Insight Focus

- PTA Futures lifted by higher upstream costs amid weakening S/D fundamentals.

- Container availability becoming an issue at some Chinese ports.

- PET resin export prices firm, exports face transhipment delays.

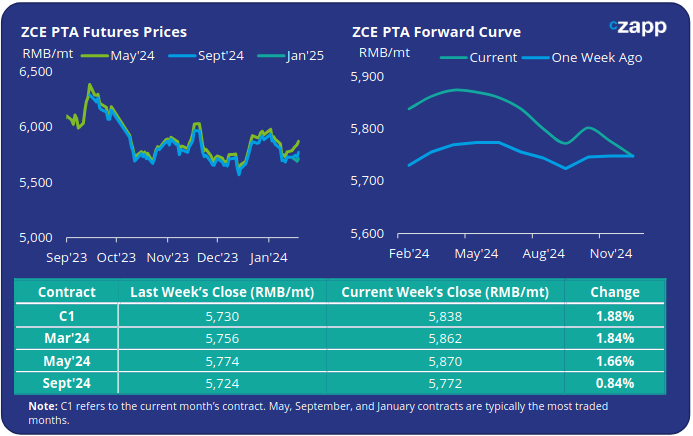

PTA Futures and Forward Curve

PTA Futures rebounded last week, driven higher by upstream costs, amid a volatile crude environment.

Having retreated to the mid-70s USD/bbl range, Brent oil prices recovered to press USD 80/tonne once again last Friday; the risk of escalation in the Middle East remains and a fall in US inventories being main drivers.

While PX-naphtha spread was relatively stable, the PTA-PX spread continued to contract, averaging another USD 5/tonne drop last week, to around USD 87/tonne.

The narrower PTA-PX spread reflects weaker PTA supply/demand fundamentals, as polyester operating rates ease, and PTA production is expected to remain relatively stable with limited maintenance in January.

As a result, availability is expected to lengthen modestly as Chinese New Year approaches.

In the short-term, upstream price volatility is expected to have the greatest influence on PTA prices.

By Friday, the PTA forward curve shows a near-term increase, peaking in April, before falling back through H2’24. May’24 has a RMB 32/tonne premium over the current month’s contract.

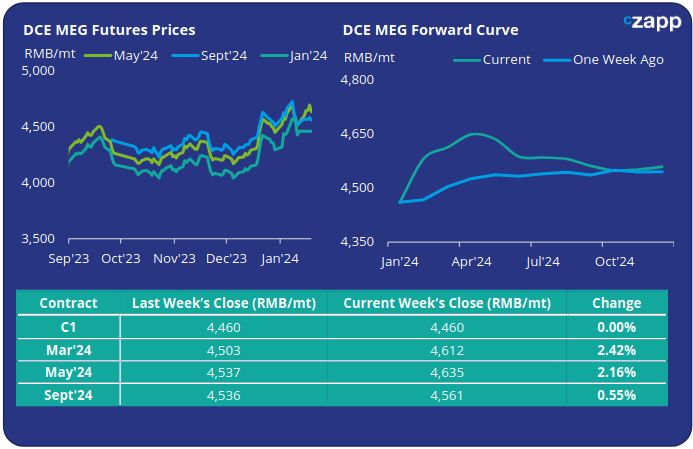

MEG Futures and Forward Curve

MEG Futures also rose last week, buoyed by falling import and port inventory levels.

Main East China port inventories decreased by 6.2% last week, to around 898k tonnes, the lowest level since January 2023, a 12-month low.

In addition to reduced supply from the Middle East, US cargoes are now not only facing constraints from reduced water levels in the Panama Canal, but also plant outages caused by the polar vortex.

Whilst inventory pressure eases, and market sentiment turns bullish, buyers are likely to be cautious ahead of Chinese New Year; easing of polyester production is also likely to constrain upside momentum.

The MEG forward curve shows a near-term increase, before easing into H2’24. The May’24 futures premium increased to RMB 175/tonne over the current month’s contract.

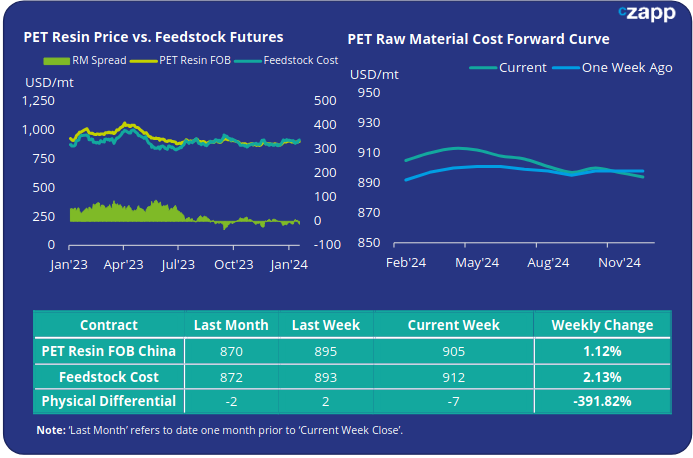

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices firmed through last week on rising raw material costs, averaging USD 905/tonne last Friday, an increase of USD 10/tonne on the previous week.

The weekly PET resin physical differential against raw material future costs fell back into negative territory, losing USD 6/tonne last week to average minus USD 7/tonne for the week. By Friday, the daily spread was minus USD 7/tonne.

The raw material cost forward curve shows a slight near term premium to April, before becoming very modestly backwardated through H2’24.

Even still, the May’24 contract was only USD 5-10/tonne above the current month, with Sept’24 just USD 5/tonne below.

Concluding Thoughts

Chinese PET export prices have firmed through the week, with indications from other Asian producers that prices are expected to follow raw material costs upward as well.

Having made some improvement late-Nov/early Dec, insufficient demand against a backdrop of over-capacity and increased production rates, saw spreads fall back once again.

Container availability is becoming an issue at some Chinese ports, delaying shipments, and leading to possible further freight rate increases.

The upcoming Chinese New Year celebrations will also mean a slowdown in operations, from producers and carriers.

Concerns around stock levels in some geographies are also rising, as cargoes face extended transhipment delays.

Beyond Chinese New Year, any resolution to the Red Sea situation, and lowering of global freight rates, could result in a sizeable return in demand, as buyers look to restock and boost supply security.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.