Insight Focus

- A new contract launched by ICE Endex will trade in 100-tonne lot sizes.

- Shipping companies are covered by EU ETS from 2024.

- Industrial buyers need a clearer picture on shift in compliance schedule.

New Mini Contract Launches

ICE Endex is set to launch a new “mini-EUA” futures contract in mid-April as it targets smaller-scale compliance entities in the EU ETS.

The new contract will offer trading in lots of 100 tonnes, instead of the traditional 1,000 tonnes that are traded under existing futures contracts.

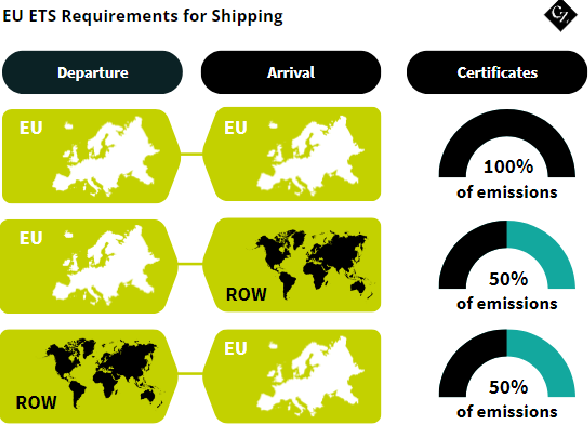

The initiative is aimed largely at shipping companies that are being brought into the bloc’s carbon market for the first time this year. From 2024, shippers are required to surrender EUAs matching 40% of their total emissions from voyages within the EU, but also those voyages that begin and end in EU waters.

The surrender requirement for shippers goes up to 70% for 2025 emissions and reaches 100% in 2026.

To find out more about the EU ETS rules for shipping, watch our short video HERE.

New Timeline for Emissions Calculations

The introduction of shipping into the EU ETS also coincides with several important changes to the market, the first of which will be a shift in the compliance schedule each year.

At the start of Phase 4 of the market in 2021, the EU introduced a “dynamic allocation” process that is intended to more accurately reflect actual plant operations in the issuance of free EUAs.

Under new EU rules, if a plant changes its production levels by more than 15% averaged over the previous two years, its free allocation will be adjusted in line with the change.

Governments struggled to calculate the changes for more than 11,000 separate installations in time for the issuance of permits each year, which formerly took place in February. There were numerous delays in the issuance of permits to companies.

Starting from 2024, the issuance of free permits will take place in the summer, giving governments up to four months additional time to calculate changes in production and amend their free issuance schedules.

And in line with this, the deadline for installations to surrender permits matching previous-year emissions shifts to September. The reporting deadline at the end of March remains unchanged.

Free Allocations Reduced

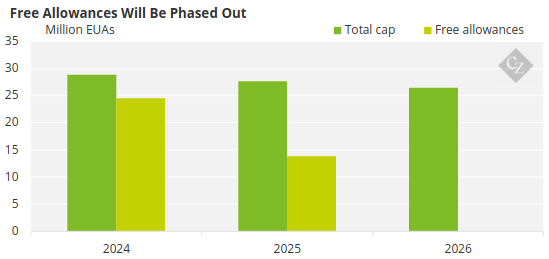

The second significant change to the EU ETS is that airlines covered by the market will start to see reductions in their free allocation.

Airlines received a total of 24.5 million EUAs free of charge in 2023 – or 85% of the total allowances cap. This will be reduced to 75% of the cap this year, and to 50% in 2025. These allowances are given in respect of intra-EU flights that are not counted towards the bloc’s participation in the global aviation market operated by ICAO.

The change to the compliance deadline has meant that the EU ETS is not experiencing its usual spike in demand as the market heads into the former compliance season between February and April.

August Contract Launches Early

Traders report modest levels of interest from compliance buyers, mostly related to weak prices that are encouraging some industrials to purchase EUAs for future use.

Futures exchange data bears this out: open interest in the March EUA futures contract peaked at around 125 million tonnes last week, compared to more than 200 million tonnes in January 2023.

At the same time, the ICE Endex exchange has launched trading in August and September contracts far earlier than previously in order to give compliance buyers ample time to position themselves for the new surrender dates.

Open interest in the August contract has already reached nearly 30 million tonnes. Previously the August contract was only listed three months before expiry, and open interest peaked in 2020 at just over 12 million tonnes.

However, the shift in compliance deadlines has been clouded by the requirement for EU member states to implement the regulations at national level, and according to some reports, not all 27 member states have yet done so.

This leaves many compliance companies concerned that they are being trapped between unamended national regulations that still require April compliance, and new EU regulations that move this deadline back to September.