Insight Focus

- PTA Futures follow crude flux as fundamentals remain relatively stable.

- PET export price increase outstripped by raw material gains, spreads retreat.

- Red Sea shipping crisis is impacting global shipping rates and availability.

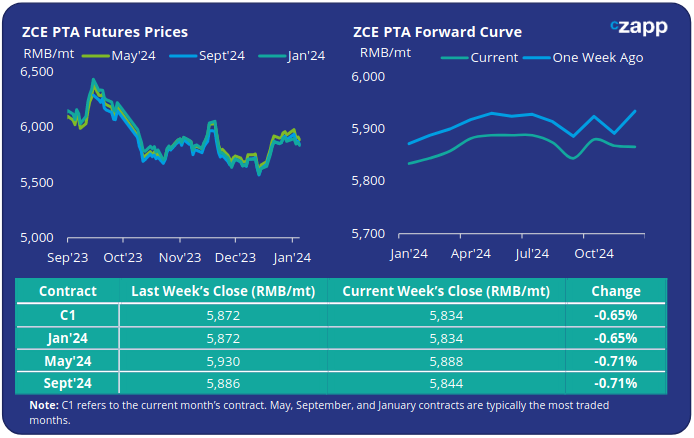

PTA Futures and Forward Curve

PTA Futures softened slightly last week, following an end of year rebound on higher upstream costs.

Oil prices experienced a choppy start to the New Year, dropping to around USD 75/bbl before creeping back up closer to USD 80/bbl.

Despite geopolitical tensions in the Middle East, production outages in Libya, and weaker fuel demand in the US, oil prices have remained broadly in line with pre-Christmas levels.

Analysts anticipate that increased oil supplies from non-OPEC sources, particularly led by US shale drillers, will be sufficient to meet global oil demand, slashing outlooks for oil prices in 2024.

Goldman Sachs predicts Brent will trade in the range between $70 and $90 per barrel for Brent this year, due to stable OPEC supply. Whilst Morgan Stanley reduced its forecast for Brent crude prices by about 9% to around $77 a barrel, indicating limited upside potential from the current levels.

With regards to the PTA market, PTA fundamentals have demonstrated relative stability. Little maintenance is planned in January; polyester operating rates are projected to show limited decline.

Consequently, PTA processing margins have also been stable, with PTA prices largely fluctuating on upstream costs.

In the medium term, polyester operating rate may reduce, the supply and demand dynamics for PTA may weaken, compressing profitability.

By Friday, the PTA forward curve shows a slight forward premium through to mid-2024; May’24 has a RMB 54/tonne premium over the current Jan’24 contract.

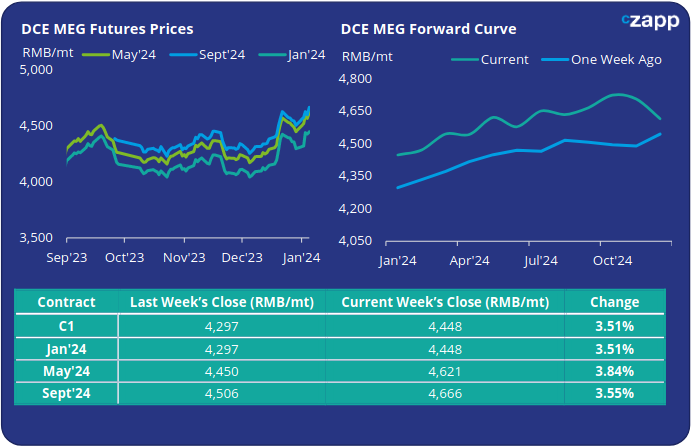

MEG Futures and Forward Curve

MEG Futures posted strong gains last week, rising by over 3.5% and continuing to break-out of the previous range, as inventories post sharp declines.

Compared to the last report dated 18th Dec, East China main ports inventories have fallen over 13% from 1,154k tonnes to 1,002k tonnes, the lowest level since July.

A further reduction in MEG inventories is expected again in late January, as major overseas suppliers have reduced their shipping plans for January-February. Deep seas arrivals are expected to drop to historical lows in February.

As a result, MEG prices may continue to make gains on improving fundamentals. Although any easing in polymerization rate could slow the price recovery.

The MEG forward curve remains in contango over the next 12-months; the May’24 futures premium widened slightly to RMB 173/tonne over Jan’24.

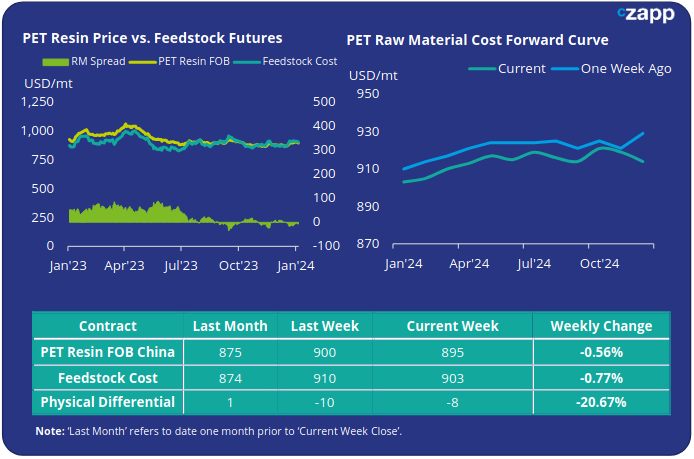

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices have steadily gained over the last few weeks, increasing around USD 25/tonne since the last report, to average USD 895/tonne last Friday.

Having plummeted back down into negative values over the Christmas period, the weekly PET resin physical differential whilst remaining depressed, inched slightly higher by USD 7/tonne to average minus USD 7/tonne for the week. By Friday, the daily spread was around minus USD 8/tonne.

The raw material cost forward curve remained in a very slight contango position through to mid-2024. The May’24 and Sep’24 contracts were both at a USD 10-15/tonne premium to Jan’24.

Concluding Thoughts

Even with rising PET resin export prices, Chinese producers have been unable to recoup operating margin, with the physical differential languishing back in negative territory.

Some producers complain about slow sales, others report sold-out positions for certain grades, although this is likely more reflective of much lower production rates than strong sales.

Whilst latest Chinese PET resin export data shows another record month in November, the Red Sea situation has already caused significant disruption to export flows and entering the New Year the situation shows no change.

Most Chinese producers are reluctant to offer into the Middle East, fearing delays and contract cancellations.

Producers are also fighting with carriers to lift shipments for existing orders, many of which are already facing delays out of Chinese ports, with the backlog inflating stock levels at factories.

Fallout from the red sea is not only impacting Middle Eastern business, but global order flows. Shipping lines are looking to capitalize on the opportunity and increase revenue but increasing rates on routes globally.

Even transpacific routes are being affected, with some rates up 50-100%. Rates across a basket of global lanes are increasing faster than during COVID and set to impact landed prices and global demand.

A potential weakening in export demand doesn’t bode well when stacked against the next wave of new capacity expected in 2024.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.