Insight Focus

- Both the No.11 and No.5 sugar futures have weakened significantly.

- Speculators have closed long positions.

- The H/H white premium has weakened, now standing at 138USD/mt.

New York No.11 Raw Sugar Futures

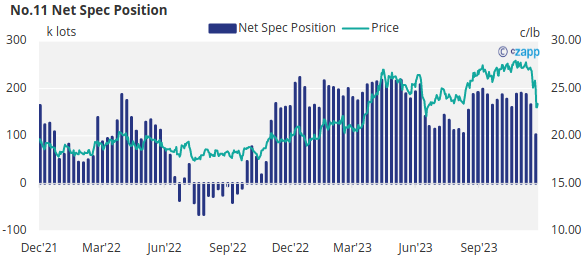

The No.11 raw sugar futures have collapsed over the past week, currently trading at 23c/Ib.

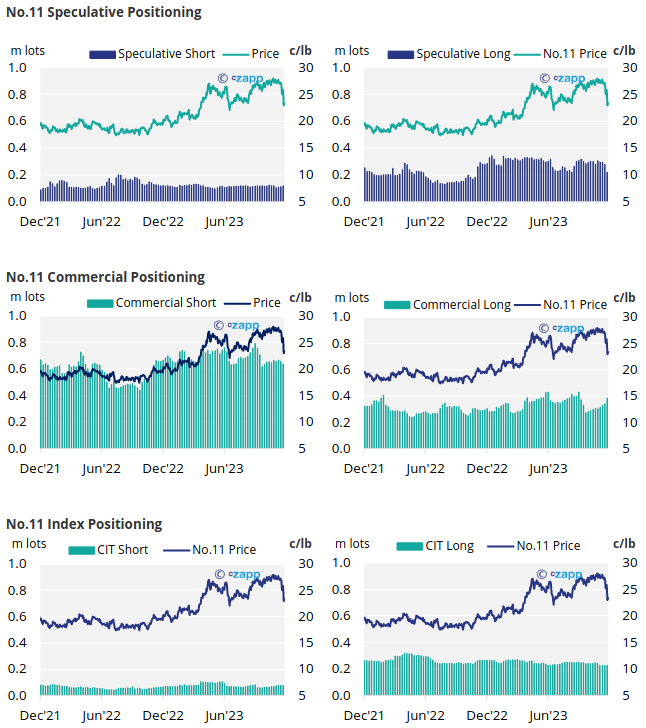

Consumers have bought into the price collapse. By the 5th of December (latest CFTC CoT report), the commercial long position increased by over 44.5k lots, indicating that consumers had taken advantage of the drop to increase their hedging cover.

Producers, unwilling to sell at today’s reduced price, have closed out a small number of positions. However, should prices return to 28c, it’s possible that producers may look to increase their selling.

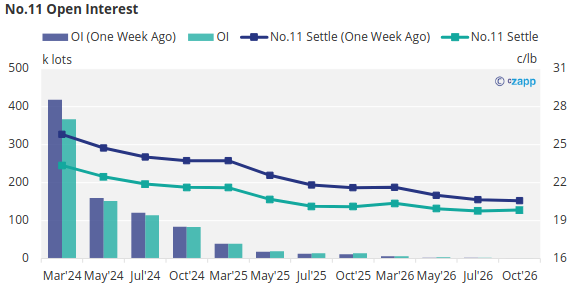

Turning our attention to speculators, they have sold a significant number of long positions. The overall net spec position is 103k lots, the smallest in more than a year.

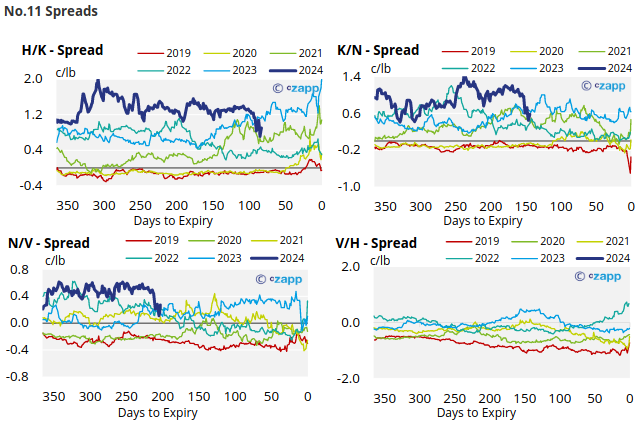

The No.11 forward curve has flattened significantly since last week.

