Insight Focus

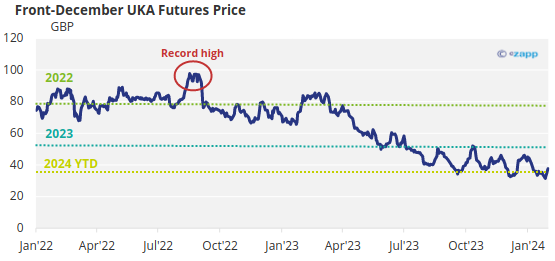

- UKA futures fell to GBP 31.30 last week after having been as high as GBP 99 in 2022.

- Mild weather and reduced power demand are depressing demand for allowances.

- Government is expected to propose supply adjustment mechanism to address the surplus.

Lower Industrial Activity Dampens UKA Appetite

UK carbon allowance prices fell to a new record low of GBP 31.30/tonne last week as mild weather and the effects of the economic slowdown dampened demand for permits. A continuing lack of regulatory clarity regarding potential reforms to the market has also cut speculative demand.

December 2024 UK Allowance futures have averaged GBP 36.97 this year to date, compared to an average of GBP 55.33 in 2023 and GBP 79.09 in 2022. Prices rose to a record high of GBP 99 in August 2022.

Since then, the rapid increase in energy prices triggered by Russia’s invasion of Ukraine has boosted costs for industrials and forced cutbacks in production or closures at many energy-intensive plants, such as CF Industries’ Billingham ammonia plant, which emitted 630,000 tonnes of CO2 in 2022.

The decision by Tata Steel last month to shut its Port Talbot blast furnace will also cut demand for additional UKAs by up to 1 million tonnes.

While many of these industrial plants receive a hefty allocation of free UKAs to protect their international competitive position, the loss of potential demand for additional allowances has acted as a drag on the market.

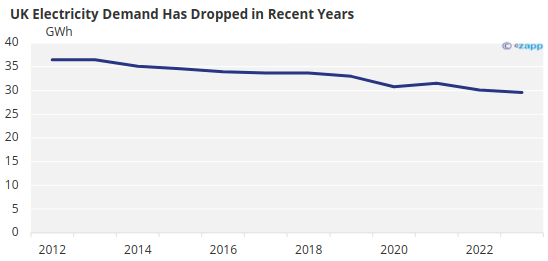

The global economic slowdown led to a year-on-year decrease in UK electricity generation of around 13% in the third quarter of 2023, the most recent period for which the government has published data.

Source: National Grid

Some of this was also due to the UK boosting imports of power from France – in 2022 the country was a net exporter, thereby reducing demand for UKAs by utilities. Higher domestic tariffs for gas and power also cut household power and gas demand by 6%.

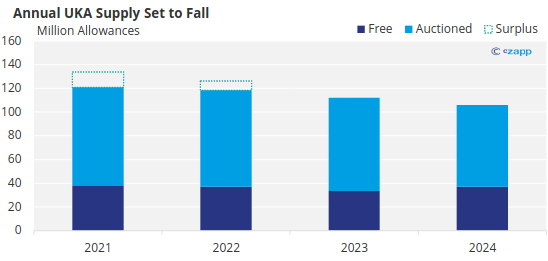

Government Provides Extra Allowances While UKA demand is down, supply is also higher. The government announced last year it will inject around 53 million additional allowances into the market between 2024 and 2027 to “smooth the path” to a lower overall cap on emissions, which is scheduled to come into effect from 2026.

The new cap is to be set at 936 million tonnes of CO2 over the entire period from 2021 to 2030, down a third from the originally legislated cap of 1.4 billion tonnes. The trajectory of the decline in the cap each year will steepen, with the annual cap falling to 50 million tonnes in 2030.

As illustration, for 2022 the UK government handed out 37 million free UKAs, and auctioned 81.3 million. At the end of the year, covered installations reported emissions totalling 110.6 million tonnes, giving a net annual surplus supply of 7.8 million allowances.

For 2024 the government will again hand out 37 million free UKAs, and auction a further 69 million, suggesting that annual supply will fall sharply in the coming years.

While the longer-term outlook for the UK ETS sees a tightening supply as the 2030 target approaches, there remains the issue of the historical surplus of allowances that continues to weigh on prices. The government’s most recent reforms neglected to address this topic and numerous sources have attributed the continuing price weakness to this oversight.

Adjustment Mechanism Could Rebalance Market

In December the UK government launched a consultation on the design of a “quantity-triggered Supply Adjustment Mechanism” that would gradually remove the oversupply.

The EU ETS has operated a Market Stability Reserve since 2019, which has taken more than 1 billion EUAs out of the market in an effort to clear a decade’s worth of excess supply. The implementation of the MSR is widely credited with triggering the recovery in EUA prices from below EUR 10/tonne in early 2018 to a record high of more than EUR 100/tonne in early 2023.

The consultation, which ends in March, suggests the SAM would work in much the same way as the EU’s MSR, with the government calculating the total number of permits in circulation each year, and withdrawing a set percentage by reducing annual market supply.

The government is seeking views on how much supply should be withheld each year – a set number or a percentage of the total surplus – and whether this cut should come from free allocation or auctions.

Despite the potentially bullish impact on prices of the cut to the cap and the proposals for a supply adjustment mechanism, the UKA market remains in the doldrums. Investment funds have held a net short position in UK allowances since April 2023, and recently increased their bets on lower prices to the most in three months.

The positioning suggests expectations that prices are unlikely to revive in the near future, but positioning and price should be expected to change rapidly if the SAM proposal advances.