Insight Focus

- Both the corn and wheat markets remain well supplied.

- Russia weighed on the wheat markets this week by selling lower, pushing others down.

- The market seems to have priced in most potential production issues.

Russia this week lowered wheat prices and forced other origins lower. But despite the downside pressure, we should be near the bottom of the market as we have reached levels that do not cover costs of production.

Corn in Chicago recovered for the first time since the downturn that began mid-December and corn planting starting soon should reflect lower acreage. However, the ample supply picture should cap any upside in the market.

Supply should continue to weigh on prices, although we think the downside should be limited now. There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop, which averages in the range of USD 4.15/bushel to USD 4.4/bushel. The average price since September 1 is running at USD 4.63/bushel.

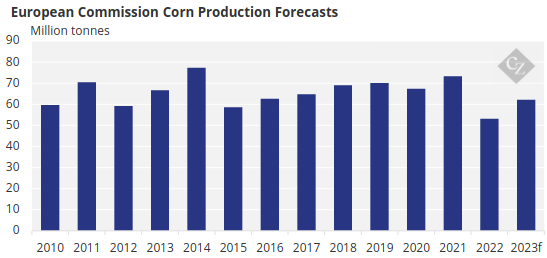

Corn Market Remains Comfortable

The downside pressure in the grains market remains despite the positive week for Chicago corn. The market ended the week negatively on Friday.

The European Commission increased its estimate for corn production to 62.3 million tonnes or 868,000 tonnes above its previous estimate, leaving the market even more comfortable than before.

In Brazil, Safrinha corn planting is 59% complete compared with 48.7% last year. The first corn crop is 24.9% harvested.

In Argentina good rains during the last few weeks have improved corn conditions, which are now 30% good or excellent, or two points higher week on week.

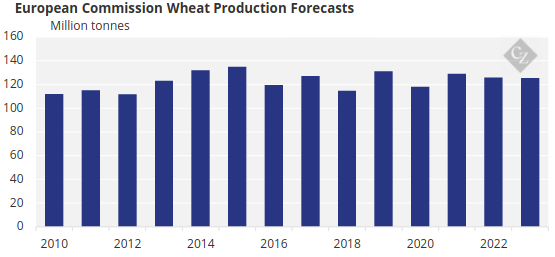

Russia Pushes Down Wheat

Wheat was unable to hold a positive start of the week and fell strongly. There were big losses in the US and Europe, but the 11% weekly fall in European wheat was influenced by the expiry of the March contract next Monday.

There was also a Friday selloff after Russian sellers reduced their prices and forced other origins lower on the export market. This is the result of the additional 4 million tonnes of exports allowed by Russia two weeks ago.

Wheat condition in France was 68% good or excellent, one percentage point lower week on week and down significantly on the 95% recorded last year.

The price didn’t even react to the European Commission reducing its estimate for wheat production to 125.6 million tonnes — 284,000 tonnes lower than its previous estimate. We think this reduction was already priced in as it came mostly in France where excess rains had a negative impact on planted area.

Fundamentals Point to Ample Supply

The US is expected to continue experiencing warmer than normal temperatures and above average rains. While the north of Brazil will experience rain, those in the centre south region are expected to be irregular. Europe is expected to receive rains through the middle of this week, turning dry during the second half of the week.

The grains market is very well supplied, and stocks are high. Lower corn production in Brazil is already priced in. But high global stocks, combined with a stock build in soybeans, more than offset lower wheat production. Only further damage to Brazilian production (with planting of the second and biggest corn crop still ongoing) could change the global supply picture.

This ample supply picture should cap any upside in the market. But despite the downside pressure we should be near the bottom of the market as we have reached levels that do not cover costs of production.