Insight Focus

- There was another negative week for grains after November WASDE reports forecasted higher global production.

- Price support is coming mainly from very tight previous crop stocks and farmers holding back on new crop.

- Unless there is further Black Sea disruption, there continues to be downside risk.

Forecast

Our forecast for the new 2023/24 Chicago corn crop is unchanged in a range of USD 3.90/bushel to USD 4.15/bushel. The average price since September 1 is running at USD 4.79/bushel.

Corn Price Dips on High Production

Chicago corn prices were already weak at the start of last week on the back of good harvesting progress and positive crop condition. But even stronger losses came on Thursday after the publication of the November World Agricultural Supply and Demand Estimates (WASDE) report.

The USDA increased its projected US corn yield by almost 2 bushels/acre to 174.9 bushels/acre in the latest WASDE report. This would result in 170 million bushels of additional production. This was partially offset by 125 million bushels more of domestic and export demand but ending stocks increased by 45 million bushels.

Global corn stocks increased by 2.6 million tonnes, all of which comes from higher production partially offset by higher demand. Besides the production increase in the US, the USDA projects an increase in Russian production by 1.4 million tonnes to 16 million tonnes. This is slightly lower than the 17 million tonnes estimated by the Russian government. The USDA increased projected Ukrainian production by 1.5 million tonnes to 29.5 million tonnes.

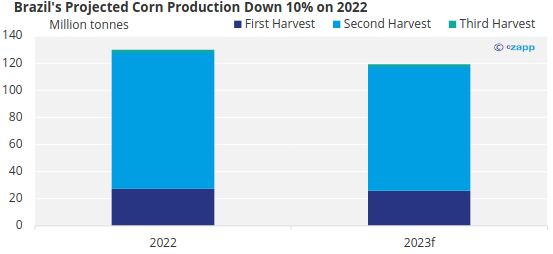

Conab – Brazil’s National Supply Company — reduced its corn production forecast to 119 million tonnes, down by 10% on last year’s record production of 131.8 million tonnes. This lower production was due to farmers migrating to more profitable crops when corn prices plummeted.

US corn was 81% harvested, slightly behind the 85% recorded at the same time last year but above the five-year average of 77%. Drought conditions worsened with 37% of the area affected.

Russian corn is 62% harvested and Ukrainian corn is 72% harvested. French corn is 95% harvested. At this point last year, the French harvest was complete. This year, the condition is down three percentage points to 80% good or excellent.

In Brazil, the first corn crop is 40.2% planted compared with 43% last year. In Argentina, planting is 24.7% complete and 20% of the crop is judged to be in good or excellent condition.

Wheat Price Holds Steady

Russia attacked port infrastructure in Odesa again, fuelling an early week rally and by mid-week Ukraine confirmed a vessel was hit after another attack. Even though it was not carrying any grain, this development rattled markets and trading slowed. However, by the end of the week, deals picked up and Black Sea trade continues.

The higher yield projected last week by the USDA in its November WASDE report didn’t catch us by surprise, but we were also expecting the market to trade lower, and it hasn’t.

We think prices have been supported thanks to very tight old crop stocks and farmers holding on to new crop stocks. Sooner or later that product will have to come to the market. Unless we have any supply disruptions out of the Black Sea, the risk should continue to be to the downside.

In the WASDE report, the USDA projected a 14-million-bushel increase in US ending stocks due to higher imports and lower consumption. World ending stocks were left basically unchanged, but production was lowered in Argentina by 1.5 million tonnes to 15 mill tonnes.

Russian production was increased by 5 million tonnes to 90 million tonnes, while Indian production was reduced by 3 million tonnes. All in all, production projections were decreased by 2 million tonnes, but this is mainly offset by lower demand.

US winter wheat is now 90% planted – about on par with last year and the five-year average. Crop conditions improved by three percentage points to 50% good or excellent, an improvement on just 30% last year. About 42% of the wheat area is under drought conditions — unchanged from last week.

Russian winter wheat plating is 91% complete, slightly ahead of 83% last year. Planting in Ukraine is 89% complete. French wheat planting progress is behind last year at 67% compared with 91%. It is also lower than the five-year average of 83%.