Insight Focus

- California’s latest auction cleared at a record high.

- RGGI prices have also reached record levels.

- Traders are now anticipating supply cuts ahead of 2030.

Supply Concerns Push Prices Up

US carbon allowances are trading at near record highs so far in 2024 as market participants speculate that regulators will tighten supply in the current round of reforms of the two main cap-and-trade systems. Meanwhile, a third state-run carbon market is seeking to link with California’s system.

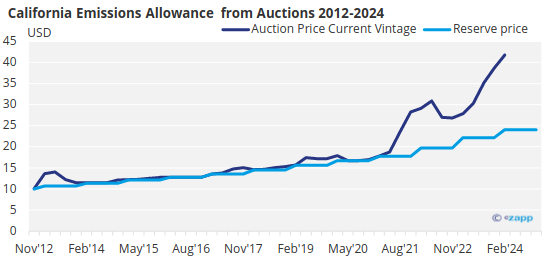

In California, the first quarterly auction of the year cleared at a record USD 41.76/tonne on February 14, eclipsing the previous record of USD 38.73/tonne set in November and far above the reserve price of USD 24.04/tonne.

Prices in the secondary market have also set records in recent weeks, with speculative buyers amassing significant holdings as regulatory reform appears likely to reduce supply in the coming years. On the east coast, the ten-state Regional Greenhouse Gas Initiative (RGGI) market set a record high price of USD 17.32/ton (USD 15.71/tonne) in early February as traders began to anticipate the first quarterly auction of the year, to be held in mid-March.

RGGI auctions will have a reserve price of just USD 2.56/ton (USD 2.32/tonne) in 2024, though every RGGI sale since 2012 has been fully subscribed.

The most recent sale in December saw all 22 million permits sold at a record clearing price of USD 14.88/ton (USD 13.50/tonne). The clearing price also triggered the sale of allowances from the Cost Containment Reserve (CCR) for only the fourth time since RGGI was launched in 2008.

The CCR is triggered when emissions reduction costs reach a certain threshold and adds 10% of the regional cap each year in allowances.

California Seeks Carbon Neutrality by 2045

Traders in both markets are speculating that regulators will lower the cap on emissions more steeply in order to drive emissions lower to meet new mid-century net zero targets. California’s legislature has already passed laws setting a 2045 target for reaching carbon neutrality, and the tighter supply of allowances is expected to drive prices even higher in both markets.

The RGGI market is undergoing a periodic review of the model rule that governs the market, and stakeholders anticipate that regulators will adjust future supply to offset the sizeable number of unused permits that are held by traders.

This so-called “bank adjustment” will take a similar form to the operation of the European market’s market stability reserve, in which new supply is adjusted lower by reducing the volume of permits sold at auction.

Washington Pegs Carbon Market to California

Meanwhile the state of Washington, which launched its own “cap-and-invest” carbon market in 2023, is seeking to link its market to the much larger Californian system.

Earlier this month legislators in the state’s upper house passed a bill to smooth the process of linkage, though a connection between the two markets would require specific rule changes and approval by a referendum.

There are some differences between the two markets at present that would need to be addressed before the two markets can be joined. For example, Washington’s sets a 2030 goal of reducing emissions by 45%, while California is targeting a 40% cut by the same date.

Washington’s market has a cap of just 63 million tonnes, compared with 294 million tonnes covered by California’s programme.

California’s cap-and-trade system is already linked with a similar market in Quebec; auctions are jointly administered, and allowances created by each market are eligible for use by installations in either jurisdiction.