Insight Focus

- Guatemala should produce approximately 2.47 million tonnes of sugar for the 2023/24 season.

- Unusual rain in November has caused a decrease in Guatemalan production.

- There will be fewer Guatemalan sugar exports in the already tight world market.

Guatemalan Sugar Production Dips

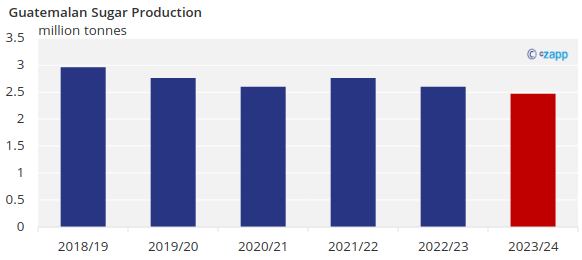

We expect Guatemala to produce approximately 2.47 million tonnes of sugar for the 2023/24 season, a 5% decrease on last year’s harvest. Guatemala’s sugar production has been relatively consistent over the past 10 years. Sugar production has remained flat due to the lack of land availability. Sugar competes with banana and palm oil in Guatemala’s southern region.

Rains Throw Off Harvest

Guatemala experiences only two seasons: a dry and a rainy season. The rainy season runs from May to October, while the dry season extends from November to April. The sugar harvest starts in Guatemala in November and usually ends in April.

This past November, Guatemala’s southern sugar-producing region experienced more rain than usual. This unexpected November rain delayed the harvest’s start for a few mills.

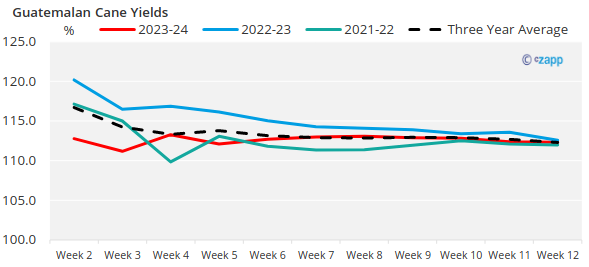

The rain doesn’t seem to have affected cane crushing, with cane yields on par with previous seasons.

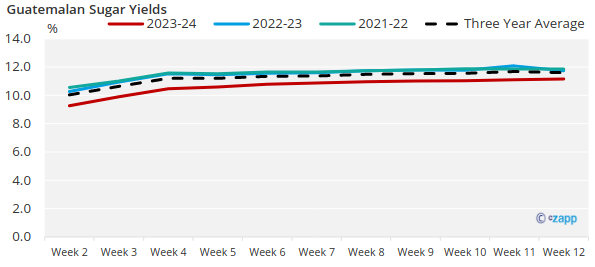

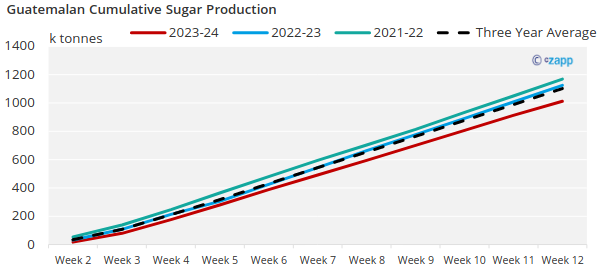

What does seem to be had been affected though are both sugar yields and sugar production.

Both of these measures are below past seasons numbers in the first 12 weeks of the harvest.

How Will This Affect the World Market?

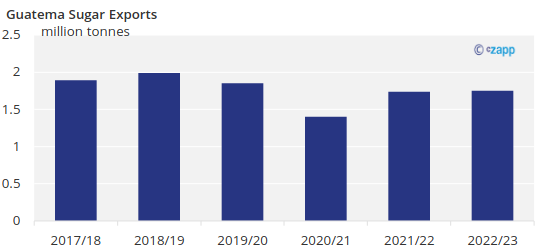

Unlike most countries, Guatemala exports most of the sugar it produces. Guatemalan exports have remained between 1.75 million tonnes and 1.89 million tonnes over the last six harvests.

The Guatemalan harvest decreasing by 5% represents a total loss of around 130,000 tonnes of sugar. With Guatemalan mills having to fill a domestic quota before being able to export sugar, the 130,000-tonne loss of sugar means an equivalent loss in the world market.

With Mexico increasing its sugar imports from Guatemala and the US needing more sugar due to Mexico’s poor harvest, there will be even less Guatemalan sugar in the already tight world market.