Insight Focus

- While corn planted area is falling in the US, stocks are still extremely high.

- Any wheat gains due to Russia’s attacks on Ukraine began to reverse.

- The next big indicator for fundamentals will be the northern hemisphere’s planting season.

There were mild gains in Chicago following the USDA prospective planting report, and weekly losses on the Euronext. We are now entering planting season in the northern hemisphere and weather is the key factor that will potentially bring some volatility.

By the end of June, we will know if corn acreage in the US has been reduced by as much as the USDA is suggesting or not. There are now cheaper inputs than last year, and crop rotation may limit the number of acres.

In any case, short term supply is ample, limiting any upside caused by the lower projected area. There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop to average in a range of USD 4.15/bushel to USD 4.4/bushel with an upside bias. The average price since September 1 is running at USD 4.58/bushel.

Grains Down on Higher Stocks

Corn and wheat in Chicago closed the week positively and the Euronext closed negatively.

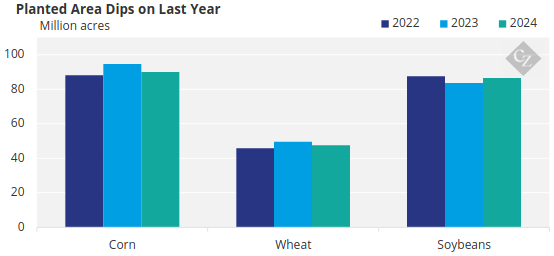

The USDA prospective planting report was released last Thursday, which caused a rally in Chicago grains. As expected, the USDA published projections of lower corn and wheat acres in favour of soybeans.

Corn was estimated to take up 90 million acres compared with 94.6 million acres for the previous crop. Soybean acres were estimated at 86.5 million acres versus 84 million acres for the last crop. And wheat was estimated at 47.5 million acres, down slightly from the 49.5 million acres of the last crop.

Source: USDA

The prospective planting report was no surprise given the fall in corn prices and the persistently high costs of inputs, which have left farmers with poor margins. This is leading to the reduction of acres in an effort to balance the market.

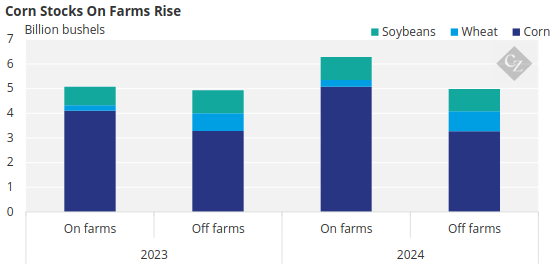

The quarterly stock report as of March 1 showed higher stocks for all grains. Corn stocks were pegged at 8.35 billion bushels — 13% higher year over year but below expectations of 8.4 billion bushels.

Interestingly, on farm stocks were up by a sizable 24% year over year, which has provided the main support for prices. Wheat stocks on farms reached 271.9 million bushels, up 19.5% year over year. Meanwhile, soybean stocks were 1.85 billion bushels – a 9% year over year growth and above the 1.83 billion bushels expected.

Source: USDA

In Brazil, the first corn crop is 42.8% harvested versus 41.9% last year. Safrinha corn (the second and larger crop) planting is virtually finished, ahead of last year’s schedule.

Wheat Market Corrects After Gains

The UK Agricultural Office left its wheat production forecast of 13.98 million tonnes unchanged. This marks a 1.56 million tonne drop year over year. The European Commission forecast wheat production at 120.8 million tonnes, down from 125.6 million tonnes last year.

Last week started negative in Chicago in a correction of the expressive gains of the previous week, which were fuelled by the Russian attacks on Ukraine port infrastructure. These attacks continued throughout last week, but apparently, they did not cause any disruption to exports. Wheat continues to flow out of Ukraine and any risk premium in the market should disappear going forward.

Weather Conditions Mixed

Dry weather is expected across the US Corn Belt, but drought conditions improved slightly with 23% of the corn area impacted, down from 34% last week. About 17% of the wheat area was affected compared with 12% last week.

Brazil is expected to receive rains in the centre west, while the rest of the centre south is expected to remain dry. Rains are also expected the north of Argentina. Europe is expected to continue receiving rains.

The European Commission in its MARS report said excess rains may delay planting of spring crops in key regions of Northwestern Europe. It was not concerned about wheat yield, which had already been reduced in its February report. The EC forecasted corn production at 69 million tonnes, up from 62.3 million tonnes last year.