Main points

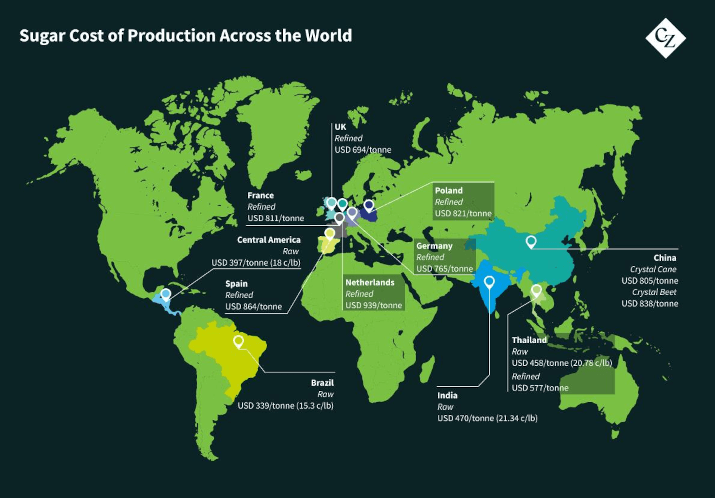

- Sugar cost of production has risen from Europe to China.

- Brazil has been the only one showing a decrease.

- No.11 current prices mean that Thailand is struggling with margins, while Brazilian producers are still generating enough cash for investments.

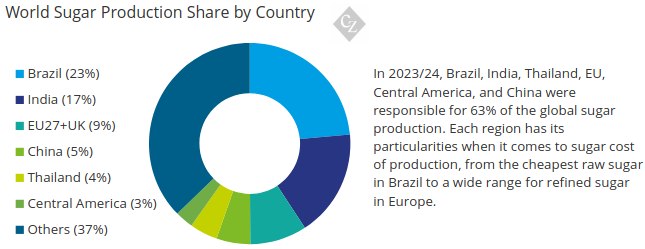

In our Cost of Production Around the World update, we have added more regions and the below represent 63% of global sugar production. Excluding Brazil, all regions have showed an increase in cost of production since our last report.

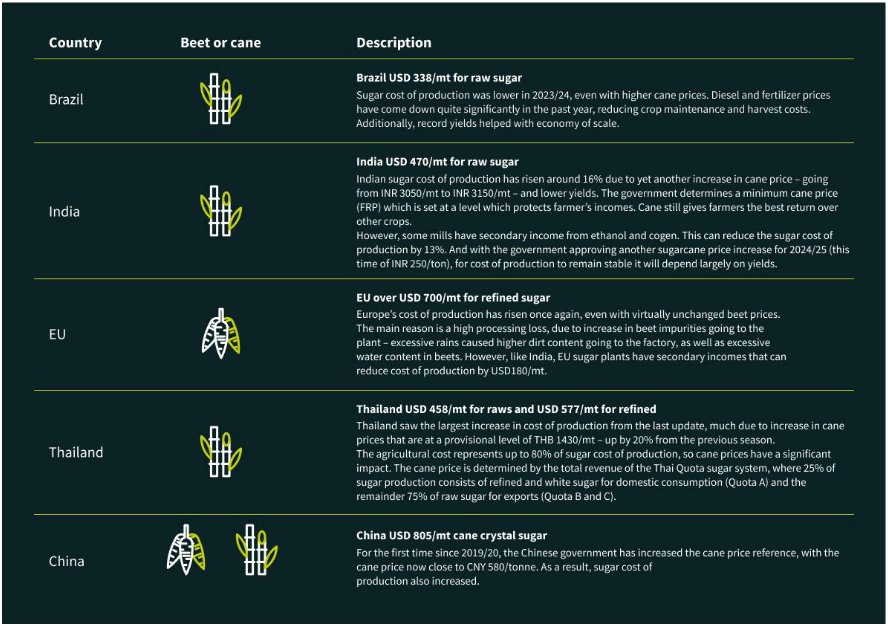

India USD 470/mt for raw sugar

Indian sugar cost of production has risen around 16% due to yet another increase in cane price – going from INR 3050/mt to INR 3150/mt – and lower yields. The government determines a minimum cane price (FRP) which is set at a level which protects farmer’s incomes. Cane still gives farmers the best return over other crops.

However, some mills have secondary income from ethanol and cogen. This can reduce the sugar cost of production by 13%.

And with the government approving another sugarcane price increase for 2024/25 (this time of INR 250/ton), for cost of production to remain stable it will depend largely on yields.

EU over USD 700/mt for refined sugar

Europe’s cost of production has risen once again, even with virtually unchanged beet prices. The main reason is a high processing loss, due to increase in beet impurities going to the plant – excessive rains caused higher dirt content going to the factory, as well as excessive water content in beets. However, like India, EU sugar plants have secondary incomes that can reduce cost of production by USD180/mt.

Thailand USD 458/mt for raws and USD 577/mt for refined

Thailand saw the largest increase in cost of production from the last update, much due to increase in cane prices that are at a provisional level of THB 1430/mt – up by 20% from the previous season.

The agricultural cost represents up to 80% of sugar cost of production, so cane prices have a significant impact. The cane price is determined by the total revenue of the Thai Quota sugar system, where 25% of sugar production consists of refined and white sugar for domestic consumption (Quota A) and the remainder 75% of raw sugar for exports (Quota B and C).

China USD 805/mt cane crystal sugar

For the first time since 2019/20, the Chinese government has increased the cane price reference, with the cane price now close to CNY 580/tonne. As a result, sugar cost of production also increased.

Brazil USD 338/mt for raw sugar

Sugar cost of production was lower in 2023/24, even with higher cane prices. Diesel and fertilizer prices have come down quite significantly in the past year, reducing crop maintenance and harvest costs. Additionally, record yields helped with economy of scale.