Insight Focus

- A small grains rally last week was short lived as production expectations were boosted.

- Rains in Brazil are recovering, creating favourable production conditions.

- Both corn and wheat markets are now well supplied.

Forecast

It was a flat week for corn in all geographies after an initial rally followed by a Friday sell off. Wheat was higher in the US and down on the Euronext. We continue to see the market comfortably supplied and with rains in Brazil recovering, the risk of lower production is limited.

Prices are holding as northern hemisphere farmers are holding on to stocks and southern 3333hemisphere crops are in the planting and early harvesting stages, as is the case with Brazil’s first corn crop.

The big picture is of a comfortably supplied market that should maintain downside pressure on prices. There is no change to our Chicago corn forecast for the 23/24 (September/August) crop at an average of USD 4.15/bushel to USD 4.4/bushel. The average price since September 1 is running at USD 4.71/bushel.

Corn Market Sells Off as Supply Concerns Ease

Last week started on a strong foot with wheat pulling corn higher following better-than-expected export inspection wheat data out of the US. The data showed a 30% increase in inspections week on week. In addition, Farm Futures reported a 3% year-on-year reduction in US wheat acreage.

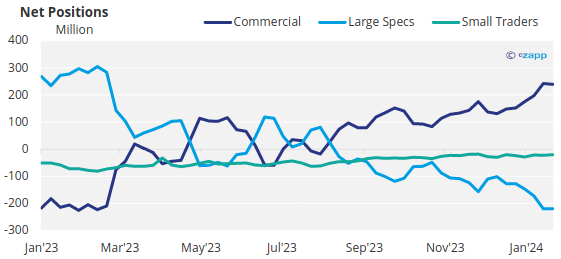

The Commitment of Traders (COT) from the week prior revealed the biggest net spec short in corn since June 2020, which should have added strength to prices in the first half of last week. Some short covering fuelled the rally.

However, poor exports sales by the end of the week for all US grains triggered profit taking and the market sold off.

The weather continues to improve in Brazil and fears of a lower corn crop are easing. The case is similar in Argentina, where BAGE increased its corn production forecast thanks to the latest rains having improved soil moisture and allowed more planting. The new forecast is of 56.5 million tonnes, up on the previous projection of 55 million tonnes on the back of higher acreage.

In both Brazil and Argentina, planting and early harvesting is ahead of last year. The summer corn crop in Brazil is now 8.6% harvested versus. 5.4% last year. Safrinha planting is 5% complete compared with 0.9% last year. Argentinian corn is 97.2% planted versus 94.1% last year.

However, the condition in Argentina fell five points in the week to 41% good or excellent versus 46% last week, somehow contradictory to the upward revision in production.

EU Wheat Pressured Lower by Russia

The EU’s January MARS bulletin was published and as we had been anticipating for some time, wheat has suffered from the combination of too much rain and frost in northern Europe, resulting in winter killing. A rain surplus was noted in northern Germany and Eastern Europe. We will see if production figures are lowered in the coming weeks.

Wheat traded negatively on Euronext despite UK production estimates being officially reduced to 13.98 million tonnes. However, this was a marginal revision of 75,000 tonnes and is immaterial to the market in our opinion. Record Russian exports pressured European values lower.

Brazil is expected to receive good rains again for a third consecutive week while Argentina is expected to remain dry. The US will experience warm temperatures and some rains across wheat areas. European weather is expected to remain dry.