Insight Focus

- The EU’s CBAM entered into force last October.

- Importers are required to report embedded emissions until end of 2025.

- Payment for carbon emissions starts January 2026.

Europe’s Carbon Border Adjustment Mechanism (CBAM) took effect on October 1 last year, beginning with a so-called transitional phase that will last until the end of 2025.

From January 1, 2026, importers of certain energy-intensive products – iron and steel, fertilisers, cement, aluminium, electricity and hydrogen – will be required to pay for the cost of carbon emissions embedded in the production of those materials.

The cost of imported carbon emissions is to be calculated and reported by importers, referred to by the EU as “declarants”, and the cost of CBAM certificates will be linked to the price of EU emissions Allowances.

The current transitional phase involves only reporting of emissions and is designed to familiarise both the EU authorities and importers with the procedures that will operate the CBAM system. The EU has already set up a temporary registry to capture data in the transitional period.

New Rules Still to Come

At present, the full regulations that will underpin the CBAM are still being drawn up. The only rule currently in effect is an implementing regulation that covers reporting obligations during the transitional period.

But the European Commission has a long list of regulations to come, which will variously govern:

- Establishment of the CBAM Registry

- Authorisation of declarants

- Authorisation and accreditation of third-party verifiers

- Rules on communicating customs data

- The scope of the CBAM

- Calculation of embedded emissions

- Verification of embedded emissions

- How CBAM certificates will be priced

- Calculating the CBAM price payable where there is a carbon price in the originating country; and

- Penalties for non-compliance

The first four are to be adopted by the end of the year. The latter regulations are anticipated to be completed and in force by the start of 2026, according to the EU.

CBAM Platform to Be Introduced

Little is yet known of the details of any of the pending regulation, though we do know that CBAM certificates will be sold and repurchased on a central platform in each member state.

Certificates will be sold at the weekly average of EU Allowance auctions, with the price published each week by the European Commission, and any surplus will be repurchased at the same price. They will not be tradable. Unused certificates will not be eligible for use later than the year in which they were purchased.

Compliance will be carried out every year. Participants will be required to surrender CBAM certificates covering the carbon content of each calendar year’s imports by no later than May 31 the following year.

Declarants will be able to sell back any unused certificates by June 30 the following year, though there will be a cap on the total number of certificates that can be re-sold at one-third of the total purchased.

Failure to surrender CBAM certificates matching the calculated emissions will incur an identical penalty to that imposed on EU ETS participants, currently EUR 100 for every tonne of CO2 equivalent that is not covered by a certificate.

Exemptions in Question

During the legislative debates over the CBAM, there were indications that the levy would not apply to certain developing or least-developed countries, but there is in the overarching legislation no mention of any specific exemptions.

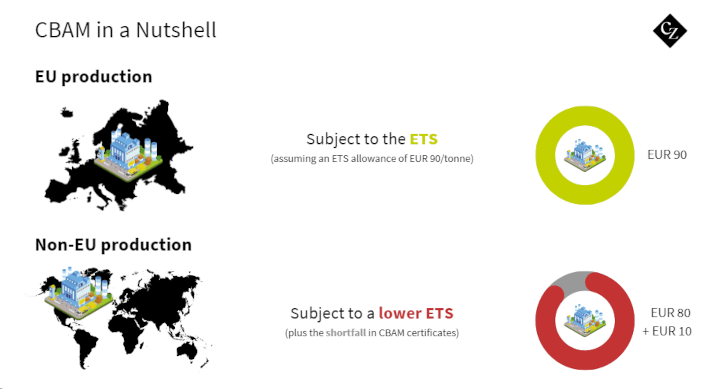

Imports from countries in which a carbon price does apply will be given partial exemption equivalent to the cost of carbon in the producing country. The difference between that price and the European price will be calculated and payable in CBAM certificates.

The EU has reserved the right to exempt imports from countries where an equivalent carbon price is in force, or in which an emissions trading system exists that is fully linked to the EU ETS. At present, only Switzerland operates a linked market.

No exemption would apply, for example, to the UK, whose market is not linked to the EU’s and where the current price of UK emission Allowances is around GBP 37/tonne, or 74% of the cost of EUAs. Instead, the difference in the two prices would be calculated and payable by importers from the UK.