Insight Focus

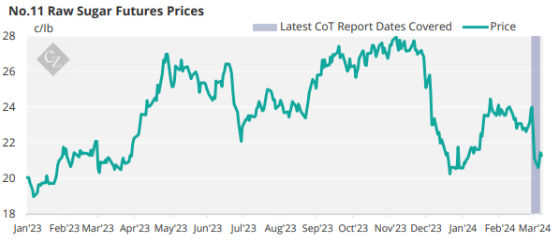

- The No.11 raw sugar futures continue to trade sideways.

- Specs could be behind this opening significant number of short positions.

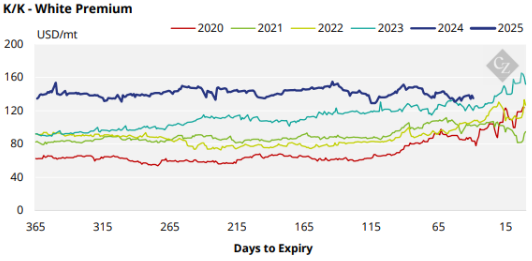

- The K/K white premium falls to a year low.

New York No.11 Raw Sugar Futures

Over the last week, the No.11 raw sugar futures traded sideways, hovering around 21c/lb.

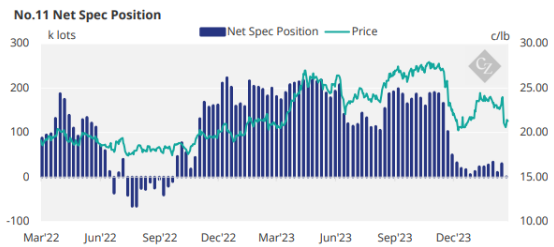

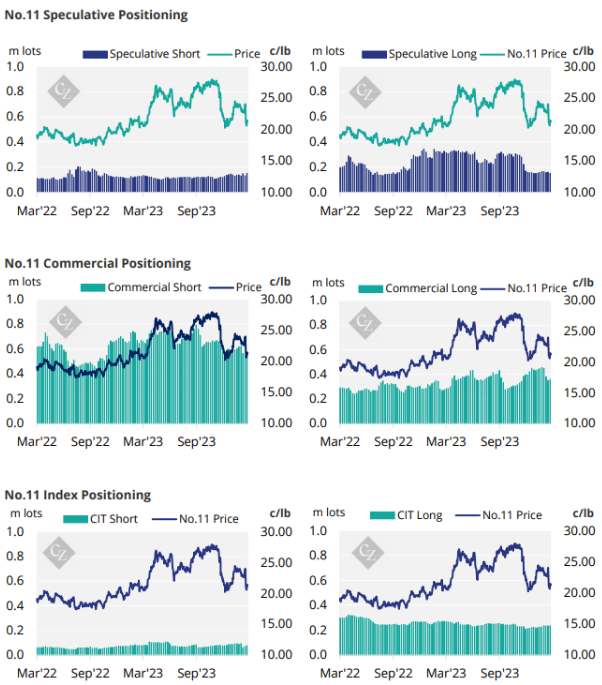

Looking at the speculators they may have been behind this sideways movement as they have closed out their recently opened long position in favour of 20.4k lots of spec shorts.

With speculators closing out their long positions for shorts, this has brought the overall net spec position to 88 lots, down 30.5k lots from the previous week.

Looking over to the commercial participants, we can see that they both have been busy over the past week with end-users taking advantage of the sideways movement and adding 7.5k lots of new hedges. Producers have closed out 26.6k lots of short paper.

