Insight Focus

- PTA Futures flat as crude downside countered by slight PTA margin recovery.

- PET resin export prices keep stubbornly rangebound, PET margins also showing recovery.

- Greater upside potential seen in PET resin export prices, following crude’s losing streak.

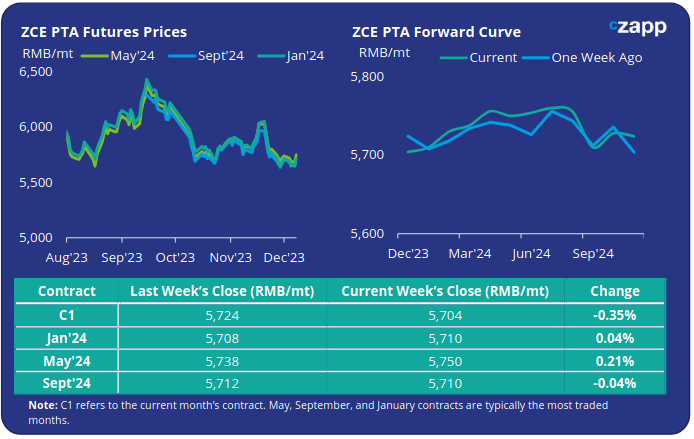

PTA Futures and Forward Curve

PTA Futures were relatively flat versus the previous week and low crude prices were balanced out by modest PTA margin recovery.

Crude prices continued to be dragged down by concerns around weaker demand and oversupply, despite the latest voluntary cuts announced by OPEC+.

The combination of weaker demand prospects and record high US production sent Brent crude prices down 4.8% last week to USD 75.7/bbl by Friday. Significantly below the USD90-100/bbl consensus that many oil market analysts predicted just a few months ago.

Lower crude also weighed on PX price, weaker fundamentals and rising PX supply squeezed the PX-Naphtha spread towards an average of USD 310/tonne for the week.

Whilst PTA operating rates increased, as returning lines ramped up production, downstream polyester demand shows no sign of weakening, keeping operating rates high and demand for PTA robust.

The weekly average PTA-PX spread on a CFR spot basis recovered back up to USD 101/tonne.

However, some inventory accumulation is anticipated in the near-term, despite some turnarounds still due, which will likely limit further upside to profitability.

By Friday, the PTA forward curve remained broadly flat/slight contango; May’24 had increased to a RMB 40/tonne premium over the main Jan’24 contract.

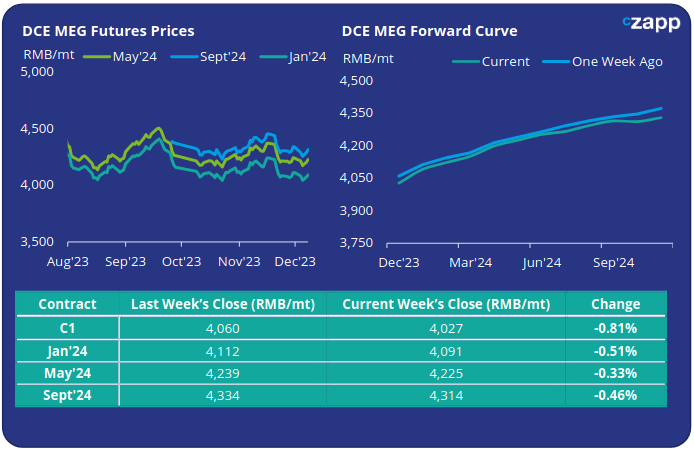

MEG Futures and Forward Curve

MEG Futures weakened as slowing demand and lower crude saw the Jan’24 contract loss 0.5% for the week.

Main port inventories once again experienced a small weekly decline, down 0.81% to 1,164k tonnes by Friday. Port inventory may continue to experience a slight decrease in early December due to complications related to the Panama Canal and a general slowdown in deep seas arrivals.

However, offtake is also slowing, and port inventories are expected to maintain high levels overall.

Average domestic Chinese MEG operating rates have fallen slightly with the introduction of new production units, but output is increasing incrementally. Overall, demand from the polyester sector remaining robust, MEG fundamentals are finely balanced.

The MEG forward curve remains in contango over the next 12-months; May’24 futures are at a RMB 134/tonne premium to Jan’24.

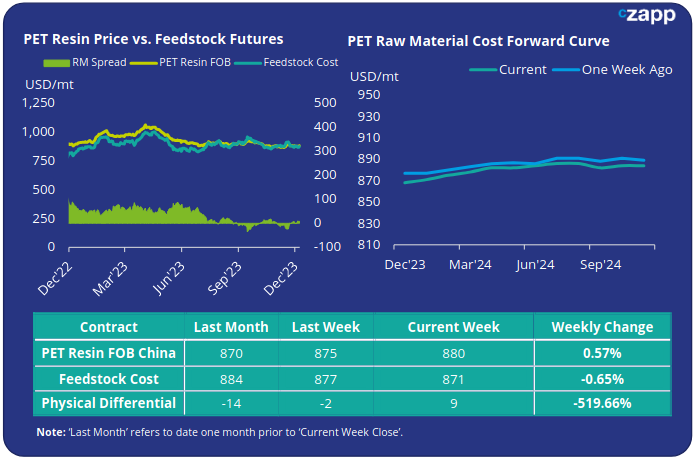

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices kept rangebound, reaching USD 880/tonne last Friday, up just USD 5/tonne on the previous week.

The weekly PET resin physical differential saw a slight increase, up USD 2/tonne to average USD 7/tonne for the week. By Friday, the daily spread was around USD 9/tonne.

Whilst the raw material cost forward curve remained in a slight contango position through to mid-2024. The May’24 and Sep’24 contracts were both at a USD 11/tonne premium to Jan’24.

Concluding Thoughts

PET resin export fundamentals have begun to show some improvement, with an improvement in the supply/demand delta, with lower levels of excess production versus demand.

This is also being reflected in the spot raw material spread, which have recovered from the lows of <USD 50/tonne mid-Sept to a current spread of USD 90/tonne as well as the physical differential to raw material futures.

Following September’s margin lows, the futures physical differential has also increased by around USD45/tonne.

Despite operating rates moving lower over the last month, overcapacity is still the major concern. Even with order intake around 400kt/month, sales volumes are still below target.

The introduction of Yisheng’s new 600kta in November and a further 2Mt tonnes of potential new capacity in 2024 will only help to constrain upside potential to margin recovery through H1 2024.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.