Insight Focus

- February’s WASDE report confirmed ample global grains supplies.

- Grains markets dipped on higher-than-expected production figures.

- With a well-supplied market, prices look fundamentally bearish.

The February WASDE report released last week reconfirmed ample grains supply, which resulted in another negative week for all grains in all geographies. The market was expecting the negative WASDE numbers and traded lower during the first half of the week. It continued down after the publication as projections came in below expectations.

There was also a negative start to the week in the US due to export inspections coming in lower than expected and the amount of US corn facing drought conditions fell, further pressuring the market.

Ample globally supply should continue to put pressure on prices, but the focus now is on weather and crop conditions in Brazil and Argentina, which should give some short-term support. The sizable spec fund net short leaves prices vulnerable to the upside with any signal of lower production in South America triggering a rally.

But the market should be capped by the ample supply. There are no changes to our Chicago corn forecast for the 2023/24 (September/August) crop to average in a range of USD 4.15/bushel to USD 4.4/bushel. The average price since September 1 is running at USD 4.69/bushel.

Higher Stock Projections Weigh on Prices

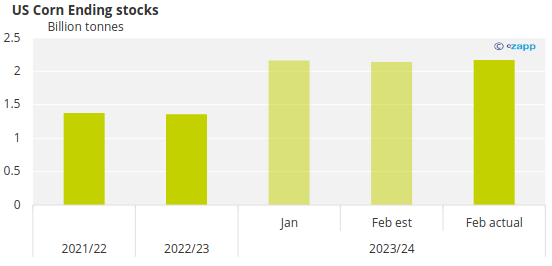

The February WASDE report showed US corn ending stocks at 2.172 billion bushels, above the expected 2.14 billion bushels and higher than the 2.162 billion bushels projected in the January WASDE report.

Source: USDA

The higher stocks came from lower food, seed and industrial demand. The market was expecting lower stocks, so prices trended negatively after publication.

In the WASDE report, global corn stocks were revised 3.16 million tonnes lower to 322 million tonnes due almost entirely to lower production in Brazil, which is now forecast at 124 million tonnes versus 127 million tonnes previously.

Mexico also saw a lower downward revision of 500,000 tonnes. Still, this is a 22-million-tonne stock build from the 2022/23 crop, which had ending stocks of 300.25 million tonnes.

Source: USDA

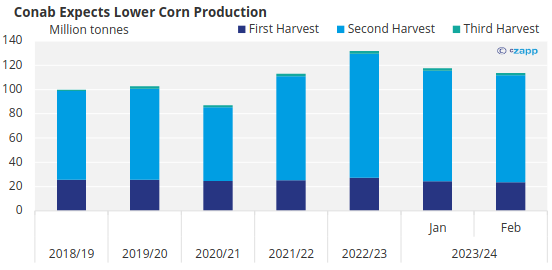

Importantly, Brazil’s National Storage Company (Conab) reduced its corn production forecast to 113.6 million tonnes from 117.6 million tonnes, which is a sizable 10.4 million tonnes below WASDE’s expected 124 million tonnes.

Source: Conab

In Argentina, BAGE registered concerns over corn yields due to a heatwave having negatively impacted the condition of the crop. Argentinian corn is virtually fully planted but the condition deteriorated to just 31% good or excellent versus 34% the previous week.

The summer corn crop in Brazil is now 13.8% harvested versus 9.1% last year. Safrinha planting is 19.8% complete, ahead of the 10.7% recorded last year.

Global Wheat Stocks Ample

Again, there was a negative start of the week in the US for wheat due to export inspection numbers coming in lower than expected.

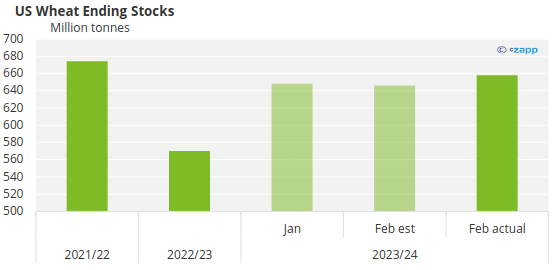

The February WASDE report projected increased US ending stocks for the 2023/24 crop. The increase of 10 million bushels to a total of 658 million bushels all comes from lower food demand.

Source: USDA

The market was expecting a carry of 646 million tonnes so there was negative price action after publication.

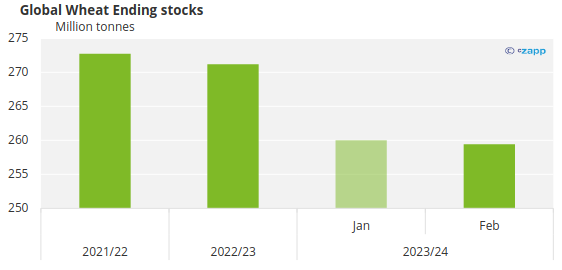

Global ending stocks were revised marginally lower by 590,000 tonnes to 259.4 million tonnes, but the big picture is a yearly stock draw of 11.7 million tonnes. This is due to a high carry of 271.2 million tonnes from the 2022/23 crop.

Source: USDA

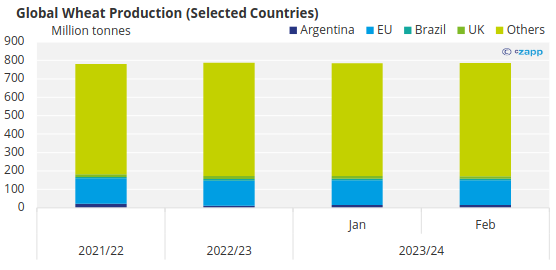

Production was revised higher by 830,000 tonnes with 500,000 tonnes up in Argentina at 15.5 million ton, 300,000 tonnes lower in the EU at 134 million tonnes, and 300,000 tonnes lower in Brazil and another 300,000 tonnes lower in the UK.

Source: USDA

Fundamentals Favour Bear Market

The WASDE report last week simply confirmed what we already know: we have ample supply of grains with global stocks combined increasing by 23.1 million tonnes year on year. A projected 11.2-million-tonne stock draw in wheat is more than offset by stock builds amounting to 21.8 million tonnes of corn and 12.5 million tonnes of soybeans.

There is an air of caution around Brazil’s production figures since Conab’s corn number differs by a sizable 10 million tonnes from that of the USDA. If Conab’s projections are correct, this would reduce the increase in global stocks from 23.1 million tonnes to 13.1 million ton. It would leave the market tighter, but still in surplus.

On the weather front, Argentina and Brazil are both expected to receive rains again, which is very much needed in both countries. Temperatures in the US are expected to continue at above average levels, so snow melting will continue, which is positive for soil moisture. Europe expects rains and colder than normal temperatures.