Insight Focus

- China has cancelled about 1.5 million tonnes of wheat purchases from around the world.

- Putin won another term as Russia’s President.

- Fund short positions add to market complexities.

Wheat markets rarely lack news stories. Weather is always near the top of the agenda, with importers and exporters often close behind.

We discussed in our last article how the new 2024 wheat crop may struggle and thus needs mild weather to avoid changing sentiment and market direction.

In the short term, top global wheat importer and stockholder China is being watched with interest. And as Putin wins another (questionable) landslide victory in Russia’s presidential elections, it remains to be seen how emboldened he will be and what will be the fallout for markets, including wheat.

Finally, adding to the uncertainty around markets are the short positions funds have been building up over many months.

The Wheat Markets

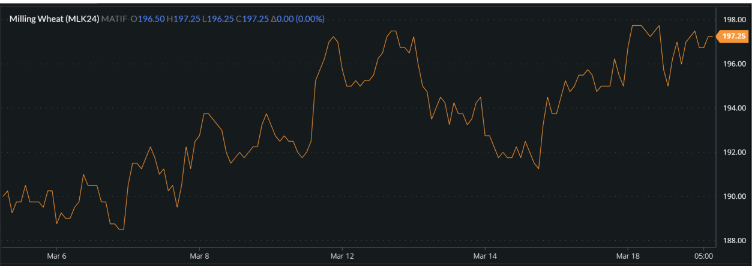

Wheat prices have been up and down over the last couple of weeks, as shown in the charts below.

The conflicting news stories about the 2023 old crop and 2024 new crop are creating daily volatility for prices.

Chicago Soft Red Wheat, May ’24 contract

Kansas Hard Red Wheat, May ’24 contract

Paris Milling Wheat, May ’24 contract

Source: Barchart Commodityview

China Embarks on Cancellation Spree

China’s place as the biggest producer and stockholder of wheat is important. However, its near-term purchases are in the spotlight. With wheat still to trade around the world, prior to the 2024 harvest beginning, there is pressure to execute the sales already committed.

The last couple of weeks have seen headlines suggesting 500,000 tonnes of US wheat, together with up to 1 million tonnes of Australian wheat purchases by China have been cancelled. There is also speculation as to whether there have been cancellations from France as well.

Sales are currently precious with farmers in need of empty stores prior to the next harvest. These cancellations, if only postponements, have given the market cause for concern, pressuring prices while the news is digested.

Putin Victory Emboldens Russia

Vladimir Putin won an apparent ‘landslide’ victory in the Russian Presidential elections in recent days.

As the world’s largest wheat exporter, with much of this shipped through the Black Sea, the impact of Russia’s election is important news. Immediately following the election results, Ukrainian ports, notably Odesa and Mykolaiv were damaged by renewed Russian attacks.

This pushed wheat prices up more than similar aggression has over recent months. This could be a sign of things to come, as Putin is emboldened by his next presidential term in office. Equally, it could just be business as usual for Russia’s war on the ever-resilient Ukrainians. Maybe time will tell.

Funds Could Drive Rally

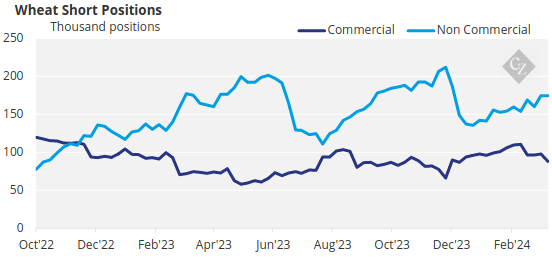

We have previously remarked upon the large fund short positions held in the wheat market, as well as soyabeans and corn.

Source: COT Report

These positions are generally held in the near months. As these months reach expiry, together with the approaching new crop harvest, there is much interest in when these positions may be bought back in.

The end of March will see more wheat stock reports and a greater number of wheat acreage estimates for the 2024 crops. Any panic by these funds to buy in shorts has the potential to drive prices up, prompting a noticeable rally.

Conclusions

Weather will remain in focus to determine forecasts for the 2024 wheat harvests.

China’s execution of purchases over the coming months will be critical to ensure stock estimates are accurate before the new crop harvest arrives.

Putin’s determination to disrupt Black Sea wheat shipments from Ukraine will be eagerly watched as his new term in office sees him increasingly enthused by his own political infallibility.

Funds have the potential to drive a price rally if they begin to panic and buy in positions over the coming weeks.

There is never a dull moment in the world of wheat, with a couple of protagonists holding the keys to market stability, or the lack of it, over the weeks ahead.