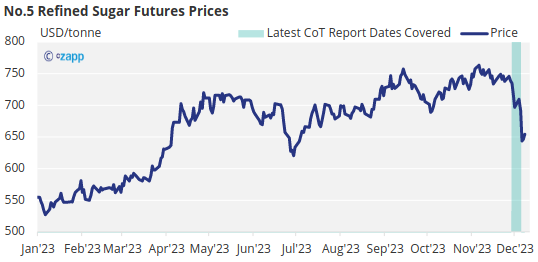

London No.5 Refined Sugar Futures

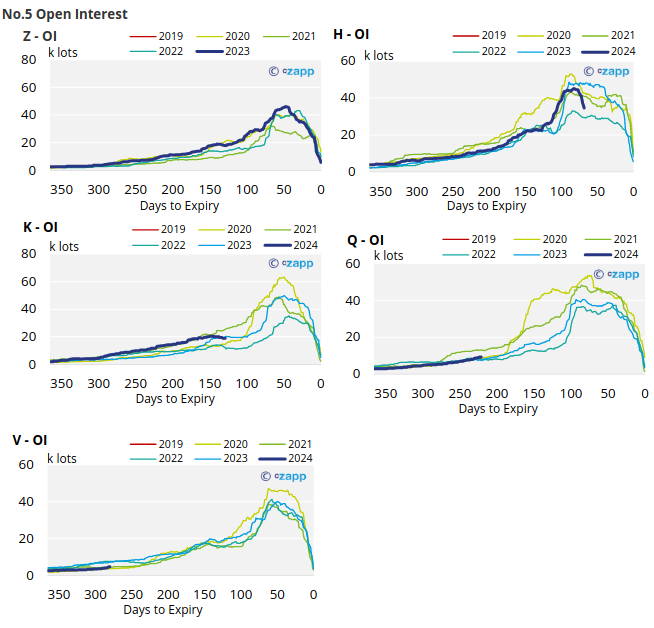

The move lower in refined sugar futures has broken the year-long upward trend, with prices now trading around 654 USD/mt.

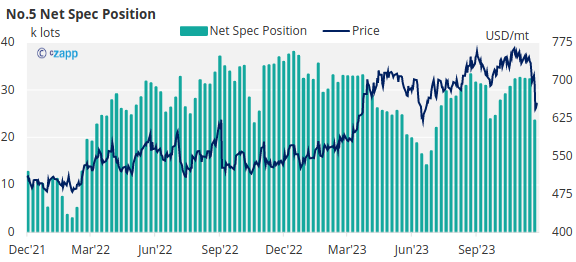

As a result, refined sugar speculators have closed out over 8.7k lots of long positions, bringing the overall net spec position to 23k lots, the lowest number of positions held in over 6 months.

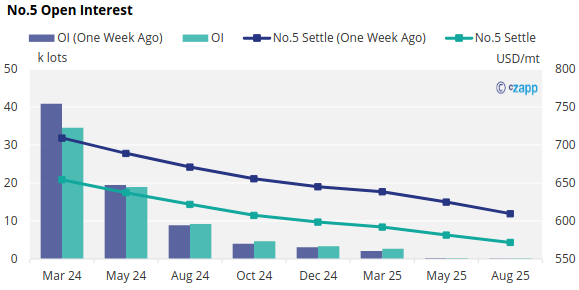

The refined sugar futures curve remains heavily backwardated.

White Premium (Arbitrage)

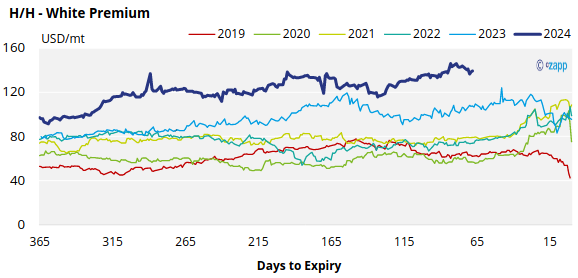

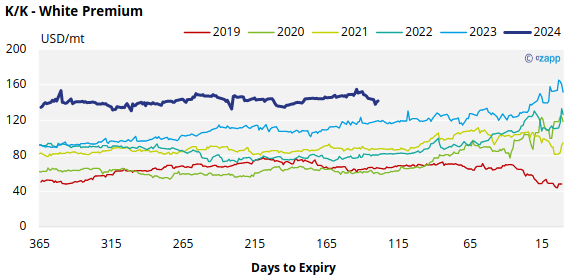

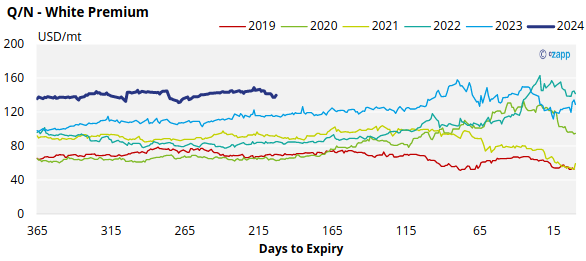

With the No.11 and No.5 sugar futures making similar moves in the past week, the H/H white premium has weakened to 138USD/mt.

The 2024 white premiums remain strong. We’ve not seen this kind of strength in the H/H white premium at this stage in the cycle in at least 5 years.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix