Insight Focus

- European PET prices rallied in January following Red Sea freight disruption and tighter supply.

- Several producers gamble on restarting lines, but can the market absorb additional supply?

- Despite freight rate increases, imports from South Korea and Vietnam remain competitive.

Market Overview

European PET resin producers started the year on a stronger footing, chaos in the Red Sea being the opportunity the industry had been waiting on to bring about a price correction and recover margin.

Reduced capacities and production constraints, due to limits on PTA availability, has tightened the market amid reduced import flows.

The escalating crisis in the Red Sea has also heavily disrupted imports, with ocean freight rates surging, longer transit time, and delays due to container availability issues in Asia. Further delays around the upcoming Chinese New Year (10-17th Feb) are also likely to slow shipments.

As a result, European PET resin prices have strengthened through January, and at least two European PET resin producers are reportedly sold-out February, albeit with lines down.

Expecting the market to remain tight into March some panic buying was noticeable, with converters looking to restock and de-risk ahead of the pre-season upswing in demand.

However, strip away much of this volatility and underlying consumer demand within Europe remains weak, with both seasonality and weak economics playing their part.

Therefore, it’s unsurprising that other buyers have taken to the side-lines, taking higher priced domestic resin hand-to-mouth, waiting for ocean freight rates to drop, ready to bring in large import volumes.

However, Asian exports are now only offering March shipment at the earliest, and freight rates look to remain higher for longer, posing a conundrum for buyers.

And whilst some have talked up a potential short squeeze when demand returns in March, several PET producers are believed to be restarting previously idled lines, potentially halting margin and price recovery.

Consumer Confidence in Europe Turns Bearish

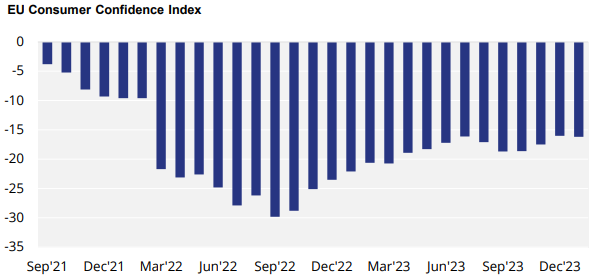

Slower consumer sales and weak economic data is feeding into the uncertainty and pessimism surrounding PET resin buyers.

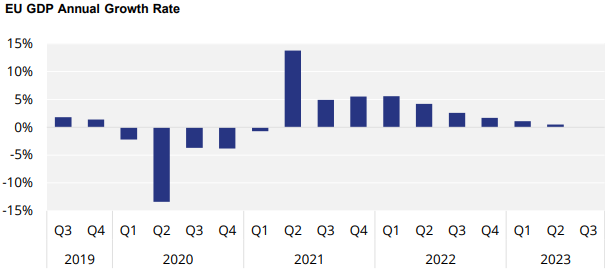

The European Union’s economy continues to stagnate; third quarter growth fell to zero, marking 18-months of successive quarterly declines.

Whilst economists are predicting that real EU GDP growth has bottomed out and will begin to stage a recovery in early 2024, potentially trending towards 1.4% in 2024, consumer confidence remains depressed.

Consumer Confidence in European Union contracted in January, bucking the recent upwards trend.

Whilst projections are still towards a steady improvement, and inflation has fallen, consumers are still feeling retail prices rise eating into their spending power.

Disruption from the Red Sea will inevitably bolster global inflation once again, or at least make it stickier in the medium-term. Expectations that central banks may start cutting interest rates early in 2024 may also need to be revised.

European PET Resin Prices Divided as Lines Restart

Although European PET resin prices have increased sharply through January, further upward momentum looks to have stalled, spot pricing thrown into disarray by new supply.

The market has found itself split. Some PET resin producers, typically those that are heavily contracted with limited spot availability, are offering in the range EUR 1100 to 1170/tonne.

However, aggressive prices as low as EUR 1050/tonne are also being offered for February from another supplier dividing the market.

