Insight Focus

- PTA Futures rally driven higher by tighter supply and polyester demand strength.

- Raw material spreads slip backwards reaching a new 3-month low.

- PET resin margins reach critical juncture, is a demand recovery imminent?

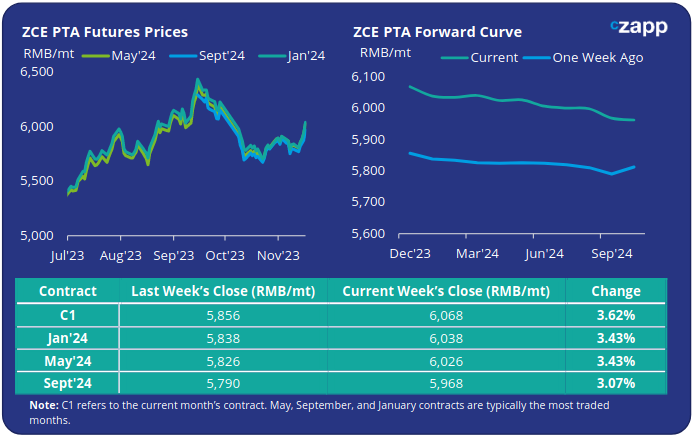

PTA Futures and Forward Curve

PTA Futures strengthened last week, with main contract months increasing by an average of 3.3% compared to the previous week’s close.

This comes despite Crude oil prices continuing to slump, posting a fourth consecutive losing week and reaching the lowest levels in four months.

The return of PX plants following maintenance turnarounds has also increased PX supply; combined with a contraction in PX-Naphtha spreads has result in an improvement in PTA production margins.

Last week the PTA-PX spread averaged around USD 94/tonne, up USD 4-5/tonne on the week, the highest level since the end of August.

The steady improvement in PTA margins is also inherently linked to the continued strength in downstream demand from the polyester industry, as much as weakness in upstream costs.

The concentration of PTA plants currently undergoing maintenance shutdowns has also reduced the average PTA operating rate, keeping supply and demand relatively balanced in November.

By Friday, the PTA forward curve kept very slightly backwardated through H1’24. The Jan’24 contract was at a RMB 30/tonne discount to the current month; the May’24 contract was now at a RMB 42/tonne discount.

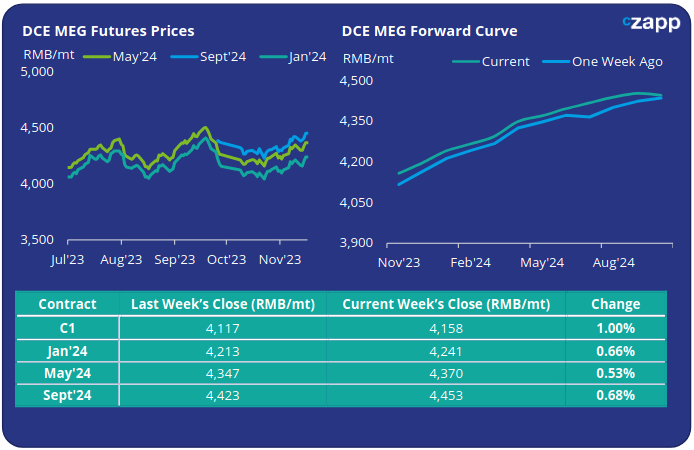

MEG Futures and Forward Curve

MEG Futures also saw modest increases last week, supported by continued high polyester operating rates and a comparatively sharp decrease in port inventory.

East China main port inventories fell by around 3.7% to 1,169k tonnes by Friday. Following previous expectation that arrivals may slow from mid-month easing some pressure on the import side.

Slowing deep-sea arrivals is largely a factor of maintenance at Saudi Arabia’s plants during October and lower volumes on water from the US.

However, overall port inventory remains at elevated levels; supply pressure is also increasing on the domestic front with high operating rates and production trials at Yuneng and Zhongkun’s new MEG plants.

If as expected, downstream polyester demand eases into a traditional off-peak cycle then MEG supply/demand fundamentals may weaken in December, with prices coming under pressure from inventory build-up.

The MEG forward curve remains in contango over the next 12-months. By Friday, the premium held by the Jan’24 contract over the current month was at RMB 83/tonne; the May’24 contract had reduced slightly to a RMB 182/tonne premium.

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices kept flat over much of the week before increasing USD 5-10/tonne on Friday, to USD 885/tonne by week’s end driven higher by the raw material increases.

Despite the increasing spot value, the weekly PET resin physical differential sunk a further USD 6/tonne lower to average negative USD 16/tonne for the week.

By end Friday, the daily spread had declined to minus USD 27/tonne, the lowest level seen since mid-September.

Whilst the raw material cost forward curve floated higher on increased values, the curve remained relatively flat through much of 2024 with Jan’24 flat to the current month, main forward contracts more or less on par with the current month.

Concluding Thoughts

Warning signs for the health of the Chinese PET resin industry are now flashing as the next couple of months will prove critical.

Despite a degree of stability in pricing, raw material spreads have continued to decline, approaching lows last seen in the market lows of September.

Price ranges have narrowed considerably, and with margins on the floor, producers are resistant to further discounting.

Equally buyers are reluctant to chase prices higher, and continue to pursue lowball prices, keeping pressure on PET margins.

The recent conflict in Gaza is also having repercussions for beverage and consumer goods demand across the Middle East.

Retailers are reportedly switching away from some multinational brands, in preference for local variations, a move that is likely to impact resin demand from converters across the region.

With the Chinese PET resin market now moving into a period which traditionally experiences an uptick in demand through to mid-December, will an up-swing in demand transpire, and will Chinese PET resin producers be able to recover margins and profitability ahead of the New Year?

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.