Introduction

India is the world’s second-largest producer of sugar. It is also aiming to blend 20% ethanol in gasoline by 2025. This ethanol will be made from sugar cane and various grain feedstocks.

This means many Indian mills now have a choice about how they use the sucrose in the cane. We will show the choices they are making in this report.

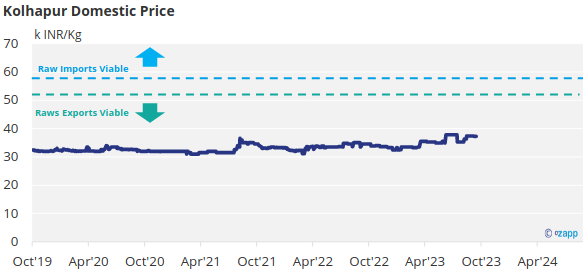

Maharashtra Sugar Imports/Exports

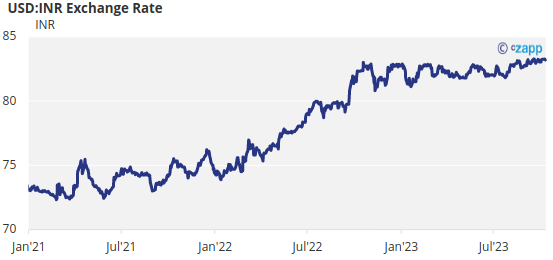

With domestic prices in Maharashtra currently at 37.3k IR/Kg, raw sugar exports are viable today.

However, the government has stopped issuing export quotas until they have a better understanding of this year’s crop, which means that no sugar will be exported.

At current world market prices and duty rates, raw sugar imports would only be workable at a local sugar price of INR 59/kg, 60% higher than today’s prices.

It’s unlikely the government will let sugar prices go this high, especially with a general election in May 2024, so raw sugar imports for domestic consumption would require some form of subsidy.

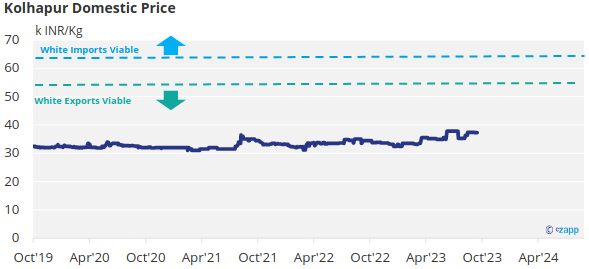

It’s a similar story for white sugar trade.

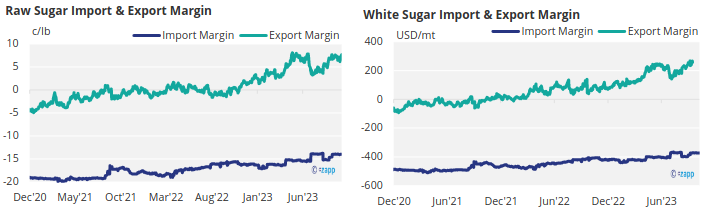

Here are the margins available for importing and exporting raw and white sugar.

Ethanol vs Sugar

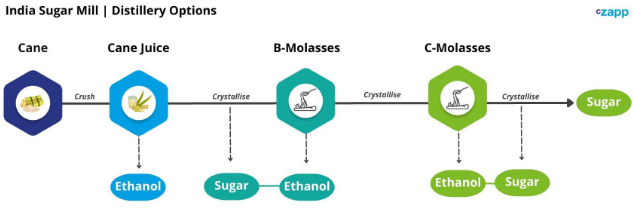

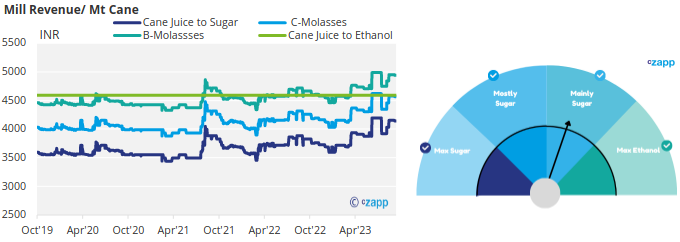

Distilleries can make ethanol directly from cane juice, or from higher-sucrose B-molasses or lower-sucrose C-molasses. Alternatively, the cane juice can be used to make only sugar with no ethanol output at all.

Many mills/distilleries have a choice over which feedstocks they use to make sugar or ethanol based on the relative prices of ethanol paid by the oil marketing companies.

At today’s prices, processors are most likely to choose to make ethanol from B molasses, which yields mainly sugar.

This means around 4-5m tonnes of Indian sucrose is being diverted to make ethanol currently, out of a total sucrose availability of around 33m tonnes.

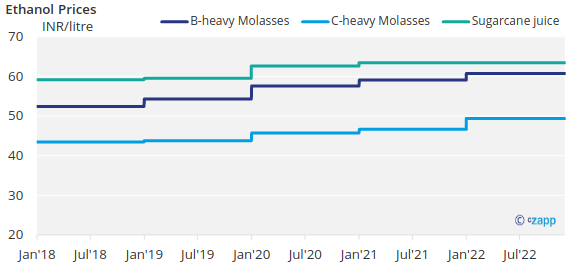

In the event of a cane crop shortfall, the government can change the ethanol prices paid to incentivise mills to use C-molasses, or to use cane juice exclusively for sugar production, reducing the ethanol diversion. Here are the current prices paid for ethanol by feedstock:

Appendix

If you have any questions, please get in touch with us at Jack@czapp.com.