Insight Focus

- European PET industry staged a dramatic come-back in Q1, further upside recovery limited.

- EU PET resin prices remain static, buyers hoping to see lower values in April/May.

- Low-priced Vietnamese resin still most competitive option, availability increasingly constrained.

Market Overview

As we approach April and the Easter break, the current European PET resin market somehow finds itself at a turning point.

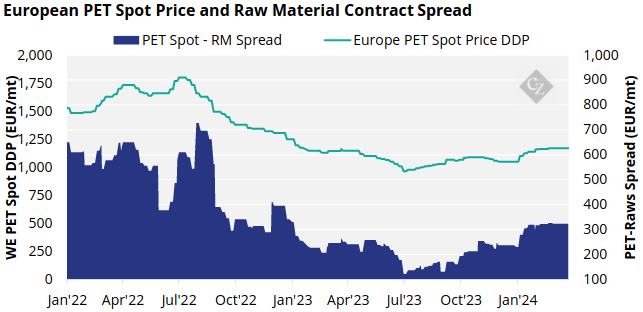

Domestic producers have seen partial margin recovery since January with several lines restarted. Most operating lines are now running at close to full rates, with strong March sales.

Alpek UK resolved production issues earlier in March, Equipolymers are believed to have restarted its second line; Polisan are also understood to be restarting after a long shutdown period.

However, EU suppliers are increasingly concerned how the sudden increase in supply will balance against future demand and are now looking to fill their order books for April.

Downstream customers continue to keep a relatively conservative outlook on demand, keeping very low stock levels in general, hoping prices will come down in the coming months.

Whilst domestic PET resin sales in April are expected to remain stable, particularly for those with higher contract levels, spot levels may begin to come under from May if higher import arrivals materialise, as some fear.

At least one Vietnamese producer reported strong sales and near sold out production for April, potentially indicating increased cargoes to Europe.

Indorama Egypt is also understood to have very little material left for spot sales, benefitting from additional Southern European demand due to the Red Sea crisis.

Producers Keep PET Resin Prices Steady, Defending Against Imports

Domestic European PET resin prices have remained relatively steady through March, with no signs of a demand squeeze due to ample availability, producers reluctant to push prices higher so as not to push customers further towards imports.

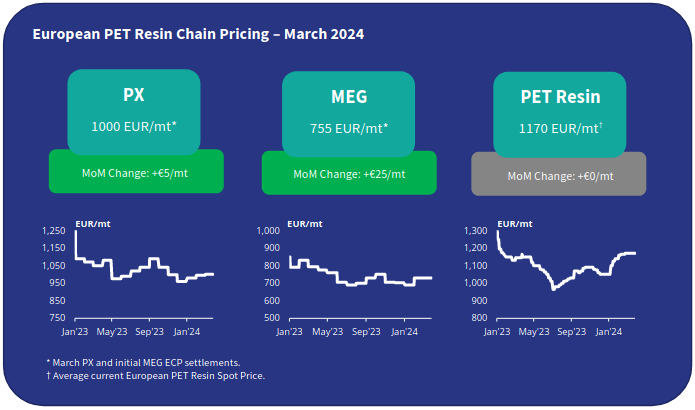

The current full market price range is assessed at EUR 1150 to EUR 1190/tonne, with an average price of EUR 1170/tonne, flat versus the last month’s report.

Large volume and regular buyers were typically able to access prices towards the lower end of the range between EUR 1150-1165/tonne.

European raw material contracts moved modestly higher in March, with the PX European Contract Price settling at EUR 1000/tonne, up just EUR 5/tonne from February.

The first MEG ECP settlement also increased in March to EUR 755/tonne, EUR 25/tonne higher than the February settlement of EUR 730/tonne.

Whilst producer margins and demand for domestic resin have improved through Q1’24, raw material spreads have now plateaued.

Any additional upside to domestic demand will now hinge on this summer’s weather, and the volume of import arrivals over the coming months.

Expectations are for sizeable import volumes to arrive, particularly from Vietnam, potentially placing pressure on producers and prices from May onwards.

However, bullish sentiment in the crude markets has driven oil prices higher; Brent oil prices reaching USD 90/bbl is a real possibility. As a result, raw material costs may also see further upside, potentially constraining further margin recovery for European PET resin producers.

EU Import Arrivals Leap in January Despite Red Sea Drama

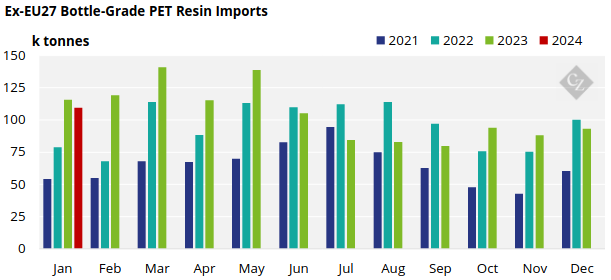

According to the latest PET resin trade data (HS 390761), the EU27 block of countries imported around 110k tonnes in January, increasing 17.6% on the previous month.

Despite Q1’24 import volumes being around 5% lower than last year’s wave, compared to previous years this was still the second highest January level on record.

Vietnam remained the largest import origin in January with 36.6k tonnes; another consecutive month above 30k tonnes, and signs that cheaper Vietnamese resin volumes may accelerate into peak season.

However, with at least one Vietnamese producer reporting strong sales, reduced availability could ultimately constrain additional European sales.

Next largest origins were Turkey (25.4k tonnes) and Egypt (19.8k tonnes) both picking up additional Southern European demand following the Red Sea disruption.

Whilst material from South Korea kept relatively lower at around 4k tonnes per month, demand for Pakistani resin has increased with over 9.2k tonnes arriving into the EU-block in January.

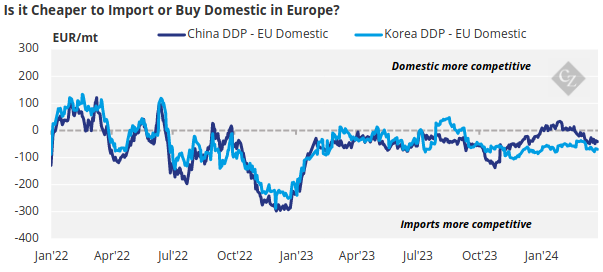

Is it cheaper to import?

Asian PET resin export prices kept range bound over the last month. At the time of writing, average Chinese resin export prices averaged USD 910/tonne, down USD 5/tonne versus late-February levels. (Please read our Asian Weekly report for further insight)

Whilst import volumes look to remain high through H1’24, paradoxically options are very limited.

On average, exports from duty-free or duty advantaged Asian origins remain at a discount versus European domestic levels.

Indicative import prices typically range EUR 1010-1030/tonne CIF NWE, equating to an average of EUR 1070-1090/tonne DDP.

One Vietnamese producer, is consistently more competitive for certain water and standard grades, currently achieving around a EUR 80-90/tonne discount to average European prices on a delivered basis.

Turkish spot export prices from the Southern part of the country lacked competitiveness into destinations outside of Italy and South East Europe. Whilst South Korean producers continue to primarily target the US market.

With substantial import volumes expected to arrive from May, and Asian suppliers continuing to offer at competitive levels, European PET resin producers are expected to resist any further expansion of the import parity delta, and in certain markets price more aggressively to fend off imports.