Insight Focus

- AmmoniaUrea prices remain under pressure.

- Processed phosphate prices should come down due to Chinese exports from June.

- Potash prices in Brazil edging up but globally prices are under pressure.

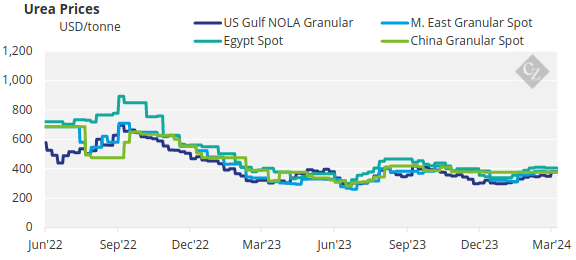

Urea

As indicated last week, Urea prices are under pressure across the board. The Middle East is now struggling to hold on to prices with the latest deal done at USD 360, although this has not been confirmed, but if so, down from previously done at USD 370 FOB. There is a glimmer of hope for the producers in that India’s RCL is said to be announcing a tender imminently. The issue of interest is what shipment period they will decide on and if full May, then there is a chance that prices could still keep declining. Another news emerged on Chinese export policy, for which apparently there is none, with the state agency of NRDC uncommitted to any details on exports. Most likely now there will be no Chinese urea in the international market until June thus India will not have the benefit of an increased supply pool for imminent tender.

The only market which is on fire is the US/NOLA where prompt availability is priced at around USD 411 ST FOB in the barge which is the equivalent of USD 447 PMT. However, April barges are priced at around USD 380 ST. Both Brazil and the European markets are slow frustrating suppliers in Egypt and Russia which saw Russian prilled urea sold this week at between USD 300-310 PMT FOB for Africa and Latin America with some saying at even less levels. Egyptian granular urea adventured into both the US and Latin America.

The outlook for urea is still bearish, but the India tender to be announced may bring a temporary halt to price declines although this has consistently failed in the past. The psychology in the market is now such that the most likely outcome is for continued decreasing price levels across the board with more products also coming on stream with two Petronas plants coming back into full production next week.

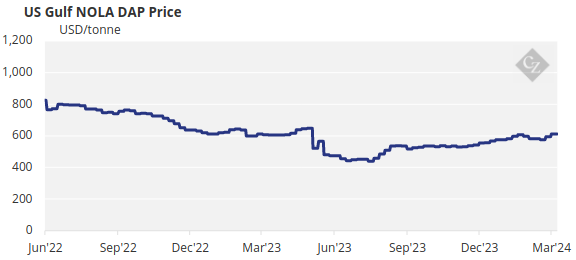

Processed Phosphate

The processed phosphate market saw China emerge with exports this week albeit with small volumes. A Thailand sale of DAP was reportedly done at around USD 600 PMT FOB with a CFR price of around USD 625 PMT. This price is considerably lower than previous deals on DAP for the Thailand market with Middle East origination. This price will have to adjust itself since India is still – and has been for months – at the USD 590-595 PMT CFR range. Chinese exports of processed phosphates will emerge in full earnest some time in late April early May provided the government does not continue restrictions since the domestic price of DAP is now the same as when export restrictions took place to reduce domestic prices, which has not been the case. Indian buyers are now looking at NPK/NPS imports due to lesser prices and deals have been made with both Russian and Indonesian products imported. Pakistan reportedly bought DAP at USD 620 PMT cfr. Brazil MAP prices are the same as last week around the USD 560-570 PMT CFR level. However, OCP is heard to be offering at USD 580 PMT CFR.Chinese 11-44 reportedly sold to Brazil at between USD 445-450 PMT FOB.

The outlook for processed phosphates is bearish in view of Chinese exports resuming in full at the end of May and beginning of June.

Potash

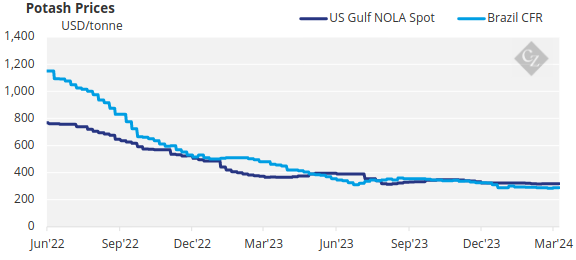

Not much excitement is happening in the potash market except for slightly increased levels in Brazil for granular potash now at a range of USD 300-310 PMT CFR. Prices are expected to increase in the weeks ahead on anticipated increased demand. Imports of granular MOP to Brazil for January and February combined was up 10% y/y at 1.4 million MT. SE Asia is facing downward pressure with the Pupuk Indonesia tender results yet to be announced and buyers are looking for price discovery. India’s contract negotiations are still dragging out with Indian buyers looking for sub USD 300 PMT CFR levels. Chinese domestic potash prices are falling on lack of demand from NPK producers and increased availability. Imports for January and February increased 60% y/y at 2.6 million MT. However, it is expected that prices may recover once the spring season comes into play. The outlook for potash prices is still bearish except for Brazil.

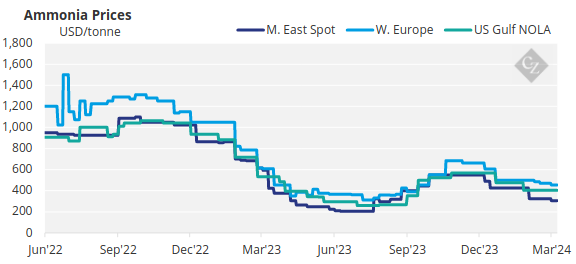

Ammonia

Although supply and demand fundamentals for ammonia appears to be balancing out, slow global demand may put pressure on prices provided production capacities are upheld. Demand in Europe is slow and gas prices are coming down with ammonia deliveries not enjoying premiums from last done. Middle East supply might get tighter with production issues reported in both Saudi Arabia and Oman. Outages in the US saw MOSAIC enter the spot market for the first time in about one year with an Algerian purchase at a higher price than the contract price with Yara at USD 445 PMT CFR.

The outlook for ammonia still hangs in the balance between stable to soft.