Insight Focus

- PTA Futures see only modest gains, despite resurgent crude prices.

- PET resin export margins continue to steadily recover as shutdowns reduce supply.

- Relatively flat forward pricing for PET exports derisks buying strategies.

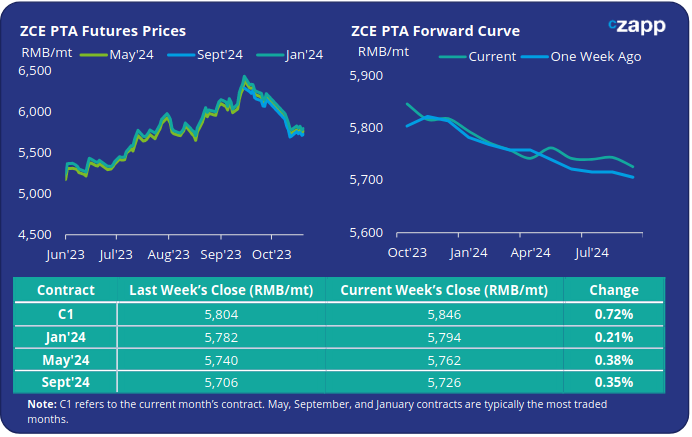

PTA Futures and Forward Curve

PTA futures were up slightly, less than 1%, by last Friday’s close, as weaker PX values weighed on pricing despite stronger crude.

At the time of writing, Oil prices are on course for a second weekly gain as tensions in the Middle East continue to climb; Brent crude was trading at USD93/bbl, with WTI at over USD90/bbl.

The PX-Naphtha spread continued to narrow, to around USD345/tonne, as PX demand was dented by weaker demand due to a greater than expected reduction in PTA operating rates post-holiday.

On the other hand, the PTA-PX showed steady improvement, reaching around USD90/tonne, up from the mid-70s before Golden Week.

The current PTA market finds itself relatively balanced, with few additional shutdowns expected and inventories at healthy levels.

However, as the polyester market transitions into the traditional low-season, lower polyester operating rates may lead to a gradual weakening in PTA fundamentals through the remainder of 2023.

By Friday, the PTA forward curve had moved into greater backwardation, with the Jan’24 contract increasing to a RMB 52/tonne discount to the current month; the May’24 contract was now at a RMB 84/tonne discount.

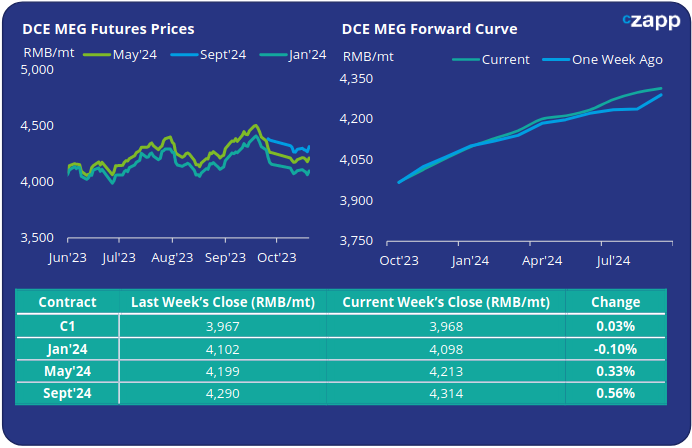

MEG Futures and Forward Curve

MEG futures were relatively flat last week, with a slight increase in some of the forward months later into 2024, as persistently high port inventories were weighed against a slowdown in domestic production.

Domestic MEG operating rates have seen reductions post-holiday and further decreases are expected into November, with shutdowns expected at CSPC and SHCCIG Yulin Chemical.

East China main port inventories were down around 6.7% to 1,057k tonnes last week. Despite the weekly decline, these elevated levels are expected to continue to pressure market sentiment through to year end.

However, robust polyester operating rates continue to support from the demand side, keeping MEG supply/demand delicately balanced at present.

The MEG forward curve remains in contango over the next 12-months. By Friday, the premium held by the Jan’24 contract over the current month remained relatively unchanged on the week at RMB 130/tonne.

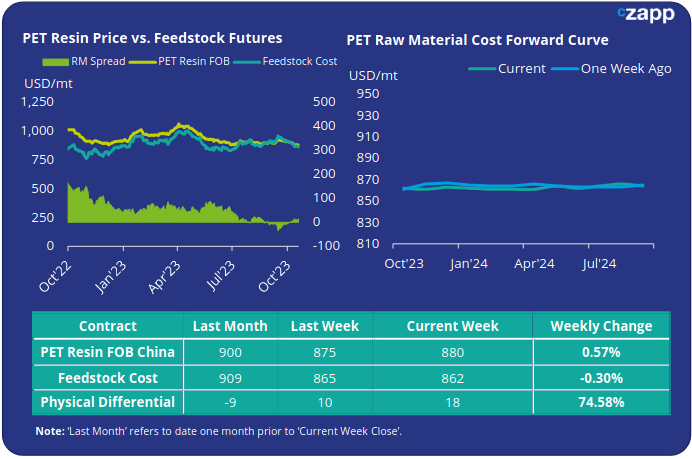

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices ebbed higher towards the back of last week, to average USD 880/tonne by Friday, up USD 5/tonne on the week.

The weekly PET resin physical differential also clawed by another USD 3/tonne to average USD 13/tonne for the week. By end Friday, the daily spread was USD 18/tonne.

This marks a major improvement from mid-September when the physical differential hit an all-time low of negative USD 36/tonne.

The raw material cost forward curve remains flat as a pancake through H1’24, with the most liquid contract months of January, May, and September 2024, all continuing to sit around USD 865/tonne.

Concluding Thoughts

Despite the massive new capacity additions in recent months, reduced supply due to maintenance shutdowns is helping fundamentals and the overall supply demand balance; further shutdowns are also planned.

Whilst we anticipate a low-margin environment in 2024, Chinese PET producers look to be treading a delicate path towards at least a partial recovery in the near-term.

The current flat raw materials forward curve suggests prices are likely to remain rangebound over the next 6-9 months, the bounds of which will be largely dictated by crude price volatility.

Current Chinese PET resin export price indications for Q1’24 remain at a relatively modest premium of USD 10-20/tonne over current spot levels.

Attractive fixed price levels are likely to garner increased export demand into key regions, such as Latin America, East Africa, and the Middle East.

European buyers in non-EU countries may also seek greater supply and price security following JBF’s announced shutdown in Belgium.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.