Insight Focus

- PTA futures fell sharply on the market re-opening, following Chinese holidays.

- Whilst PET export prices also dropped sharply, raw material spreads rebounded.

- Buying activity picked up, but resurgent crude prices may dampen bargain hunting.

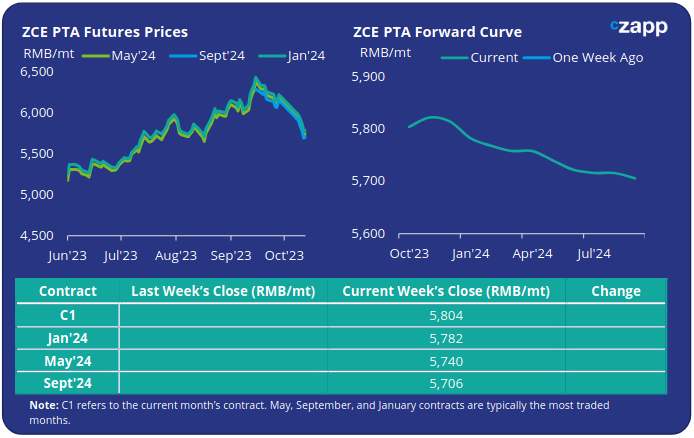

PTA Futures and Forward Curve

Following the recent oil price slump, crude prices showed modest gains early in the week, before a rally on Friday saw brent prices once again hit USD90/bbl.

The price rise was driven by a combination of stronger Chinese economic and manufacturing data, and the United States sanctioning two companies for breaching the Russian oil price cap.

PTA futures opened Monday down 3.8% versus the pre-Golden Week close; by Friday the futures had fallen a further 3.6%.

Although the PX-Naphtha spread has narrowed since mid-Sept, the Asia PTA-PX spread has clawed back around USD 10/tonne over the same period.

Despite poor polyester sales over the holiday period, reduced production and unexpected maintenance has keep the supply and demand situation relatively balanced.

Further ahead, fewer scheduled turnarounds and several major plant restarts, coupled with seasonal weakening of polyester demand, could lead to gradual inventory build-up through the remainder of Q4’23.

By Friday, the Jan’24 contract was at a slight RMB 22/tonne discount to the current month, with the forward curve continuing in modest backwardation through H1’24.

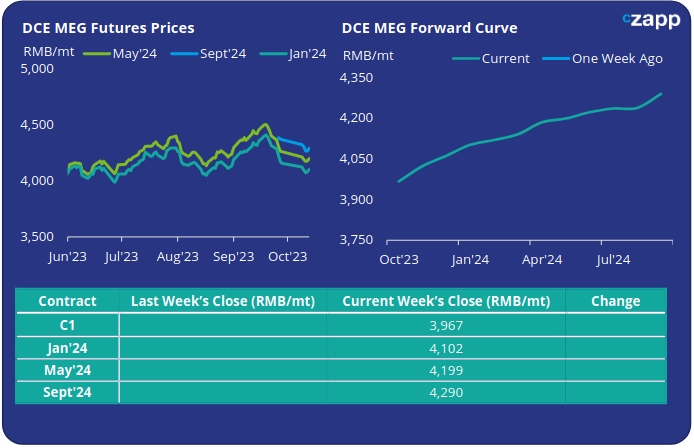

MEG Futures and Forward Curve

MEG futures also fell last week although not as sharply as PTA, dropping around 2% on the pre-holiday close, then staying relatively flat through the remainder of the week.

Despite a reduction in operating rates and scheduled maintenance shutdowns, high total inventory levels persist keeping MEG prices rangebound.

East China main port inventories swelled by around 6.7% to 1,101k tonnes last week, reversing declines seen in recent weeks, with daily offtake also falling sharply.

As anticipated, East China main port inventories have swelled over the last fortnight, up 2.9% on the week to over 1,133k tonnes. Daily offtake has also dropped sharply since beginning of September.

The MEG forward curve remains in contango over the next 12-months. By Friday, the premium held by the Jan’24 contract over the current month contract had expanded slightly to RMB 135/tonne.

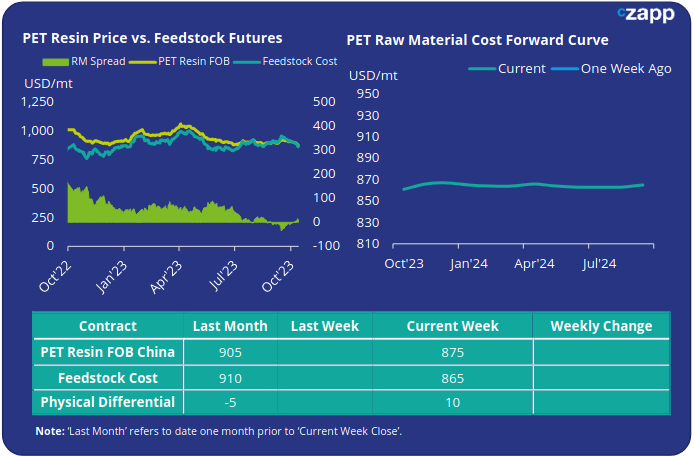

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices have fallen sharply post-holiday, dropping to average of USD 875/tonne last Friday, a new low point for the year.

Despite the drop in PET resin pricing, raw material cost decline faster meaning, the weekly PET resin physical differential saw a large increase of USD 18/tonne to average USD 10/tonne for the week.

This marked the first time since the end of August that the physical differential had been positive. By end Friday, the daily spread was USD 10/tonne.

The raw material cost forward curve remains flat through H1’24, with the most liquid contract months of January, May and September 2024, all sitting at USD 865/tonne.

Concluding Thoughts

The return to a positive premium may mark a turning point for Chinese PET resin producers; an indication that the weakest point of the year in terms of supply/demand balance may have been reached.

Export price indications for Q1’24 shipment have retreated to around to USD 900/tonne mark.

Recent price drops have stimulated additional demand with buyers rushing back into the market post-holidays; at the same time producers have reduced operating rates and moved lines into annual maintenance.

With crude prices looking set to recover into the USD 90/bbl, the window for bargain hunters already looks to be shutting, potentially putting the brakes on a further slide in PET resin export prices.

However, producers are likely to see buyer resistance to any increases in PET price due to current oil price uncertainty and a flat forward curve.

Inventory levels also continue to swell, and with downstream Chinese beverage factories beginning to enter the traditional maintenance period, stock levels are expected to constrain any effort for margin recovery.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.