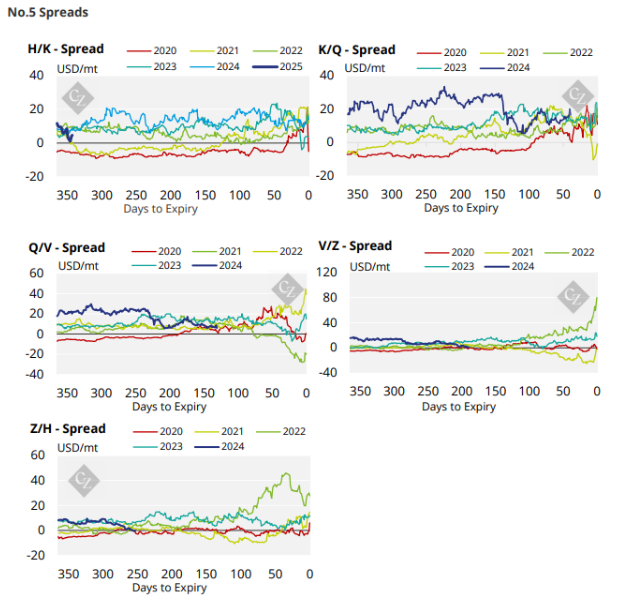

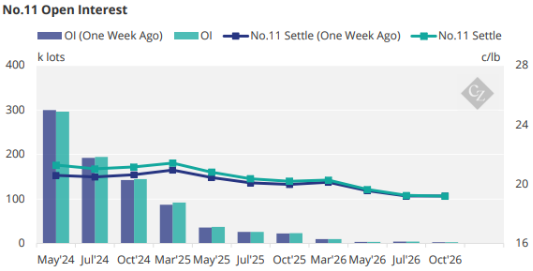

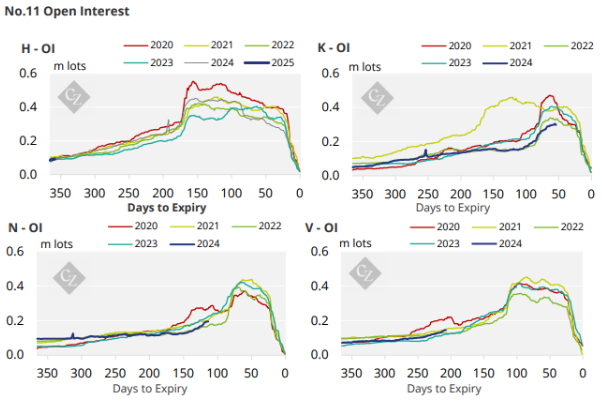

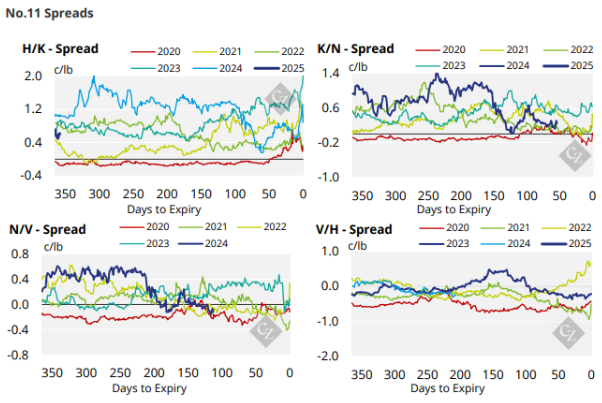

In the last week the No.11 raw sugar futures curve has strengthened and remains largely flat in 2024

