Insight Focus

- Sugar exports are currently prohibited.

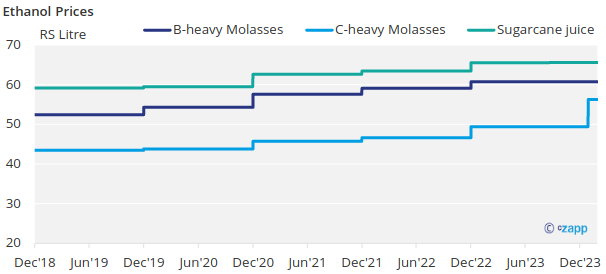

- At today’s prices, processors continue to favour B-molasses to produce ethanol.

- Another revision to ethanol diversion?

Introduction

India, the world’s second-largest producer of sugar, aims to blend 20% ethanol in gasoline by 2025.

This ethanol will be made from sugar cane and various grain feedstocks, which means many Indian mills now have a choice about how they use the sucrose in the cane. We will show the choices they are making in this report.

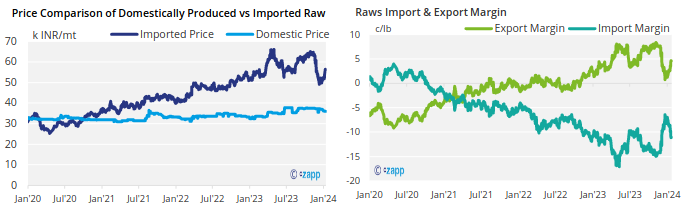

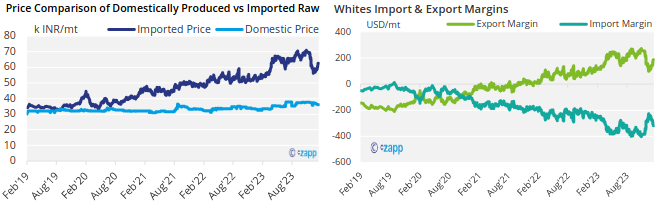

Maharashtra Sugar Imports/Exports

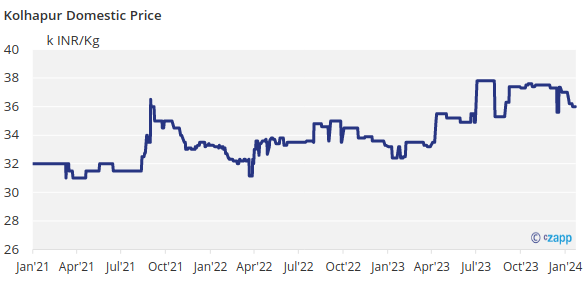

Domestic sugar prices have remained sideways over the past week, hovering around 36INR/kg.

With elections coming up in a few months, the Indian government is concerned about food security. Although imports are not required at this time, there is still insufficient sugar to allow for an export quota to be released, preventing mills from capitalising on large margins.

Ethanol vs Sugar

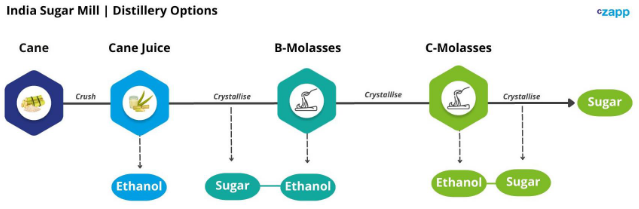

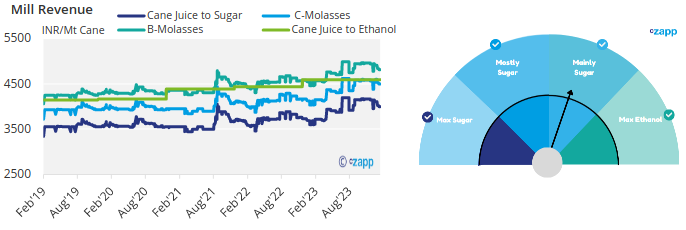

Many mills/distilleries have a choice over which feedstocks they use to make sugar or ethanol based on the relative prices of ethanol paid by the oil marketing companies.

At today’s prices, processors are most likely to choose to make ethanol from B molasses, which yields mainly sugar.

However, in order to address India’s food security issue, the government has decided to cap sugar diversion to ethanol at 1.7m tonnes.

In the event of a cane crop shortfall, the government can change the ethanol prices paid to incentivise mills to use C-molasses, or to use cane juice exclusively for sugar production, reducing the ethanol diversion. Here are the current prices paid for ethanol by feedstock:

Appendix

If you have any questions, please get in touch with us at Jack@czapp.com.