Insight Focus

- The white premium is backwardated through 2024 and into 2025.

- Why does it get cheaper through time?

- What does this mean for re-export refiners?

Sugar Production is Growing

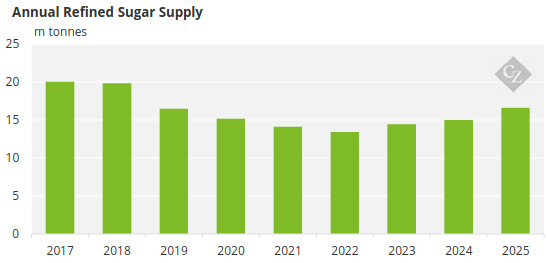

Sugar’s production surplus in the 2024/25 season could be the largest since 2017/18 at 4.7m tonnes. We tentatively expect 2025/26 to deliver an even greater production surplus.

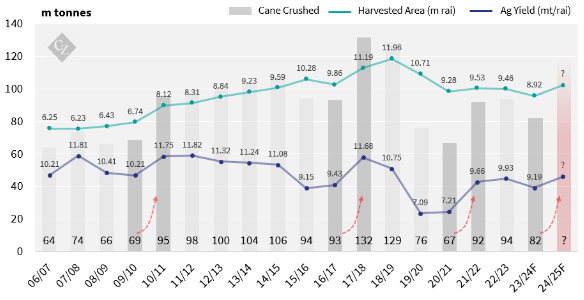

This means that sugar production is finally responding to high prices. We hope for a cane rebound in Thailand; cane should be the best returning major crop there for the first time in 5 years.

Not only that, but there are better European beet prospects. Thanks to higher prices, beet area in the EU for the next season (2024/25) may increase by up to 5%.

Of course, this increased production is welcome. Global sugar stocks can rebuild after several years of being run lower. However, it is important to note that the Thai and EU crops are a long way from harvest and are still vulnerable to the weather.

What Does This Mean for Refiners?

Thailand and Europe are both refined sugar suppliers to the world market. Additional supply from these origins could weigh on the white premium. Owing to firm freight rates and energy prices, many of the world’s re-export require a white premium of more than USD 100/m to operate profitably.

Some of the higher cost toll refiners may struggle as additional Thai and European supply becomes available and white premiums decline.