Insight Focus

- Both PTA and MEG futures prices edge up slightly over the previous week.

- PET feedstock costs rise as FOB export prices remain flat by Friday.

- This means the physical differential returns close to neutral after a brief recovery.

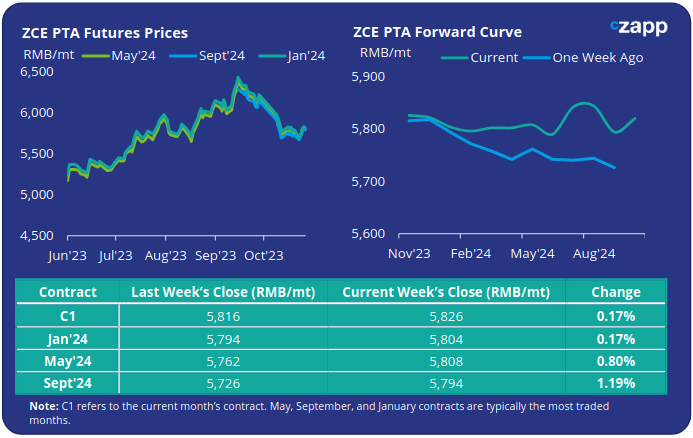

PTA Futures and Forward Curve

PTA futures strengthened slightly over the previous week, with the main Jan’24 contract closing on Friday at just over 5800RMB/tonne, up almost 0.2% on the previous Friday.

Despite rising tensions in the Middle East, Brent crude and WTI oil prices fell slightly over the last week, hindering PTA price strength.

Looking forward, port inventories are currently at reasonable levels, with fundamentals relatively balanced in October. Expectation is for a gradual decline in polyester operating rates in the coming months, potentially resulting in PTA stock accumulation.

This is somewhat reflected in the PTA futures forward curve, which although less backwardated than the previous week is still downwards sloping out to Jun’24 which is trading at a 36RMB/tonne discount to the Jan’24 contract.

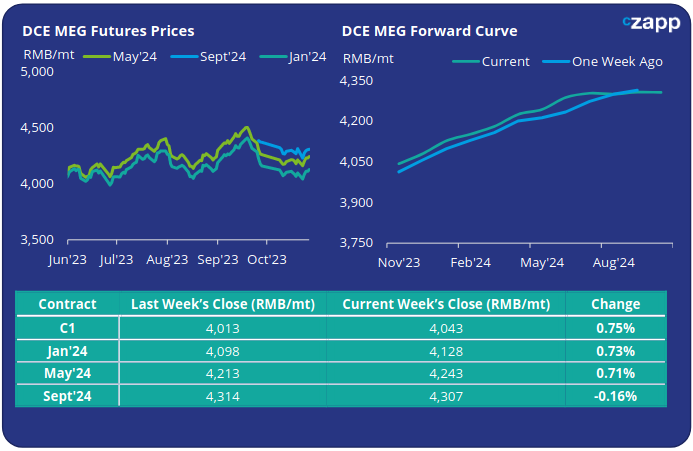

MEG Futures and Forward Curve

MEG futures also lifted slightly over the previous week, with the main Jan’24 contract strengthening over 0.7% to 4128RMB/tonne by Friday close.

East China main port inventories are up around 6% to 1.121m tonnes, reversing much of the decline from the week before. Elevated levels are expected to continue to pressure the market to the downside through to the end of 2023.

This is reflected in the MEG futures curve which remains strongly in contango, until at least Sept’24. The main Jan’24 contract currently trades at an 85RMB/tonne premium to the spot Nov’23 contract.

On the demand side, polyester operating rates remain robust.

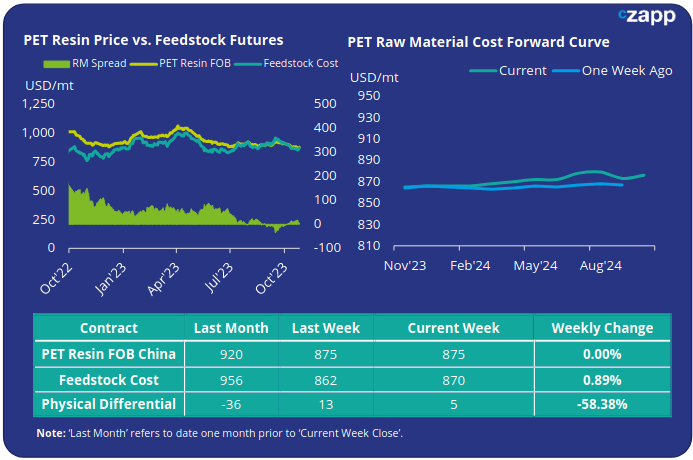

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices traded sideways over the previous week, returning to 875USD/tonne by week’s end.

However, with feedstock costs rallying by 0.89% to 870USD/tonne by Friday, the physical differential has shrunk back toward flat again, now standing at just 5USD/tonne.

Whilst far from the all-time low of negative 36USD/tonne back in September, this still represents a particularly tight period with prices expected to continue to track feedstock costs in the short term.

The raw material cost forward curve has lifted slightly in the later-dated contracts since the week before but remains mostly flat. The main January, May, and September contracts all trading within 2USD/tonne of each other at around 875USD/tonne.

Concluding Thoughts

Whilst we still anticipate a low-margin environment in 2024, PET export order intake could begin to see recovery in November, mirroring the trend experienced in the last two years.

Any further upward trend in the physical differential could be indicative of a new wave of orders beginning in earnest.

However even this said, the current flat raw materials forward curve suggests prices are likely to remain rangebound over the next 6-9 months, the bounds of which will be largely dictated by crude price volatility, driven at the moment by the situation in the Middle East.

Additionally, trading volumes for both domestic and export sales remain weak, with the market now in the midst of low season. Operating rates continue to fall, reflective of higher stock levels and a slowdown in downstream domestic beverage production.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.