Insight Focus

- Lunar New Year and Carnival in Brazil dampened interest in the fertiliser market this week.

- There are roadblocks ahead on the path to increased urea prices.

- Ammonia markets both east and west of Suez appear long.

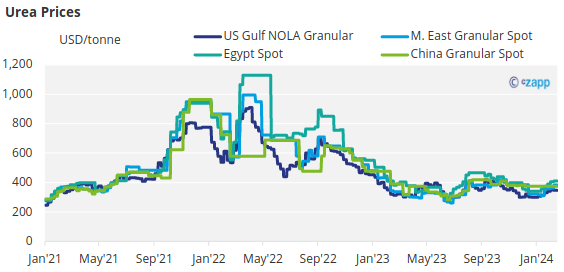

Urea Price Turns Bearish

There are several roadblocks in the way of further urea price increases. The week has been rather inactive with the Carnival celebrations in Brazil and the Lunar New Year celebrations in the East taking priority.

Egypt’s FOB values have returned to around USD 400/tonne from as high as USD 410/tonne. Middle East netbacks are closer to USD 370/tonne FOB with sales of granular urea to west coast Mexico as a barometer. Middle East prices had been advancing towards USD 400/tonne with as high as USD 385/tonne FOB reported.

Black Sea granular urea is now at around USD 380/tonne with Ukraine demand taking a pause. Iran has achieved USD 352/tonne FOB. There was a report late this week that the Iranian south-north gas pipeline had suffered explosions, but it appears now that the impacts were limited.

With Brazilian buyers out of the market for the holidays, prices dropped towards USD 370/tonne CFR, down from around as high as USD 395/tonne CFR. Some reports indicate that Venezuelan products may be offered at lower levels.

India needs to come back into the market with a tender to revitalize the urea market. Although rumours persisted that a urea tender was forthcoming, this has now evaporated into thin air with March tendering now more likely.

It will also be interesting to see what the Chinese government will do on the current export restrictions after Lunar New Year. Coupled with a looming Indonesia tender now that the election is over, the market will be carefully watching any direction the price of urea will take. For now, the market has turned somewhat bearish.

All Quiet in Processed Phosphate

On the processed phosphate side, the only two active markets are India and Pakistan. The former has bought DAP at USD 595/tonne CFR – a price that now appears to be set in concrete with the Indian government showing no signs of coming to the table with higher rates. Pakistan reportedly bought a SABIC DAP cargo this week at USD 627/tonne CFR which probably is more reflective of the current price level.

MAP prices in Brazil are also set in stone with levels of USD 565/tonne CFR having been unchanged for months.

Again, all eyes will be on the potential resumption of Chinese exports. Once this happens, prices will correct downwards.

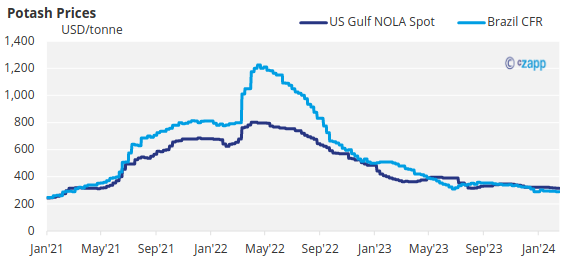

India Seeks Lower Potash Price

Potash prices are stable mostly due to lack of activity in Brazil and the Far East. Granular MOP prices in Brazil pegged at a range of USD 275-290/tonne CFR. India is looking to settle new contracts at below USD 300/tonne CFR. Indian imports in 2023 dropped 25.6% year over year to 2.4 million tonnes.

In 2023, Canadian exports reached their highest level ever with a total of 22.8 million tonnes exported, of which 7.6 million tonnes went to the US, up 21.8% year on year. Full year US MOP imports from Canada rose 12.5% to 10.5 million tonnes while US re-export of MOP from Portland amounted to 1.87 million tonnes, down 36%. Brazil imported 4.4 million tonnes of MOP from Canada.

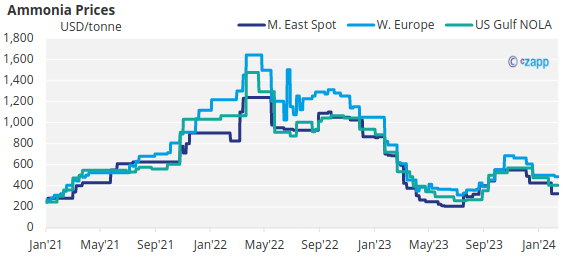

Ammonia Markets Go Long

The ammonia market has been quiet this week, but it appears that the market is long on either side of the Suez. Eastern producers seem to be longer than those in the west.

Major markets South Korea, China and Taiwan were all on Lunar New Year holidays this week.

The only notable sale this week was a small parcel sold from Indonesia to India at USD 320/tonne CFR, which is not attracting interest from Middle Eastern suppliers looking to secure long term contracts rather than entering the spot market. The current Middle East range is USD 300-330/tonne FOB.