Insight Focus

- Producers are putting faith in next week’s India tender to provide support for urea prices.

- Processed phosphate prices are under pressure with increased Chinese exports.

- Potash markets are humming along with little movement in prices.

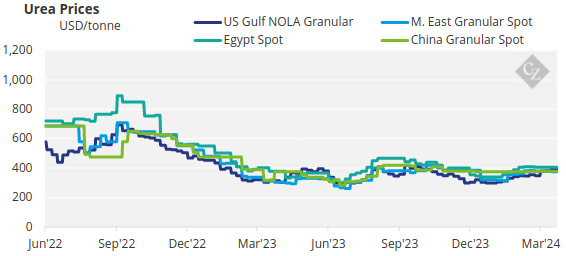

Urea Prices Begin to Sink

As discussed over the past few weeks, the inevitable is progressively happening and we are seeing lower values for all fertilizers with Urea taking the lead.

US/NOLA prompt has been traded around the USD 400/short ton (USD 440/tonne) FOB barge level with May at as low as USD 320/short ton (USD 352/tonne) to USD 330/short ton (USD 363/tonne) FOB barge.

Egyptian producers are struggling to hold at USD 340/tonne FOB with long haul sales taking place. Regular European shipments have vanished due to lacklustre demand in Europe.

The Middle East is now around the USD 350/tonne FOB mark – with paper values for May recorded at USD 310/tonne FOB and June at USD 305/tonne FOB.

Brazil CFR values now at best USD 350/tonne. Australian importers are holding back with large quantities arriving at higher prices, so inventories are full and replacement costs are expected to be as low as USD 350/tonne CFR.

India will tender next week. The January tender saw prices at USD 316.80/tonne CFR West Coast India and USD 329.40/tonne CFR East Coast India. Both prices could be replicated during the upcoming tender although most think at higher levels.

As we have seen in the past, India alone cannot hold up the urea market and we will certainly see very aggressive pricing with Russian prilled urea taking centre stage. Russian prilled urea FOB levels are currently marginally on either side of USD 300/tonne with freight to India at between USD 60-70/tonne.

However, we could see sub USD 340/tonne CFR as the winning number in India with shipment by May 20, which would most likely exclude Chinese participation. However, it is understood that NRDC (the Chinese governing body on exports) is monitoring expected price levels in India.

Decreasing prices could be on the horizon from June onwards with Chinese products entering the international market and the possibility of no India tender. Some are now indicating that lower international prices could keep the Chinese from exporting indefinitely although if it is to meet its annual export target of 5 million tonnes for 2024, exports will have to resume at some point.

History has proven that Chinese fertilizer exporters are pragmatic, and producers would like to earn some US dollars once the domestic season in China is over. Thus, the consensus is that Chinese products will find their way offshore.

The only question is to which markets. Most markets, excluding Australia and Thailand are now in their buying season, but both require granular urea rather than prilled urea.

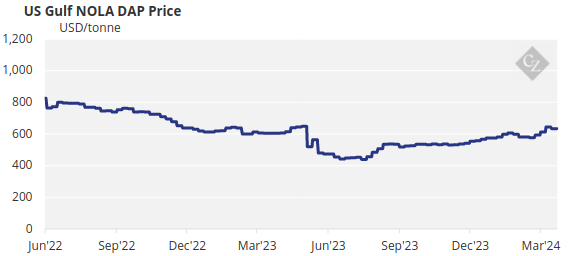

Chinese DAP, MAP Exports Imminent

All eyes are on China now that the government has eased export restrictions on DAP and MAP as of March 15, with export inspections performed in 10 days. China’s exports of DAP fell 69% for January and February this year to 115,371 tonnes, while MAP exports fell 71% year over year to 99,287 tonnes. Full year exports of DAP from China in 2023 were 5.4 million tonnes, up 41% from the year before.

With increased exports from China, we are now seeing falls in prices of DAP in India with the latest price recorded at USD 579/tonne CFR — down from the previous price of USD 595/tonne CFR. Prices are expected to fall further with more exports becoming available in the next couple of months.

India’s imports of DAP in February fell 17% on the previous year to 222,000 tonnes. For the first two months of 2024, imports were down 68% to 266,000 tonnes.

The only bright spot for processed phosphate prices were MAP in Brazil, which came up an average of USD 5/tonne to reach USD 570/tonne. However, it must be noted that this price was secured before impact was felt from Chinese availability, which certainly will put pressure on prices.

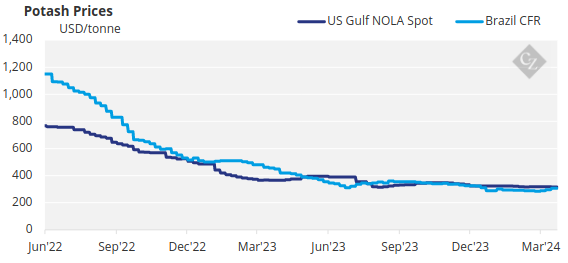

Little Potash Activity Occurs

The international potash market is humming along this week. Granular prices in Brazil are around the USD 300-315/tonne CFR range. India has yet to finalize contract prices but is still looking for potash at prices below USD 300/tonne CFR.

Prices in Southeast Asia are unchanged at around the USD 300/tonne CFR mark with some rumours that the latest Pupuk Indonesia tender will close at USD 302/tonne CFR.

Domestic prices in China are falling due to oversupply. The outlook for the potash market is stable-to-soft with increased demand in Brazil being the only bright spot.

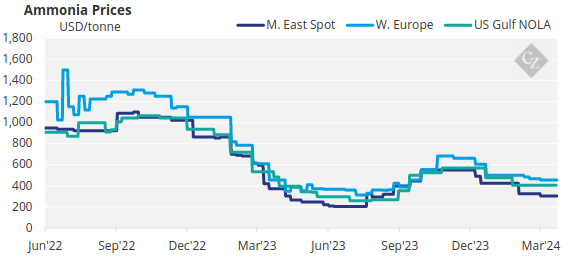

Lack of Ammonia Spot Deals

The ammonia market was dormant this week with little or no spot activity taking place. The merchant ammonia market remains long in most regions heading into the second quarter.

Weak demand from both fertilizer and industrial buyers’ low inventories are contributing to market softness. Plenty of Iranian tonnage is heading towards Turkey, putting pressure on North African suppliers.

All eyes are on the imminent Tampa CFR contract between Mosaic and Yara.

The outlook for the ammonia market is stable-to-soft with further possible declines in prices from April onwards unless demand picks up.