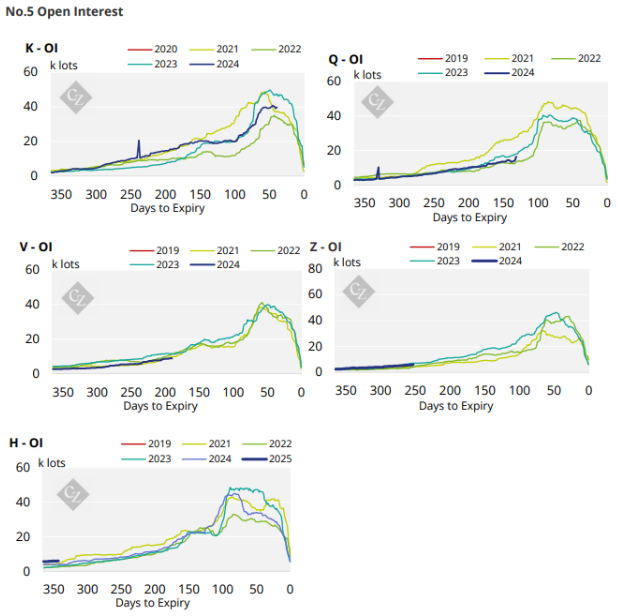

London No.5 Refined Sugar Futures

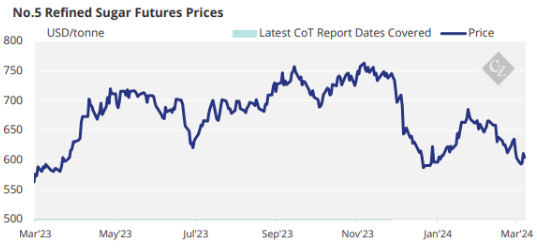

The No.5 refined sugar futures contract has strengthened over the past week, going up from 593USD/mt at the start of the week to 604USD/mt by Friday’s close.

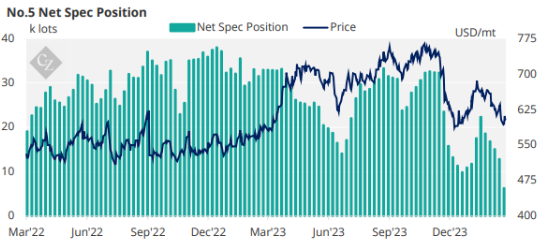

Despite the slight strength in the futures market, with the macro environment being unsupportive of sugar speculators are going neutral, closing 6.5k lots long positions in the past week.

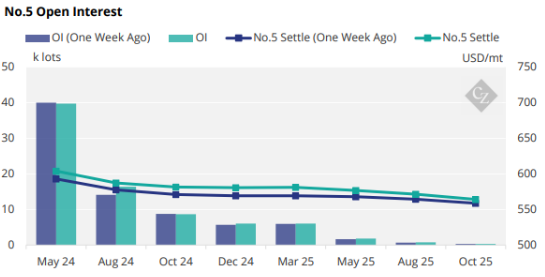

With contracts strengthening across the board the refined sugar futures curve continues to remain backwardated through to October 2025.

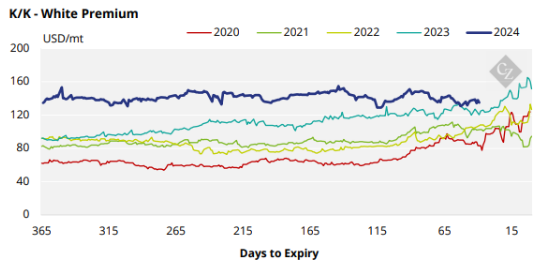

White Premium (Arbitrage)

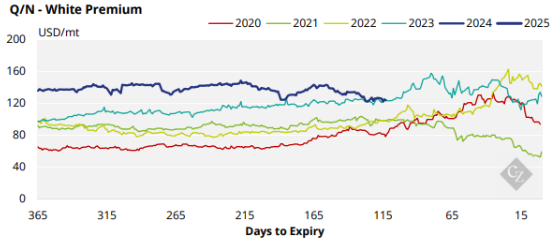

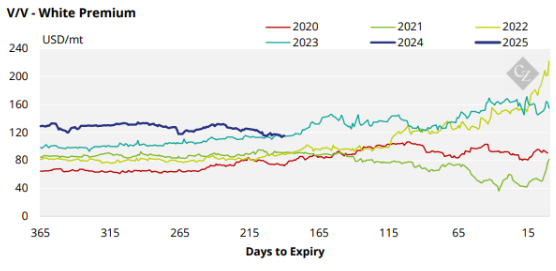

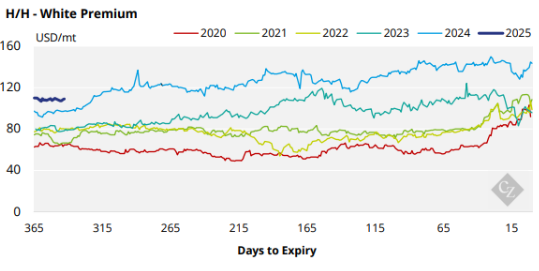

The K/K White premium falls to year lows dropping to 130USD/mt. Similarly, the Q/N is trading below $120 for the first time since March 2023.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar, therefore physical values should still be necessary to bridge this gap.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix