Insight Focus

- PTA and MEG Futures drop on broader Chinese chemicals market volatility.

- Raw material forward curve moves into contango due to near-term price decrease.

- Chinese PET resin producers see slow progress on sales front.

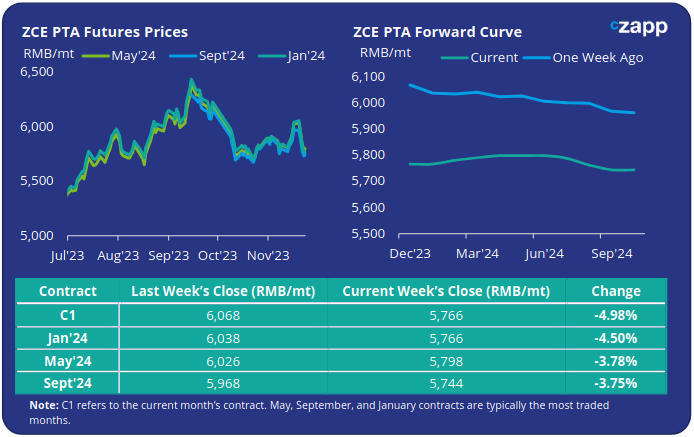

PTA Futures and Forward Curve

PTA Futures faced steep declines, with main Jan’24 contract down 4.5%, shedding over RMB 272/tonne versus the previous Friday close.

Volatility was also reflected in oil markets which have also seen wild swings over the last couple of weeks based purely on daily macro and geopolitical sentiment rather than any marked change in fundamentals.

OPEC’s next meeting on the 30 Nov could help give the market a firmer direction headed into 2024.

On the PTA side, PTA fundamentals have steadily improved through November with last week’s sell-off attributed more to a broader chemical market sell-off in China than any shift in PTA dynamics.

Despite the fall in future pricing, the PTA-PX spread on CFR spot prices continued to also improve, averaging USD 98/tonne last week, up a further USD 4-5/tonne.

However, expectations are for some plants undergoing maintenance to return to full operation in the coming weeks, with others potentially increasing operating rates off the back of higher margins.

Potential weakness in polyester demand, combined with increased supply could result in some inventory accumulation through December and into January, constraining further margin recovery.

By Friday, the PTA forward curve moved from backwardation to broadly flat/slight contango, due to the near-term price fall. The Jan’24 contract was on par to the current month. Whilst the May’24 contract moved from a 42/tonne discount last week to a USD 32/tonne premium.

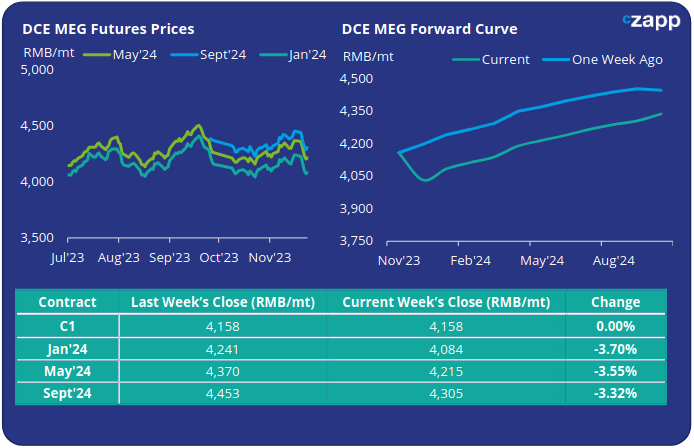

MEG Futures and Forward Curve

MEG Futures also fell sharply last week, with main month contracts down around 3.5% on average. Crude volatility, macroeconomic sentiment, and broader Chinese chemical market sell off were all contributing factors.

Deep seas arrivals continued to slow following Middle East turnarounds congestion in Panama, making transits difficult from the US gulf. Although direct impact from Panama Canal issues is relatively minor at present.

However, off-take from main ports has also slowed over the last week, meaning East China main port inventories increased slightly, a little less than 1% to 1,180k tonnes by Friday.

Whilst polyester operating rates keep high close to the 90% level, supporting MEG demand, weaker downstream textile demand may result in the future lowering of polyester rates and further MEG accumulation over the coming months.

The MEG forward curve remains in contango over the next 12-months. However, Jan’24 futures are showing a RMB 74/tonne discount to the current month before the curve move upwards; the May’24 contract held a RMB 131/tonne premium over Jan’24.

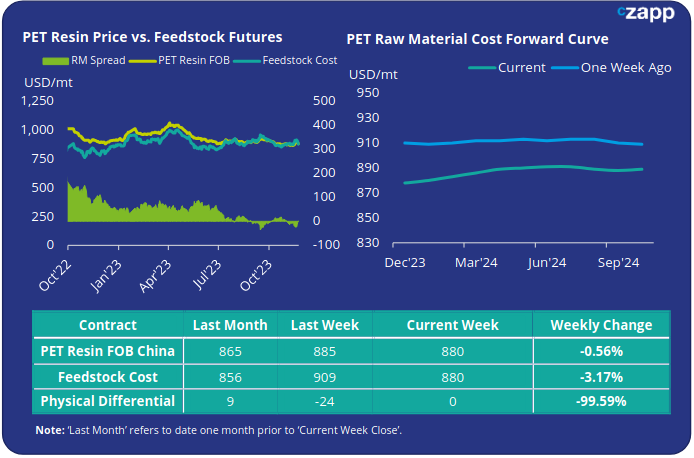

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices increased slightly at the beginning of last week before losing ground once more. By Friday, China PET resin export prices averaged USD 880/tonne, down USD 5/tonne on the previous week.

However, the weekly PET resin physical differential showed an improvement, increasing USD 9/tonne to average negative USD 7/tonne for the week.

By end Friday, the daily spread was zero, a distinct improvement from where it had been just a week earlier.

Whilst the raw material cost forward curve moved lower, with much of the recent price decline focused on the near term, the curve moved into a slight contango position. The May’24 and Sep’24 contracts were both at a USD 10/tonne premium to Jan’24.

Concluding Thoughts

Chinese PET resin export prices have remained broadly flat over the last few weeks despite volatility in upstream costs.

Whilst the physical differential has also ebbed and flowed, the key take-away is that spreads and margins remain depressed, far below the historical average.

Demand is also looking stale. Although producers would typically expect to see added interest through to mid-Dec, fresh inquiries are reportedly limited.

RMB appreciation also means that Chinese producers may have to raise prices for export, potentially hindering sales further.

Slower transit through the Panama Canal is also impacting freight rates from Asia to East Coast US and Latin America. Whilst less relevant for Chinese resin, buyers sourcing from Other Asian origins may see increased CFR prices.

Next few weeks will give critical insight into H1’24 trade flows and potential future price dynamics.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.