Insight Focus

- European PET resin sales improve in Nov/Dec, economic outlook turns more positive.

- Provisional ADD against Chinese resin announced, levels undershoot expectations.

- PET resin prices soften on lower raw material costs, producer see modest margin gains.

Market Overview

After tough year for the entire European PET resin value chain, November is at last providing some positives, some sign of life.

Several producers reported stronger than expected domestic resin sales, with at least one sold out for both November and December, and although early, even January sales are looking strong.

For certain, JBF’s ‘shutdown’ announcement stimulated some panic buying within the domestic market. Whilst in fact, JBF continued to run one line at low rates to fulfill certain contracts rather than shutdown entirely.

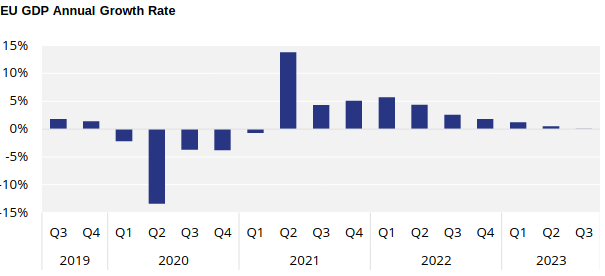

Added economic optimism may also be beginning to creep into the buyer’s psyche. Economists are predicting that real EU GDP growth has bottomed out and will begin to stage a recovery in early 2024.

Whilst real GDP annual growth is projected to average 0.7% in 2023, the IMF and EU are forecasting growth to double next year to 1.7%.

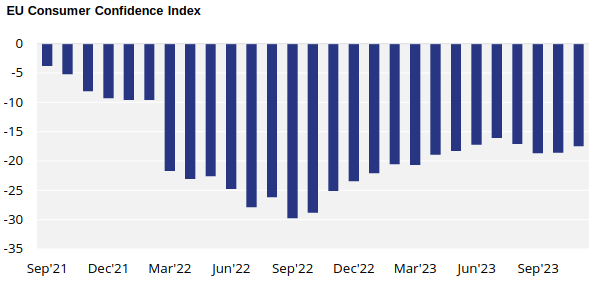

Consumer confidence within the EU is also showing signs of recovery, approaching the least negative levels seen in nearly two-years.

Headwinds in consumer demand do exist though, clearly seen in recent Q3 corporate results for some of Europe’s largest beverage producers. Coca-Cola Europacific Partners (CCEP) reported comparable European volume sales fell 4% in Q3’23 (0% YTD), with mixed summer weather across Europe being also partly to blame.

Whereas Coca-Cola HBC reported volume to established European markets fell 7.1% in Q3’23 versus the same period a year earlier.

Danone and Nestle also reported European volume decline, down 4.1% and 2.1% (Real internal growth) respectively, for all products including bottled water sales.

Provisional Anti-Dumping Duties Leave Door Ajar for Chinese Imports

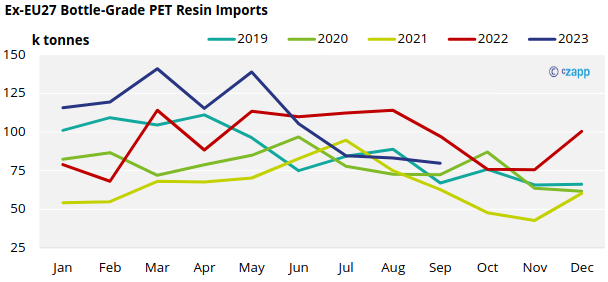

According to the latest PET resin trade data (HS 390761), the EU27 block of countries imported around 80k tonnes in September, down a little under 4% from August.

Over first nine months of the year, extra-regional imports into the EU27 trade block have totaled over 983k tonnes, a 9.7% increase on the same period the previous year. Whilst still on track to set a new annual record level, H2 volumes are likely to undershoot those seen in 2022.

Turkey was the largest origin in September with over 18k tonnes. However, looking over the last three-month period since the volume change was so pronounced, the top 3 largest sources were Vietnam (56kt), Turkey (46kt), and Egypt (46kt).

Chinese PET resin imports dropped to a new low in September, at just 3.6k tonnes.

Provisional anti-dumping duties on all Chinese PET resin (>0.78IV; HS 390761) were announced on 31st October. Provisional duties for major exporters were as follows: Sanfame 6.6%, Wankai 10.7%, CRC 17.2%, other cooperating companies 11.1%. All other companies, including Yisheng were placed at 24.2%.

These levels resulted in mixed emotions from European producers. On one hand, some believe that any added protectionism is better than nothing, others fell underwhelmed and disappointed by the levels, albeit provisional, seeing them as being too low.

The later may be right to be pessimistic. Chinese trade data to EU27 countries for October was already showing an upwards swing in volume, from around 8.5k tonnes in August to 21.4k tonnes.

European buyers have also been quick to engage with Chinese suppliers on the lower end of the duty spectrum in future offtake following the announcement.

