Insight Focus

- EU’s CBAM driving market building around the world.

- Turkey, Brazil, Vietnam in early stages of market set-up.

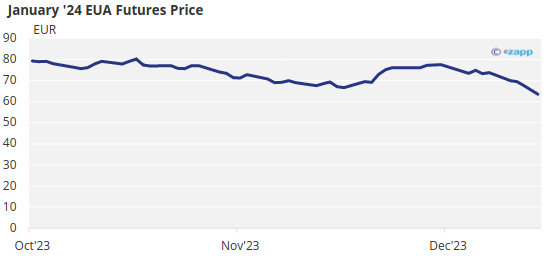

- EU price outlook flat to weaker in 2024.

Emissions Drop Across Europe

The outlook for 2024 for carbon prices in the EU is seen as flat to slightly bearish. With analysts predicting that 2023 saw a more than 20% drop in emissions from the power sector and a 7-8% drop in industrial emissions, there is likely to be a slight increase in the market’s long-term surplus of allowances.

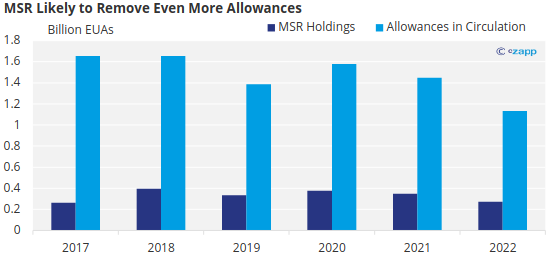

This will mean that the Market Stability Reserve, the mechanism that controls supply, will need to withdraw considerably more EUAs from September 2024 than it did last year. The MSR takes out 24% of total unused supply each year. After taking 272 million EUAs out of the market between September 2023 and August 2024, it’s likely to take much more out this year.

Experts say the market is likely to see depressed prices for the first half of the year, as the current economic downturn continues to depress industrial output and power generation using gas remains more economical than using coal.

The market will also see a key shift in trading activity this year. The annual compliance deadline, when companies must surrender EUAs matching their emissions to the European Commission, moves from April 30 to September 30. This will move the traditional demand season from Q1 to Q3 and may mean that the European summer holiday period becomes rather more active than in previous years.

2024 Carbon Market Outlook

Carbon pricing systems look set to enjoy a year of growth in 2024 as the world’s largest exporters seek to build insurance against a proliferation of carbon border taxes, led by the EU’s Carbon Border Adjustment Mechanism.

The EU’s CBAM came into effect on October 1 last year, and in its transitional phase requires importers of selected materials – iron and steel, aluminium, fertilisers, hydrogen, electricity and cement – to report the carbon emissions generated in their production.

From January 2026 importers will need to buy so-called CBAM certificates covering carbon emissions for the imported products at the prevailing EU allowance price. Exporting countries that have a domestic carbon price in effect will still need to buy CBAM certificates covering any difference in the effective carbon price.

Even the UK, whose emissions trading system was set up on very similar lines to the European model and whose prices were equivalent to European levels 18 months ago, has seen its carbon price plummet in the last year to as little as £35/tonne – 63% of the EU price.

This means that certain UK exports will need to buy CBAM certificates equivalent to nearly 40% of the UK carbon price when they enter the EU.

Source: ICE

The EU is seeking both to create a level playing field for its own industry, which is subject to the EU Emissions Trading System’s price on emissions, against its international competitors, but also to export its climate ambition to more parts of the world.

And it’s working. Among the countries actively setting up carbon markets are Turkey, Brazil, Ukraine, Vietnam and Colombia, while three of the EU’s four largest trading partners – China, the UK and Switzerland – already have carbon markets in place.

Others are at earlier stages in establishing their plans for carbon markets, and these include Brazil, India, Malaysia, Pakistan, Thailand and Nigeria.

To be sure, many of these new markets will not adopt the “cap-and-trade” model that is used by the EU, the UK and others. Instead, they are likely to require their domestic industries to purchase carbon credits matching their emissions, meaning that there will not be a legally binding limit on CO2 pollution.

Yet these developments will expose thousands of companies to carbon pricing and can be seen as the first steps in a journey that may end with strict caps on emissions.