Insight Focus

- Urea prices are driven by Australian and US demand.

- Anticipated US sanctions on Russian producers slowed processed phosphate markets.

- Brazilian granular potash price appears to have reached a floor at USD 280/tonne CFR.

Urea Market Positive on US Demand

The international urea market this week was driven by imports to Australia with another sale reported from Qatar Energy this time at USD 380/tonne FOB. This is slightly less than the price obtained last week. It will be interesting to see how this price will be reflected in the granular urea tender to be held in Pupuk Indonesia for 25,000-30,000 tonnes for March shipment.

CaMau of Vietnam was rumoured to have sold a 30,000-tonne granular urea cargo to a trader at USD 405/tonne FOB to be sent to an unknown destination. Both Thailand and Australia could support FOB levels around the USD 385/tonne mark – or higher considering freight differentials to the Middle East.

The other market creating some interest was NOLA/US where a March barge was reportedly sold at USD 330/short ton (USD 297/tonne). A prompt February barge changed hands at USD 370/short ton (USD 333/tonne). Spring is approaching in the US and subject to the weather, the US is expected to import a considerable volume of urea.

Both Brazilian and European buyers are holding back with little or no interest. Urea prices are expected to hold firm until April when the Chinese exports are expected to resume, putting pressure on prices. A correction appears inevitable.

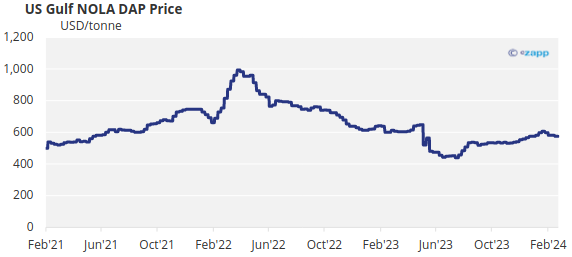

All Quiet in Processed Phosphate

On the processed phosphate side, rumours are persisting that the US may announce sanctions against Russian fertilizer producers. However, Russian producers are already blocked from selling to the US due to the Countervailing Duties imposed previously, so any action would be more like a ceremonial marking of the suspicious death of political activist Alexei Navalny.

The only other news this week was a reported Ma’aden sale of DAP to Thailand at USD 645/tonne CFR.

There are rumours that China may be entering the export market sometime in March and that companies with export clearance suspended would be allowed to ship these cargoes. However, it is more likely that China will only start exporting in a meaningful way after the end of the spring season in April.

In other news, a vessel transporting phosphate fertilizer from Saudi Arabia to Bulgaria was struck by missiles on February 18 while passing through the Gulf of Aden. This marks the third phosphate cargo to be attacked by Houthi rebels in Yemen over the past three months. The impact of these attacks on fertilizer market fundamentals has been largely limited to date, but supply risks remain.

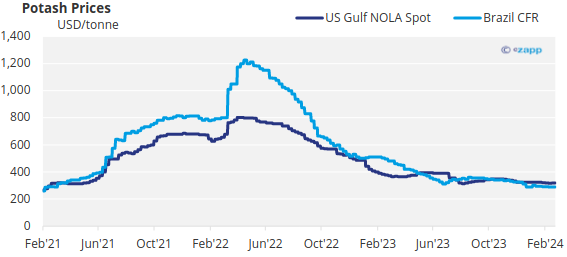

Mosaic Results Signal Potash Market Normalisation

Potash prices in Brazil appear to have reached a floor with the weekly range increasing on the lower end by USD 5/tonne to USD 280/tonne versus USD 275/tonne CFR last week. The range is now at USD 280-290/tonne CFR. All other markets remain unchanged.

There is no news on contract settlements in India with Indian buyers looking for prices below USD 300/tonne CFR.

Thailand’s imports of MOP in 2023 decreased by 3.6% year over year to 709,565 tonnes. Laos increased MOP sales by 110% to reach 133,510 tonnes. Canada reduced sales by 36% to 235,332 tonnes.

Elsewhere, Mosaic’s fourth quarter 2023 net earnings slumped, despite a 37% increase in potash sales volumes to 2.6 million tonnes from 1.9 million tonnes in the same quarter a year earlier. The average MOP selling price decreased 58% from USD 581/tonne in the fourth quarter of 2022 to USD 243/tonne in the same quarter of 2023.

Fourth-quarter EBITDA for potash reached USD 322 million, down 46% from USD 597 million in the same quarter of 2022. The quarterly results take Mosaic’s full-year 2023 potash sales volumes to 8.9 tonnes and potash segment-adjusted EBITDA to USD 1.471 billion.

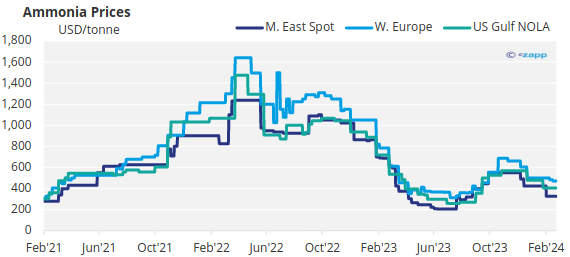

Ammonia Market Awaits March Settlement

Amid a subdued market, most global ammonia benchmarks were assessed unchanged, despite the relative length seen in several regions, though some have begun to moot the possibility of a bottom being reached in the coming weeks. The market appears long in most areas for the time being, but a lack of business has kept prices stable in recent weeks.

Talk of a bottom being reached may well be realised should producers in Southeast Asia begin to initiate turnarounds on a significant scale, though there is currently no official signal that this will happen. A March contract settlement between Mosaic and Yara is expected next week with either a rollover of current price of USD 445/tonne CFR or a slight increase.