Insight Focus

- Crude oil prices surge on further escalation in the Middle East and Red Sea.

- Raw material futures driven higher following upstream, prompting increased PET prices.

- Weakening physical differential against futures, may indicate higher PET export prices to come.

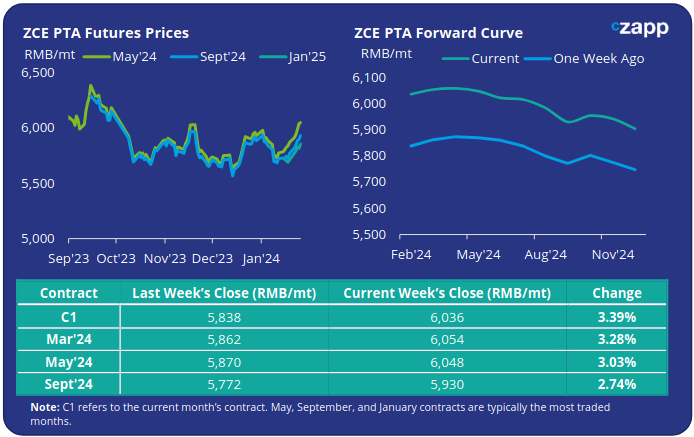

PTA Futures and Forward Curve

PTA Futures prices rallied last week with main contract months up by over 3%, tracking the recent surge in oil prices.

Brent crude oil price soared 6.25% to just under USD 84/bbl, the highest level since December. The latest rally is linked to a combination of robust US economic indicators and rising tensions in the Middle East.

Both the PX-Naphtha, and PTA-PX spreads remained relatively stable. The PTA-PX CFR spread averaged USD 91/tonne last week, broadly in line with recent weeks.

Supply/demand also kept relatively balanced, despite further reductions in polyester production and maintenance plans, PTA turnarounds by Billion and Hengli kept inventory expansion limited.

Strong downstream polyester sales ahead of Chinese New Year (10-17 Feb) lend PTA support, with expectations of continued short-term demand strength through February and into March.

The PTA forward curve lifted last week on higher prices, keeping relativity flat through H1’24. May’24 has a RMB 12/tonne premium over the current month’s contract.

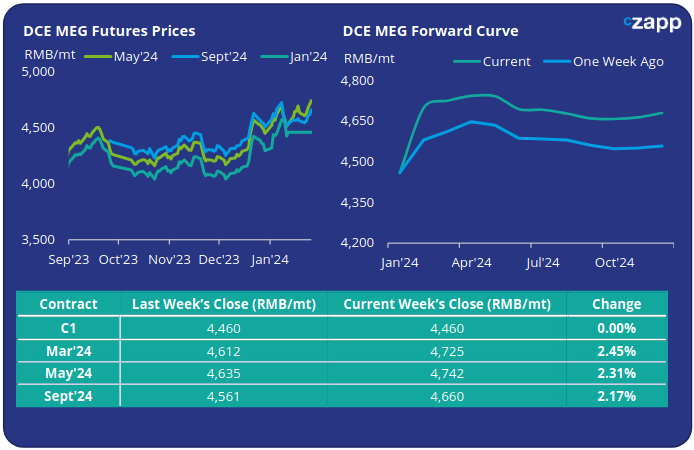

MEG Futures and Forward Curve

MEG Futures also experienced gains on the back of reduced import arrivals, although returning domestic supply has softened bullish overtones of recent weeks.

Main East China port inventories decreased by 7.7% last week, to around 828k tonnes, impacted by global freight disruption, delayed Saudi shipments, and a US winter freeze.

However, domestic production has increased sharply, coming out of a period of heavy turnarounds, and offsetting the reduction in imports. As a result, further upside to prices may be constrained.

The MEG forward curve shows a near-term increase, before easing into H2’24. The May’24 futures premium increased to RMB 282/tonne over the current month’s contract.

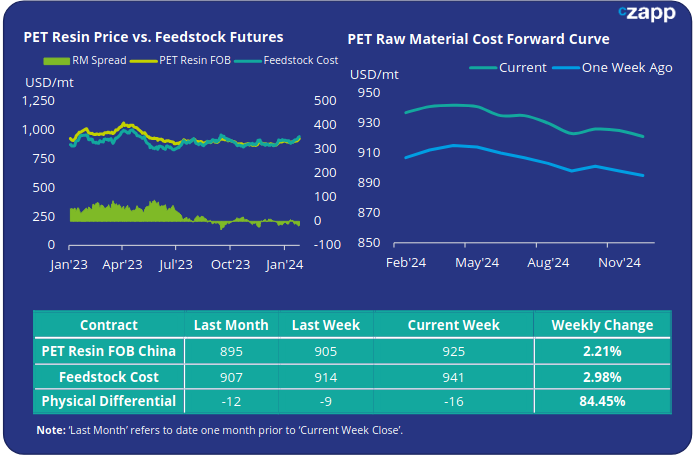

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices increased through last week on rising raw material costs, averaging USD 925/tonne last Friday, an increase of USD 20/tonne on the previous week.

The weekly PET resin physical differential against raw material future costs lost a further USD 10/tonne last week to average minus USD 16/tonne for the week. By Friday, the daily spread was minus USD 16/tonne.

The raw material cost forward curve has flattened more to June, before becoming modestly backwardated through H2’24.

The current May’24 contract was only USD 4/tonne above the current month, with Sept’24 around USD 15/tonne below May.

Concluding Thoughts

Chinese PET resin export prices are expected to continue to track raw materials closely, with further rises over the next week expected if crude further strengthens.

Despite price rises, moderate restocking was noticeable in the PET resin export market.

In addition, turnarounds are keeping operating rates relatively low, containing any escalation in factory inventory levels that currently run around 14 days.

Spot PET-Raw Material spreads have eased slightly since the beginning of the year, falling from around USD 75/tonne to USD 69 tonne.

On the basis that the market will see stronger demand coming into the pre-season, downside risk to spot margins is expected to be limited.

Therefore, a weaker physical differential to PET resin spot prices is indicative that PET resin export prices are set to continue to rise steadily into the coming months.

Beyond Chinese New Year, any resolution to the Red Sea situation, and lowering of global freight rates, could result in a sizeable return in demand, as buyers look to restock and boost supply security.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.