Insight Focus

- CS Brazil sugar production could reach record highs this season.

- Sugar export nominations in October already stand at 3m tonnes.

- The waiting time to berth has reached 16 days.

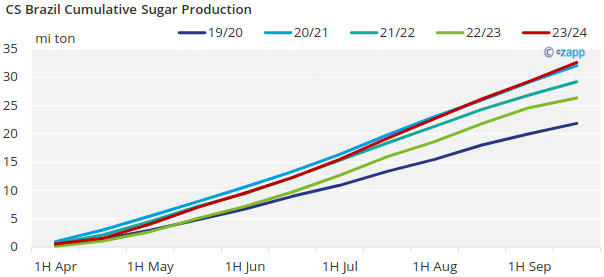

Centre South (CS) Brazil has made 32.6m tonnes of sugar to the end of September. This is a record for this stage in the cane harvest. Depending on weather from now on, mills in the region could potentially make close to 40m tonnes of sugar, a level never achieved before.

With production moving at such a strong pace, how have logistics been behaving?

All the images below are from our Brazil Port Logistics Dashboard, explore the data on Czapp.

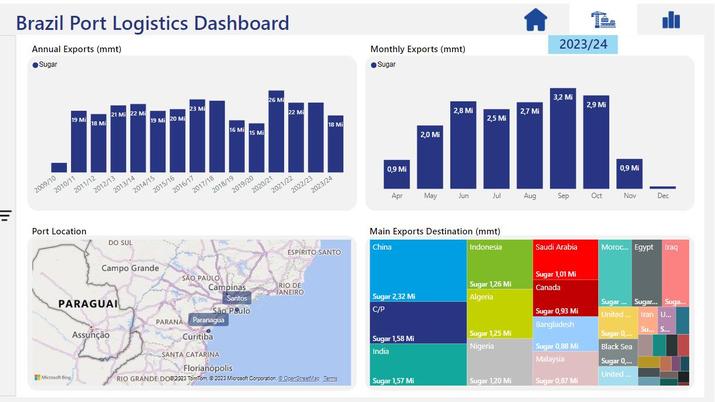

We believed that raw sugar elevation at Brazilian ports was limited to 2.7m tonnes a month. But exports exceeded this level in September. TAC (Copersucar), Tiplam and Pasa terminals exported more sugar than last year and the weather was drier, allowing for loading operations to be carried out without significant interruptions.

However, we cannot assume that the stars will line up as last month. The last line up update showed that in one week more than 1m tonnes of sugar was nominated, taking total nominations for October to 3m tonnes. We assume that the majority of the volume is related to the record October expiry. The waiting time to berth has risen to 16 days in October, resulting in a USD400k demurrage bill.

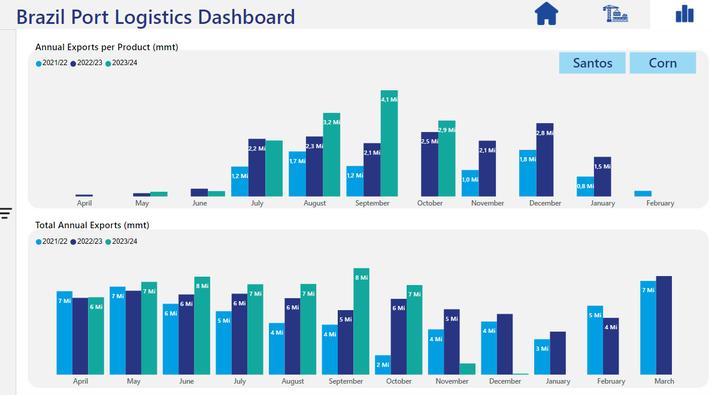

After a slow start in July, corn exports have been picking up. Last month 4,1m tonnes were shipped out of Santos (twice the volume registered last year) and 2.9m tonnes are already nominated for October – 16% higher than the volume exported in 2023.

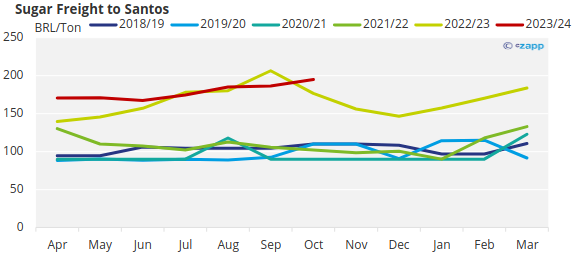

A higher volume of corn flowing to Santos means road freight competition with sugar, which has been reflected in freight values. In the first week of October, mills were reporting difficulty in finding trucks to go to Santos and freight values for Ribeirao Preto to the port rose around 5% – surpassing last year’s values. Additionally, an outstanding volume of soybean is still being shipped.

Sugar freight values should continue to climb in this last quarter of the year. Corn exports will remain strong until December and compete with sugar that needs to be shipped.

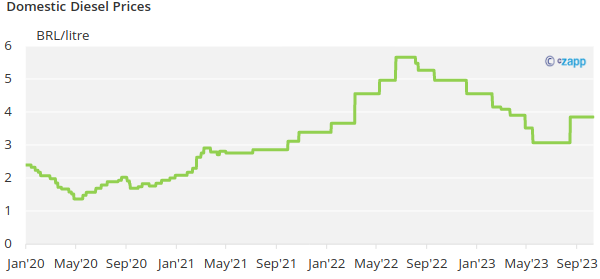

While the freight curve last year fell until December, it was more related to diesel price reduction than to volume of exports. Since diesel represents around 60% of freight rates, any change has a massive impact.

This year, diesel prices are already 12% below international prices. Unless the currency strengthens or oil prices come down, is hard to count on this variable reducing logistics costs.