Insight Focus

- Funds currently hold a record net short position.

- EUA prices below EUR 60 are seen as a “bargain” by analysts.

- Additional auction supply is potentially delaying recovery.

Record Short for Investment Funds

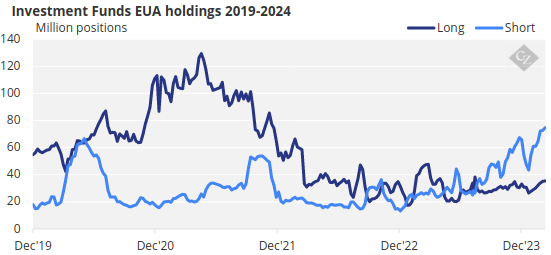

Investment funds have held a net short position in EU carbon allowances for the last 30 weeks – the longest streak of bearish bets on EUA prices since data was first published in 2019.

Funds’ total holdings in EUAs reached a peak in September 2021 when they held positions totalling more than 150 million EUAs.

But as benchmark futures prices climbed to their record high of EUR 101.25 in February 2023, long positions steadily decreased from 100 million EUAs to as little as 17 million EUAs in early 2023. Over the same period, short holdings held steady at between 15 million and 25 million positions.

Since last August, however, total shorts have exceeded total long positions by a growing margin. Funds’ net short is now at a record 37 million positions.

Funds Could Reverse Course

So, why are investment funds so bearish on EU carbon, and are they about to reverse these positions?

A few analysts think so. Bjarne Schieldrop, chief commodities analyst at SEB bank and a former carbon market analyst at Point Carbon, argues that EUA price below EUR 60/tonne are “cheap”, and says buying carbon permits is the “opportunity of the year.”

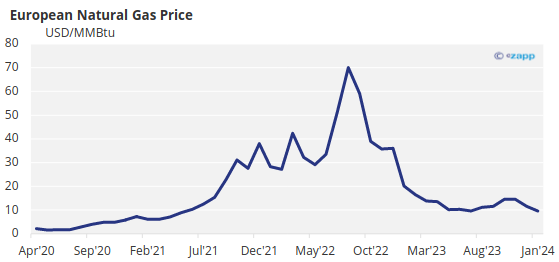

Schieldrop lists several contributing factors to what he believes is the coming rally in carbon. Firstly, the return of energy prices to “normal” levels after several years of high prices may trigger an uptick in European industrial output.

This would be helped in no small measure by eventual reductions in pan-EU interest rates, which other analysts suggest may begin by the second half of 2024.

A boost in industrial activity would in turn revive demand for natural gas and perhaps lift prices again, which would in turn support EUA prices. Since gas and coal compete as fuels for power generation, any rise in gas prices risks bringing coal back into profitability, which would mean utilities require more EUAs.

Source: World Bank

Resurging Asian demand for LNG could also filter through to European prices for gas, since the EU now relies much more heavily on LNG after banning Russian piped gas.

With these factors in mind, compliance buyers in the EU ETS may start to see the current EUA price of around EUR 54-55 as being a good level to buy at, as Schieldrop and other analysts have recently said.

REPowerEU Program Could Weigh

But if EUAs fail to recover and continue to languish in the EUR 50s, there is a possibility that politicians and regulators may wish to intervene in the market to prop up the price.

Source: ICE

With an additional 250 million EUAs – at least – being brought into the market in the 2023-2026 period to help fund the EU’s transition away from Russian fossil supplies, the market may not be tight enough to justify a price increase, and regulators may feel the need to set a price floor or take other measures. While there has been no talk of this in Brussels, market participants have begun to speculate.

But there is also a bear case that suggests prices may remain depressed deep into 2024 and perhaps even 2025.

The injection of more than 250 million EUAs into the auction reserve for the next three years has been a significant price determinant in the last few months. The REPowerEU programme calls for a total for EUR 20 billion to be raised from these sales, and if sales are failing to meet the revenue target, additional allowances may be added to the schedule.

While the funds from sales to date are more or less on target, this is entirely due to early sales (starting in July 2023) having generated revenues well above the EU’s target of EUR 75/tonne. But with prices now as much as EUR 20/tonne below that level, funds are starting to slip behind schedule.

This may trigger the injection of even more EUAs into the REPowerEU pot, delaying any recovery in prices.

Auction Supply to Tighten From 2027

Longer term, however, the REPowerEU programme will tighten the market after 2026 considerably. Since the additional auction volumes have been drawn from reserves that were originally intended to be sold in the latter part of the current decade, analysts have been careful to point out that EUA supply in 2027-2030 will be even tighter, on top of already-shrinking allocations and a bigger annual cut in the market-wide cap.

Consequently, the market is maintaining a close watch on the positioning of investment funds. The weekly Commitment of Traders report is published every Wednesday and prices have often reacted sharply to shifts in fund holdings.

While in the latter months of 2023 speculative traders tended to squeeze the market higher after every increase in funds’ net short positioning, there have been fewer squeezes this year, which may mean spec traders have given up trying to test the funds, or that the bearish sentiment has spread.

But a sudden drop in funds’ short positioning could trigger a sharp rally in EUA prices and when it comes, the reversal could be significant.