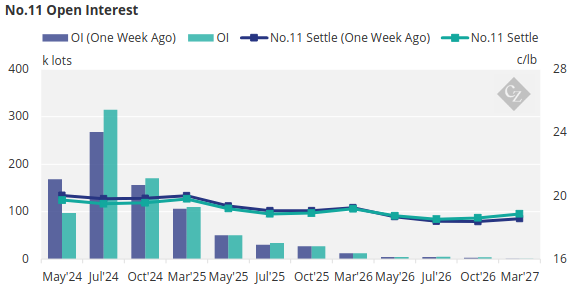

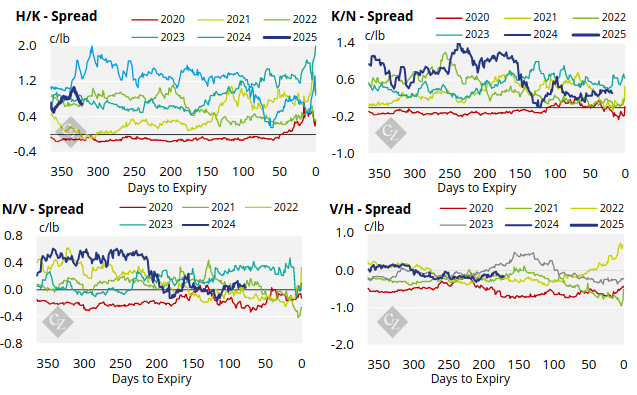

Since our last update, the No.11 curve has flattened.

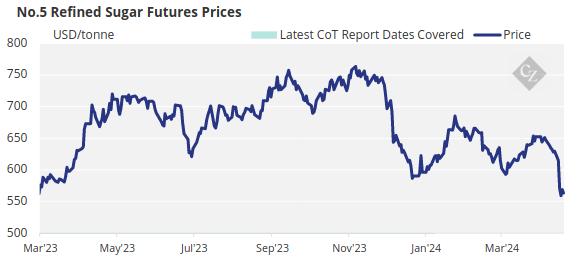

London No.5 Refined Sugar Futures

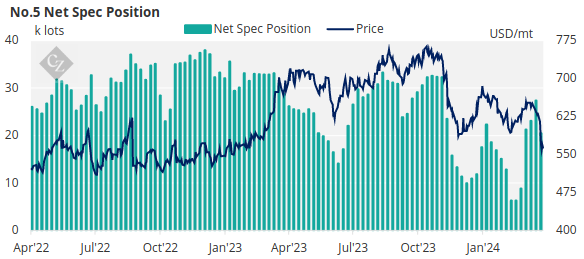

Like the No.11, the No.5 refined sugar futures contract has also dropped, trading at USD 563.5/mt by Friday’s close.

Speculators have closed out 6.9k lots of recently opened hedges in the past week, bringing the net spec position down to 20.5k lots.

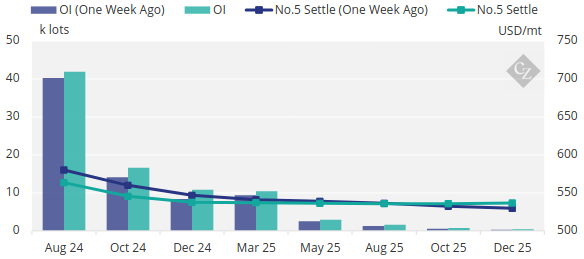

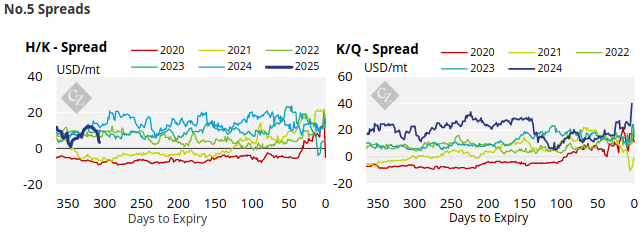

The refined sugar futures curve has flattened in the past week, with the curve remaining in backwardation through to Oct’25.

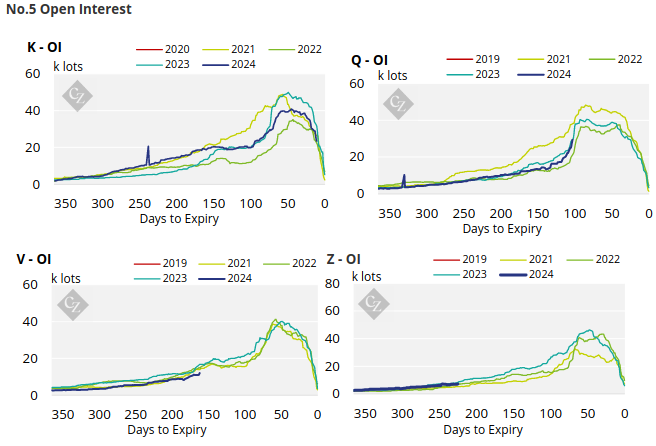

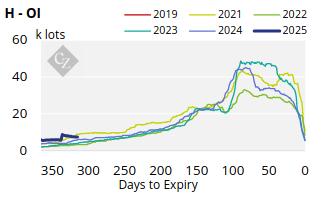

No.5 Open Interest

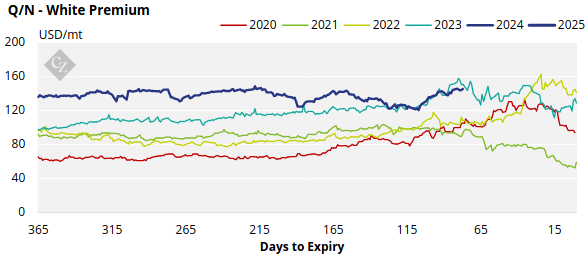

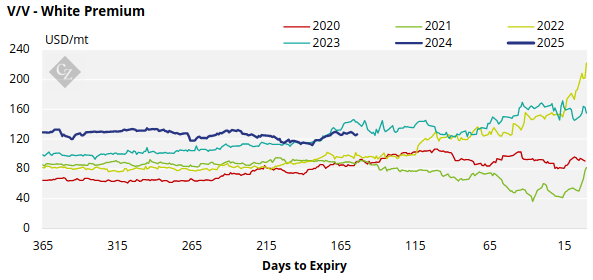

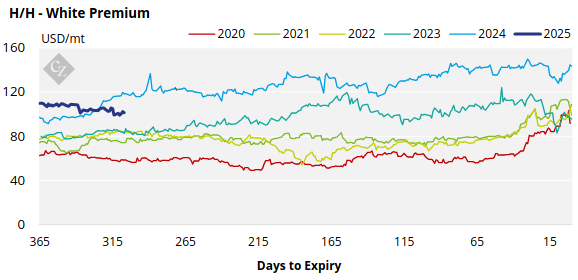

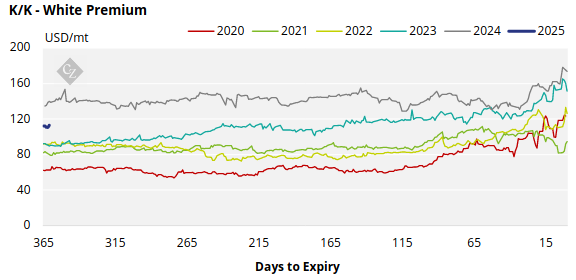

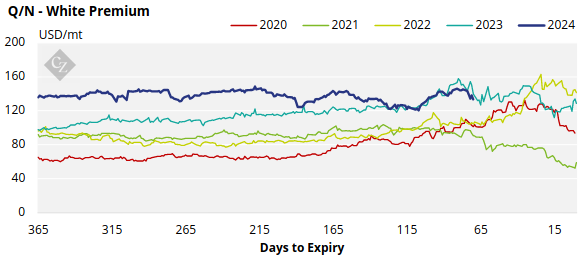

White Premium (Arbitrage)

The Q/N White premium currently stands at 133.6USD/mt.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar. The current white premium is well above this level, which means we should theoretically see a pick up in demand soon.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

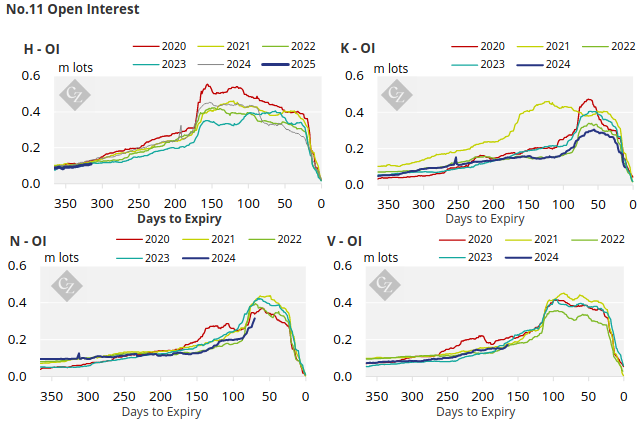

No.11 (Raw Sugar) Appendix

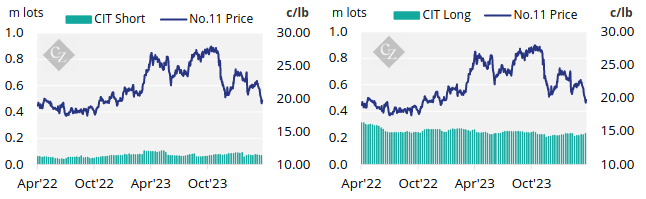

No.11 Index Positioning

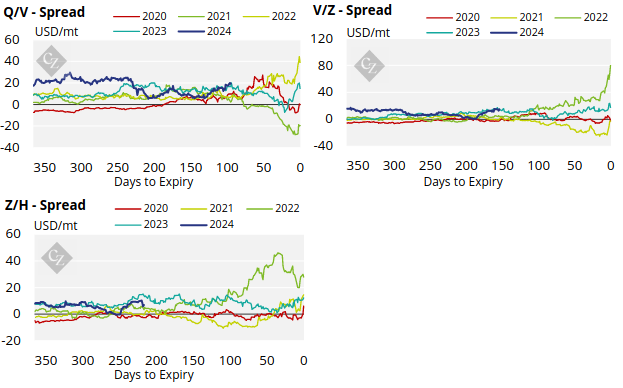

No.11 Spreads

No.5 (White Sugar) Appendix

White Premium Appendix