Insight Focus

- There has been another attack in the Black Sea.

- The EU is mulling import tariffs against Russian wheat.

- These factors have helped provide support to wheat and corn prices.

European grains rallied on the back of supply risk out of the Black Sea and fresh import tariffs on Russian grains. US corn experienced milder gains.

We expect some volatility with multiple factors impacting the market, including trade flows out of Ukraine, approval of the new taxes on Russian grain exports, weather, and the USDA’s prospective planting report.

Despite these factors in the short term, the big picture is that the market is comfortably supplied, which should be the major cap on prices.

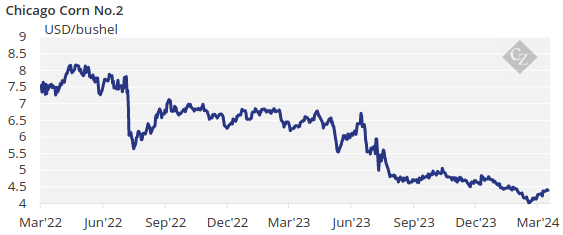

There is no change to our Chicago corn forecast for the 2023/24 crop (September/August) to average in a range of USD 4.15/bushel to USD 4.4/bushel. The average price since September 1 is running at USD 4.6/bushel.

Corn Lifts on Strong Wheat

Corn was lifted by wheat last week and by a positive macro environment with no fundamental data changing the big picture. The major cap for the Chicago corn market was the need for FOB prices to compete with Brazil.

In South America the harvests are progressing differently with the first corn crop in Brazil at 37% harvested compared with 35% last year. Safrinha corn – the second and bigger crop — is 92.3% planted versus 85.1% last year.

On the other hand, Argentina’s corn harvesting is 3.7% complete with almost no progress from last week due to rains. Conditions also deteriorated to 24% good or excellent — one percentage point lower week on week.

BAGE lowered its corn production forecast by 2.5 million tonnes to 54 million tonnes. The latest WASDE report still pegs Argentinian production at 56 million tonnes.

Black Sea Supply Supports Wheat Price

Wheat experienced a substantial rally last week both in Chicago and Europe even after poor export inspections out of the US were published. Net sales showed the lowest number of the year. There were two major factors for the rally: the Black Sea corridor and new taxes on Russian grains.

Supply risks out of the Black Sea were the focus again after Russia attacked Ukrainian port infrastructure early last week, which had an immediate impact on wheat prices.

On top of that, the European Commission proposed an increase of import tariffs on Russian grains and oilseeds, including those from Belarus. There is no clarity over whether it will be a fixed tariff of EUR 95/tonne or simply 50%. This was announced last Friday and resulted in a 4% rally in Euronext wheat.

Coceral reduced its wheat production forecast for EU+UK to 137.1 million tonnes, down from 139.4 million tonnes and from 140 million tonnes in 2023. This was due to excess rainfall in northwestern Europe during the planting season at the end of last year. The Coceral forecast is 10 million tonnes lower than the 147.65 million tonnes forecast by the latest WASDE report. The wheat condition in France was 66% good or excellent versus 94% last year.

Prospective Planting Report Due

The US is expected to receive snow in the northern Corn Belt, easing dry conditions of the last few weeks. US drought conditions improved slightly with 32% of the corn area impacted, up from 36% last week, and 12% of the wheat area versus 14% last week.

Brazil is expected to receive cold and rainy weather in the south and centre west while Sao Paulo state is forecast to remain dry. Argentina is also expected to receive good rains. Europe is expected to experience warm temperatures together with rains mostly in Northwest Europe.

The USDA’s Prospective Planting report will be released on Thursday and there is chatter in the market that it will increase acreage projections. The reality is that margins should favour fewer corn acres in favour of soybeans, but rotation limits this flexibility.