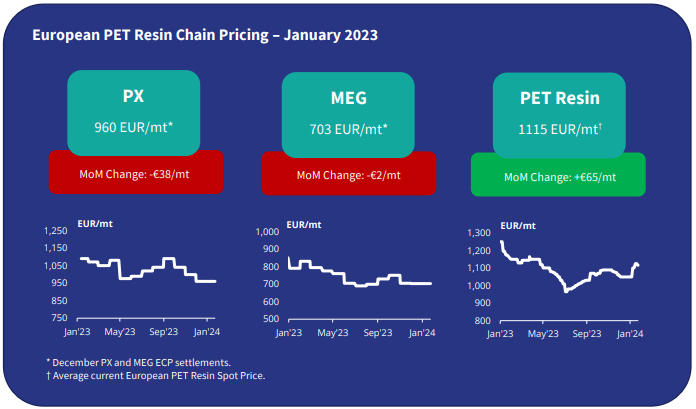

On the basis that lower priced volumes are still somewhat limited, the current average price is assessed at EUR 1115/tonne, representing an increase of around EUR 65/tonne over the last month.

There are nuances within the full price range. However, even at this, added spot availability at lower prices has stalled the price rally going into February.

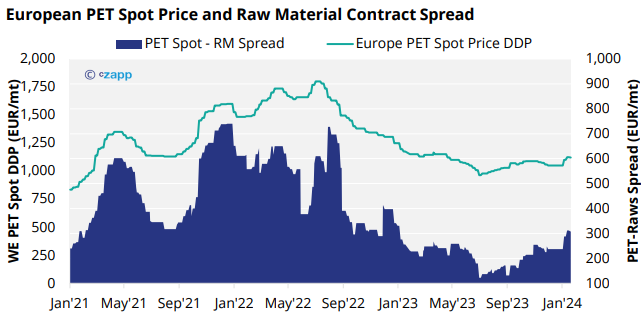

The December PX European Contract Price settled at EUR 960/tonne, representing a EUR 38/tonne decrease from the previous month. December’s MEG ECP adjusted down very slight by just EUR 2/tonne.

As a result, European producers continue to experience a steady margin improvement on raw-material- formula contracts.

Given the trend in recent years away from traditional raw-material-based contracts, even producers not currently selling on the spot market have a heavy exposure to spot prices through market-linked price contracts.

Therefore, there is an argument that these distinct, discounted prices should be excluded from index assessments in the short-term.

Indices may see a slight upward correction in the coming weeks due to the limited volumes available at the lower end of the range.

However, other dormant lines are also expected to come back on-stream ahead of pre-season demand. The question for many is, is this the right time to restart, and will the market be able to absorb this additional production?

Is it cheaper to import?

Asian PET resin export prices have firmed through the start of year on rising raw material costs. At the time of writing, average Chinese resin export prices averaged USD 920/tonne, up USD 40/tonne versus pre-Christmas levels.

Although crude prices remain volatile, other Asian PET resin producers are also expected to follow raw material costs upward. (Please read our Asian Weekly report for further insight)

Vietnamese PET resin export prices have increased USD 20-30/tonne over the last month; Turkish prices have leapt to around EUR 1035/tonne FOB, an increase of over EUR 100/tonne since New Year.

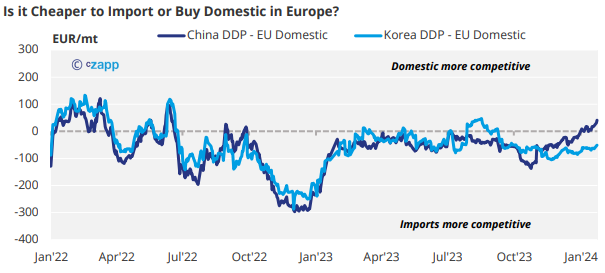

Indicative import prices typically range EUR 995-1025/tonne CIF duty paid NWE, equating to around EUR 1050-1070/tonne DDP.

On average, import prices from duty advantaged origins are EUR 55/tonne lower than the average European domestic PET resin price.

However, the sharp differences in domestic prices available across European sales territories mean buyers in Eastern and Southern Europe could still benefit from the import delta, despite recent increases in ocean freight.