Insight Focus

-

Global sugar production in 2023/24 is set to be the second highest on record.

-

The world will make surplus sugar this year.

-

Production could then fall in 2024/25.

2023/24 at a Glance…

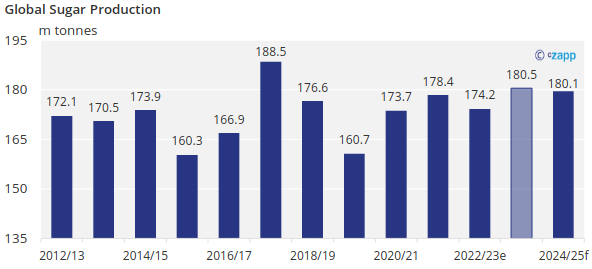

Global Sugar Production

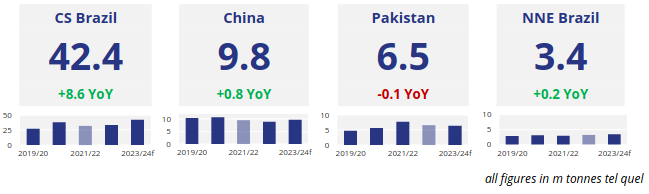

Global sugar production remains in the middle of a decade-long 160-190m tonne range, reaching 180.5 tonnes in 2023/24, up 0.8m tonnes from our previous update.

This increase in production for this season is mainly due to weather conditions in Centre-South Brazil, allowing mills to continue crushing cane. However, despite CS Brazil’s record sugar output, the sugar market remains stressed and highly vulnerable to any adverse events. Relying on a single source of supply is unhealthy, and CS Brazil cannot save the market alone – other regions must also play a role. Without growth in India, global sugar production in 2024/25 is likely to fall.

Global Sugar Consumption

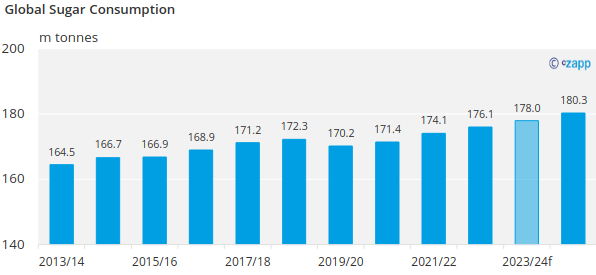

In 2023/24 we think that the world will have consumed around 178m tonnes of sugar.

Despite high world market prices, global sugar consumption continues to remain strong, and we anticipate that this trend will continue as we enter the 2024/25 season, with global consumption reaching 180.3m tonnes.

Small Production Surplus

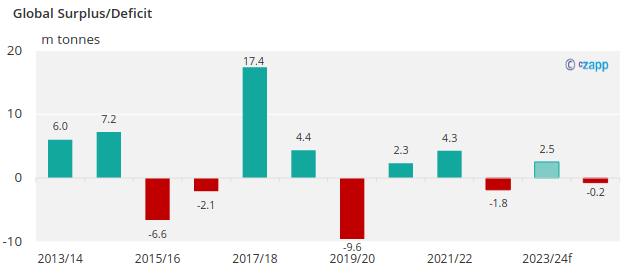

With upward revisions to production for CS Brazil and several other minor sugar-producing countries, we believe global sugar production will outpace consumption in 2023/24.

Production Update: Thailand

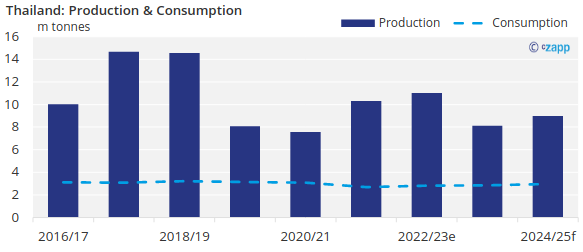

Thailand will produce 8.1m tonnes of sugar in 2023/24, a 2.9m tonne decrease from the previous season.

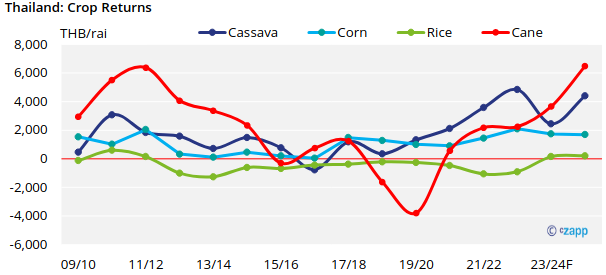

Aside from the loss of cane acreage to cassava this season, the drop in production was also caused in part by lower sucrose yields due to excessive rainfall in September and October, which diluted the sugar content of the cane. Furthermore, the quality of cane delivered to mills this season was subpar, with higher-than-average extraneous matter.

Despite this season’s challenges, the outlook for the next season is promising. Higher cane returns are helping to incentivize farmers to increase their cane acreages at the expense of other competitor crops such as cassava. This means that, should everything go smoothly, we can expect Thailand to crush over 80m tonnes of cane in 2024/25.

Other Sugar Producers at a Glance…

If you have any questions, please get in touch with us at Will@czapp.com.