Insight Focus

- India needs to divert more sugar to ethanol to meet its blending target.

- But there is some uncertainty about ethanol prices for 2023/24.

- Mills may divert less sugar than the previous year.

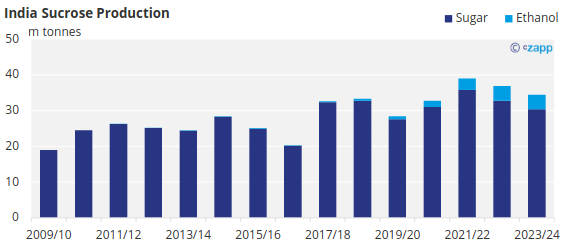

India, the world’s second-largest producer of sugar, aims blend 20% ethanol in gasoline by 2025.This ethanol will be derived from sugar cane and various grain feedstocks, offering Indian mills the flexibility to choose how they utilize the sucrose in the cane.

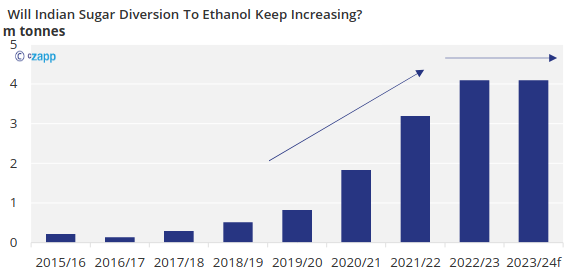

India’s Sugar Diversion Not Growing?

We now think that Indian mills will divert 4.1m tonnes of sugar towards ethanol in the recently started season (2023/24). This is the same as in the previous season but lower than our initial estimates.

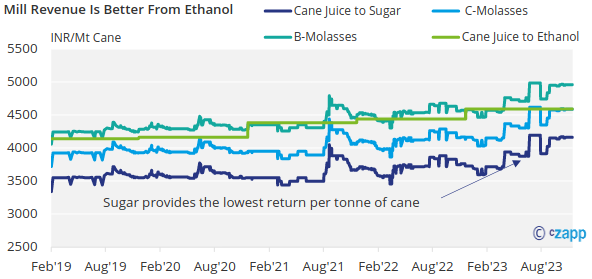

There is still some uncertainty about what ethanol prices will be this season; they have not been publicly announced. However, we believe that mills are aware of the liekly price range and this should reassure them that ethanol returns will remain above sugar’s.

In recent years the government has set ethanol prices by feedstock to ensure that mills have the right price signal to keep investing distillation capacity. We track these prices and relative returns in our new monthly update.

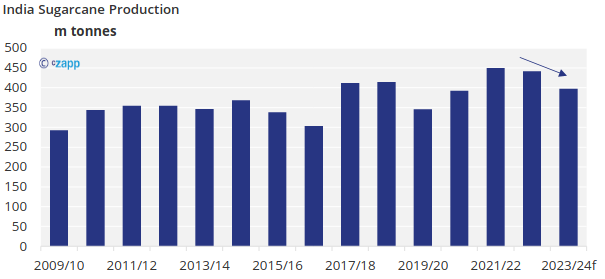

The main problem today is the availability of feedstock – the sugarcane, corn and rice that are needed to produce ethanol. All of these crops are being badly impacted by El Nino and a lack of monsoon rainfall. Back in July India banned the export of rice whilst we expect cane output to fall back below 400m tonnes, an 11% drop from the previous year.

This has meant that mills and ethanol distributors have been very slow to offer supplies at this season’s ethanol auctions. The results of the latest auction imply that just 3m tonnes of sugar would be diverted to ethanol. But there is plenty of time left to offer up more ethanol for the season.

What Does This Mean For Sugar?

If less sucrose is diverted towards making ethanol then more sugar will be produced. This won’t guarantee more sugar to the world market, though, as the government still hasn’t approved an export quota. It may relieve some pressure on domestic stocks, making a small export programme more likely.

Given how undersupplied the sugar market any additional export availability may come as a very welcome relief.