Insight Focus

- 70% of expected Chinese sugar production for this season has been completed.

- Sucrose yields in the main sugarcane producing areas declined due to adverse weather.

- What will be the final sugar output? What’s the Impact?

China is a sugar deficit country. Sugar production has trended downward since it peaked at 14.84m tonnes in 2007/08.

But consumption isn’t really growing either. China’s population growth has stalled. There were 9 million births last year, compared with 16 million two decades earlier. But the large population still supports annual sugar consumption of 15 to 16 million tonnes.

This means that China’s domestic sugar production still determines its import dependence.

Source: CSA, Czapp

For the 2023/24 season, we expect China to produce 9.8 million tonnes of sugar, a recovery of 10% over last season. It could recover further with higher cane prices incentivizing planting for 2024/25.

Let’s go back to the question – how is 2023/24 progressing?

2023-24 Production 70% Completed

As of the end of January, 60% of China’s 2023-24 expected sugar production had been completed. Sugar beet processing was almost entirely finished, while sugarcane crushing was 55% done.

Mid-February was the Chinese Lunar New Year, and as of today, we think sugar production is now 70% complete.

Higher Cane Price Incentivize Planting but Weather Dampens Sucrose Yields

Production in Guangxi, China’s largest producing region, has fallen short of initial optimistic market expectations of 6 – 6.4 million tonnes.

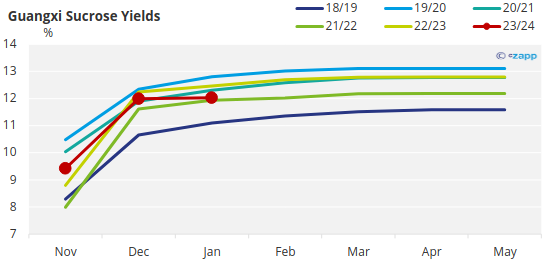

In Guangxi, last year’s rainfall in cane areas was relatively high and this was conducive to the growth of sugarcane. But because of the lack of sunlight and low temperature variation, the sugar accumulation was slow.

The temperature difference between January and December was more favorable, which was conducive to sugar accumulation in sugarcane, but two freezing cold spells in mid-December and late January had an adverse effect on sugarcane.

As of the end of January, Guangxi’s sugar yield was 12.03%, down 0.43% year-on-year.

In the 2023-24 season, we currently estimate that Guangxi’s sugarcane production will reach 49.6 million tonnes, with sugar production at about 6 million tonnes, an increase of about 700k tonnes from the previous crushing season.

Policy Supports

President Xi visited Guangxi Sugar in December 2023 and this clearly brought a more positive signal to the local sugar industry. President Xi pointed out that it is necessary to make Guangxi’s sugar industry stronger and bigger and play a greater role in ensuring the safety of the national sugar industry and promoting the income of sugarcane farmers.

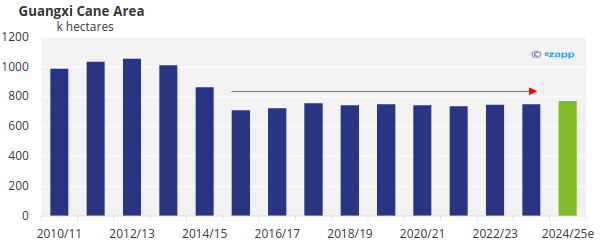

In terms of practice, we see that Guangxi is promoting the breeding base of improved sugarcane varieties (to improve the quality of sugarcane), launching a new round of subsidies for improved seeds, and continuing to promote the action of “eucalyptus switching to sugarcane”.

Among Guangxi’s 7.73 million hectares of sugar cane protection zone, there’s 85 thousand hectares of eucalyptus, accounting for 11% of the reserve area. Guangxi has formulated a three-year action plan to clear 67 thousand hectares of eucalyptus planting area by the end of 2024.

Together with higher sugarcane prices, we expect to see a further increase in sugarcane acreage in Guangxi for the 2024/25 crushing season.

War Stops Cross-Border Canes

Yunnan, the second largest producing region, faces a different problem. The weather in the region has been relatively normal, but the inflow of sugarcane from abroad has been affected by the war in Myanmar. In the war area, farmers are unable to go to the planting sites to harvest sugarcane.

As of January 31, Yunnan produced a total of 619,900 tonnes of sugar, a decrease of 6.26% compared with the same period last season. We expect Yunnan to produce around 2.1 million tonnes of sugar in the 23/24 season, and it looks likely that final production may be slightly lower than expected now.

What Does It Mean for 2023-24?

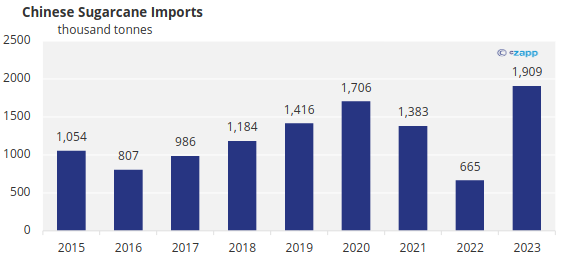

At the start of the 23/24 season, China’s industrial and commercial sugar stocks have reached a low level, excluding central sugar reserves. This year, China’s sugar production may not reach 10 million tonnes, which means that China still needs at least 5 million to 6 million tonnes of imported sugar to meet domestic consumption.

Let’s keep a close eye on who will this lottery will fall on: liquid sugar, premix powder, raw sugar, or sugar substitutes?