Insight Focus

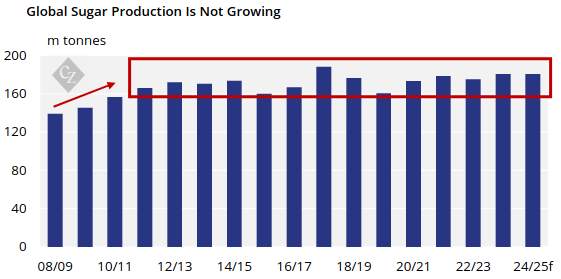

- Global sugar production is still in its 13-year-old range.

- However, it’s in the upper end of the range above 180m tonnes this year and next.

- This means the world is producing small sugar surpluses.

2023/24 at a Glance…

Global Sugar Production

In 2023/24, global sugar production will reach 181.3m tonnes, the second highest on record.

Despite this record output, global sugar production remains in a 13-year-old range. To some extent this is a function of poor weather in 2023. Once weather normalises it’s possible the world can equal 2017/18’s record outturn of around 190m tonnes sugar production.

At the very least, today the world is no longer drawing down sugar stocks, though those stocks are still unevenly-placed, largely in Brazil, India and Thailand. If production can turn higher then global sugar stocks can rebuild to more comfortable levels.

However, the market still hasn’t encouraged new greenfield sugar production capacity growth in Brazil, Thailand, China or Europe. Even when the current bull market ends, the sugar market will remain vulnerable to shortfalls in supply. The next bear market won’t last as long as the 2010’s price bust.

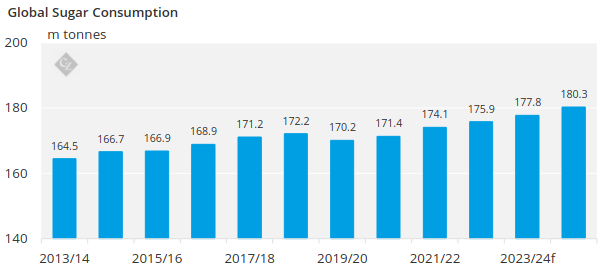

Global Sugar Consumption

We think the world will consume 177.8m tonnes of sugar in 2023/24, a 1.1% increase on the previous year.

This means that sugar consumption is growing in line with the world’s population and per capita sugar intake is not growing.

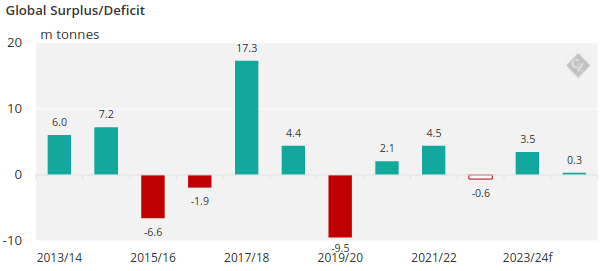

Small Production Surplus in 2023/24

Upward revisions to our production forecasts for CS Brazil, Thailand, and the EU have resulted in a global sugar surplus.

While this sounds negative for sugar prices, global sugar stocks on a per person basis remain low, and the growth in sugar production and stocks is largely concentrated in Brazil, where there are logistical challenges in getting this sugar to where it is needed in the global market.

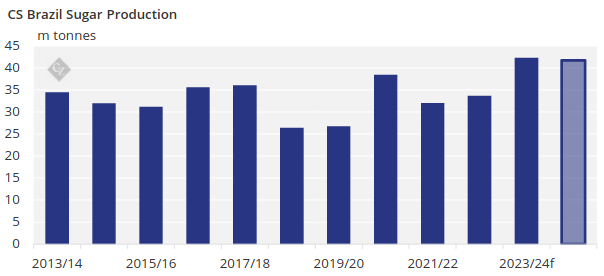

Production Update: CS Brazil

As the 2023/24 season draws to a close, CS Brazil is on track to produce over 42m tonnes of sugar – a record-breaking season!

Looking ahead, we expect CS Brazil to crush 610m tonnes of cane in 2024/25, resulting in 41.5m tonnes of sugar.

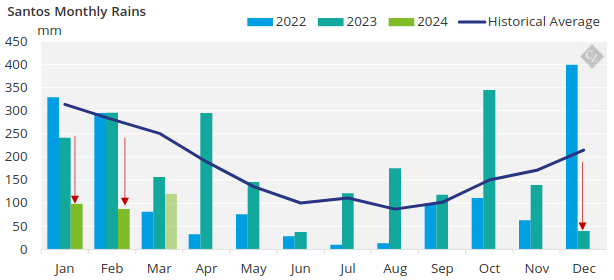

This drop in production is mainly due to the dry weather this quarter, which has had a significant impact on agricultural yields and cane availability.

That being said, despite the slight drop in production, stocks are still growing and will be even larger next season, putting significant pressure on exports.

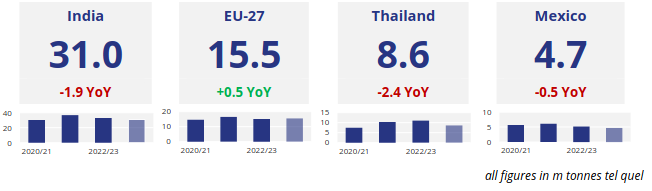

Other Sugar Producers at a Glance…