European PET Spot Prices Soften, Green Shoots Showing on Margin Recovery

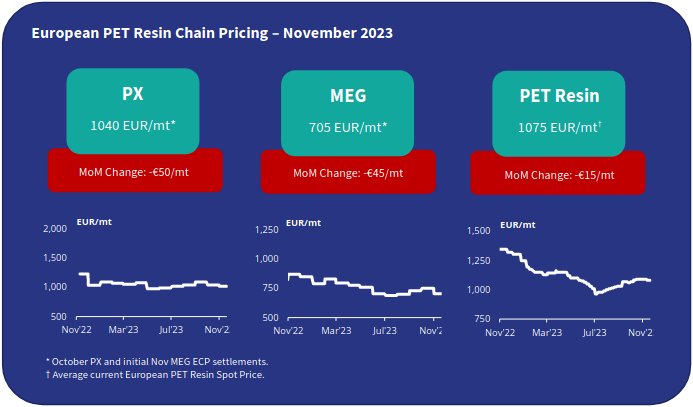

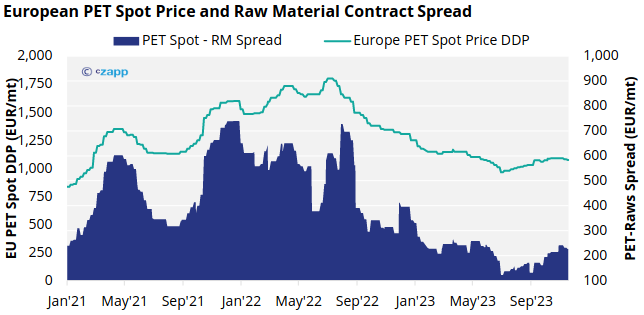

The current market price range is assessed at EUR 1060 to EUR 1090/tonne, with an average price of EUR 1075/tonne, representing a decrease of around EUR 15/tonne over the last month.

Better than expected sales volumes have surprised everyone given how weak the market has been of late and its now in the midst of the traditional off-peak season.

Sales drivers may include some restocking by buyers ahead of Christmas but is more likely seen as a reaction to JBF’s production slowdown.

JBF’s ‘Shutdown’ announcement in October has jolted buyers and their perceived risk towards supply security. Not only has the reaction brought more activity to the spot market but also added momentum behind 2024 contract negotiations.

In a reversal of the trend in recent years, which has seen producers and buyers largely move to market-index-based contracts, producers and buyers are reporting a greater preference for raw material formula-based contracts.

Some buyers are also pressing for Asian raw material-linked formulae to enable hedging mechanisms using Chinese Futures.

The October PX European Contract Price settled at EUR 1040/tonne, representing a EUR 50/tonne decrease versus the September settlement, back down to the same level seen in August. Expectations are for a further modest decline in the PX ECP in November.

November’s initial MEG settlement also fell, decreasing to EUR 705/tonne, down EUR 45/tonne on the previous month.

The raw material spread to spot PET resin prices has continued to improve, coming off the lows seen mid-summer with a potential partial recovery in progress.

However, European PET resin prices are expected to continue to soften through to year end, in part pressured by the widening price gap with imports.

Is it cheaper to import?

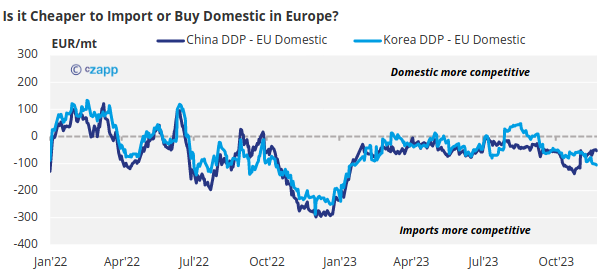

Chinese PET export prices have stabilized over the last couple of weeks, keeping relatively rangebound. At the time of writing, daily Chinese FOB prices averaged USD 880/tonne.

Chinese PET raw material costs continue to show minimal downside on the futures forward curve. As such, future PET resin export prices through the remainder of 2023 will rely heavily on the direction of Asian PX and crude oil prices. (see latest weekly report).

Other Asian export prices have fallen by USD20-30/tonne over the last month, indicative import prices for duty-free Korean and Vietnamese resin typically ranges USD 995-1015/tonne CIF NWE, equating to around EUR 965-980/tonne DDP.

The weakening US Dollar against the Euro has also favoured imports, widening the gap between domestic and imported resin.

Even when including the new provisional anti-dumping duties into the calculation (at the lower level of 6.6% for Sanfame), Chinese resin is running at around EUR 50/tonne discount to import parity; ‘Duty-free origins’ have widened their discount to over EUR 100/tonne.

Concluding Thoughts

Green shoots are beginning to show and conversations with some producers are beginning to turn more positive.

JBF’s ‘shutdown’ seems to have brought some stability to the market; whilst a stronger than expected end to the year may not erase losses incurred earlier in the year, talks are slowly pivoting to increasing production and bringing idled lines back on-stream.

That said, fundamental challenges within the market remain. Whilst energy costs have come down significantly, spot margins are extremely low, workable contract margins, volumes, and formulas are needed to be secured for 2024 to begin a turnaround in fortune.

European producers also need to reduce the import delta and stop any potential runaway in price difference, as was seen last year.

Whilst provisional ADD levels are not prohibitive for Chinese resin into the EU market, the level is seen as a large enough barrier to enable modest European margin recovery into the 2024 peak season.