Insight Focus

- We project Mexico will only produce 5 million tonnes of sugar this season.

- Mexico’s poor crop and yields means it will likely continue importing.

- This will lead the US to have to import more sugar from the world market.

Mexico is facing a second consecutive disappointing sugar harvest. In the 2021/22 season, sugar production in Mexico reached 6.2 million tonnes. However, in the following year, production declined by nearly a million tonnes, falling to 5.2 million tonnes. Hopes for a recovery in the upcoming 2023/24 season have diminished, and our present forecast anticipates production of 5 million tonnes.

Mexico Facing Second Poor Crop

Mexico is currently experiencing the El Niño phenomenon. During El Niño, Mexico experiences more rain during the winter, followed by an arid summer. A summer drought could adversely affect cane development in Mexico as the crop needs rainfall through the middle of the year to grow and mature fully. The lack of rain has led to lower yields as more than 60% of Mexican cane is not irrigated.

Key Indicators Look Negative

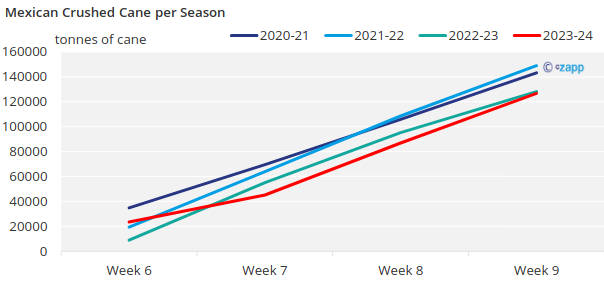

Through the first nine weeks of the harvest, many key indicators have shown that the Mexican harvest is trending negatively. The cumulative cane crush through the first nine weeks is below pace from the previous three seasons (including the disappointing 2022/23 harvest).

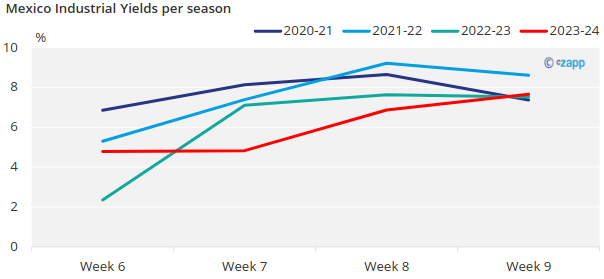

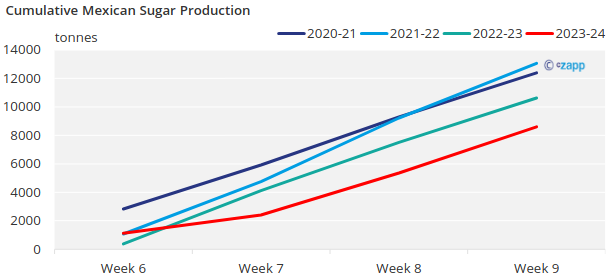

Not only is less cane being crushed, but the amount of sugar coming from the cane is lower too. Both industrial yield percentages and the cumulative sugar produced for the first nine months of the harvest are on pace to be below the past three years.

What Does This Mean for the World Market?

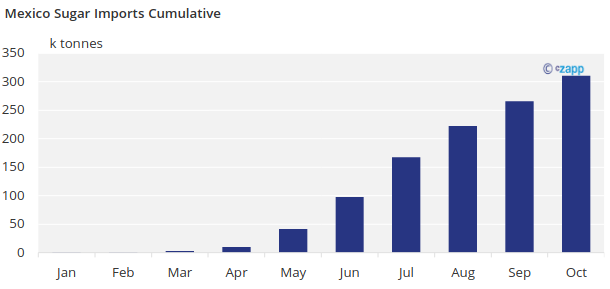

Another poor Mexican sugar harvest means that Mexico will continue importing sugar, mostly from Central America.

Mexico is also the largest sugar trade partner of the US. Mexico usually exports around 1.35 million tonnes of sugar to the US (70% raw vs. 30% white). Last year, Mexico could only export 1 million tonnes due to the drought.

We project Mexico will ship the same amount of sugar to the US this coming season. The shortfall of Mexican exports to the US means that the US will most likely increase its sugar supply via the raw sugar TRQ again, which means less sugar left for the already undersupplied world market.