Insight into focus

- China has imported 370k tonnes of liquid sugar and 181k tonnes of premix since October.

- That’s an 82% increase year on year.

- Might we be in line for record white sugar/liquid/premix arrivals?

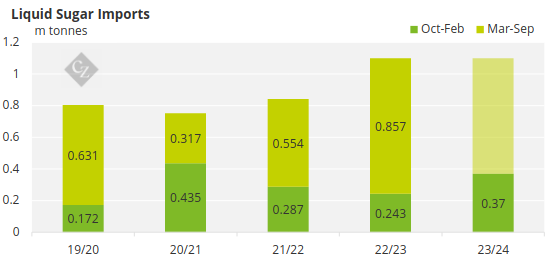

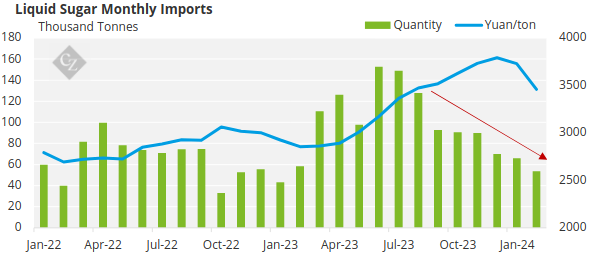

Liquid Sugar Imports Aren’t Regulated…Yet

Imports in January-February were in line with our previous forecast, at 120k tonnes.

By the end of February, the cumulative import of liquid sugar in the 2023/24 season reached 370k tonnes, an increase of 127k tonnes over the same period in the 2022/23 season. This is equivalent to 248k tonnes of white sugar.

We now believe that imports in the 2023/24 season are likely to maintain 1.1m tonnes, due to unchanged policies and lower availability from Thailand and India.

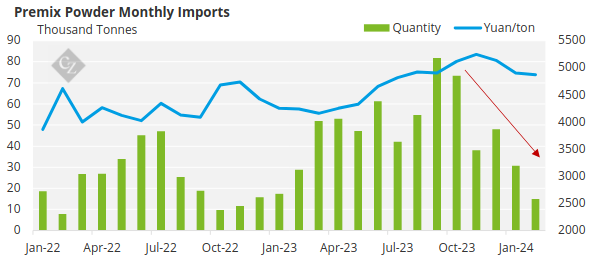

Source: China Customs, Czapp

The monthly import volume fell for the eighth consecutive month to 53.7k tonnes in Feb’24. This is due to the high import prices, as well as concerns about increased government regulation. Meanwhile, we also see that the import price has fallen from the peak of 3,792 yuan/tonne in December last year to 3,460 yuan/tonne, a decrease of 8.8%. This means a reduction in import costs and an improvement in profit margins.

In our previous report, we mentioned policy risks regarding liquid sugar regulations, including the release of new standards for the liquid sugar industry by the Ministry of Industry and Information Technology, the preparatory meeting of the Rock Sugar Committee convened by the China Sugar Association, and the proposed controls that were rumored at the two sessions in March. But two weeks after the conclusion of the two sessions on March 12th, we still haven’t heard anything new, and the longer the quiet period of this policy, the deeper the market’s skepticism will become.

We expect imports of liquid sugar and premix powder to start picking up in the second quarter.

Premix Imports in Feb Fell to 15-Month Low

The import of premix powder is like that of liquid sugar. Imports fell to their lowest level in 15 months at 15k tonnes in February.

Despite this, imports of premix in the 2023/24 season totalled 205k tonnes, an increase of 122k tonnes over the same period in the 2022/23 season.

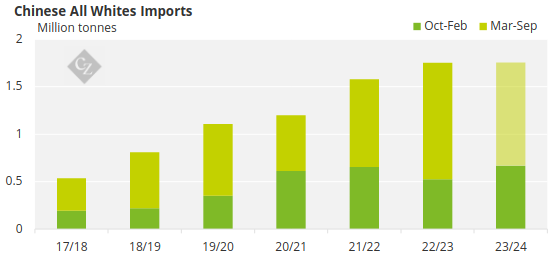

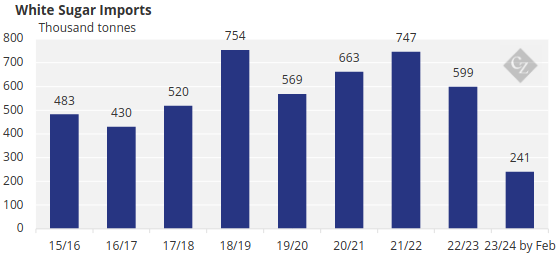

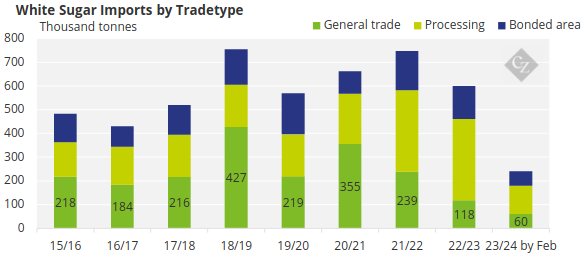

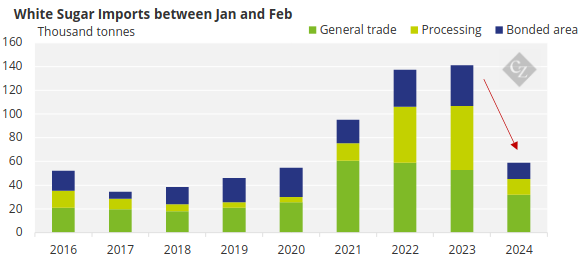

Liquid and Premix Compensate Reduction of White Sugar Imports

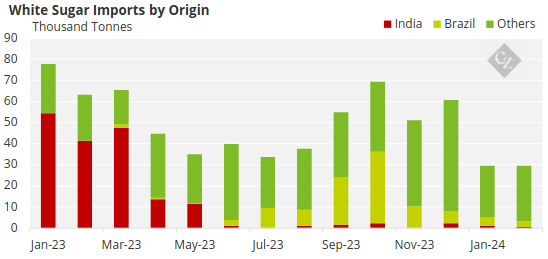

As of the end of February in the 2023/24 season, China has imported a total of 241k tonnes of white sugar, 47k tonnes lower than the same time last season. Last season, China imported a total of 599k tonnes of white sugar, 148k tonnes lower than the 2021/22 season.

The lower imports are due to poor sugar import margins, which led to some of the white sugar quota to be reallocated to raws. However, strong imports for processing trade have partially made up for this shortfall. We believe that the increase of processing trade is for premix powder production in a CBZ.

However, the imports under all trade types in January-February were disappointing at only 60k tonnes, less than half of the same period last year.

This may be due to the lack of availability of Indian sugar, as well as the concerns about the control policy mentioned above.

China’s Demand for All Whites

In terms of dry weight sugar equivalent, China has imported a record 669k tonnes of whites in the first five months of the 23/24 season. We believe that in the remaining seven months of the season, we should achieve 1 million tonnes of imports, including white crystalized sugar, liquid sugar, and premix powder.

This means the total whites demand for this season should be same at 1.76 million tonnes. This strong demand will continue to support world’s white sugar market.