Insight Focus

- UK minister says CBAM won’t be implemented in full.

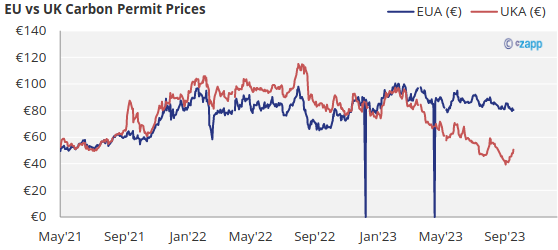

- UK carbon allowance price has fallen 50% to half the EU price.

- Exporters will face big bills to ship steel, cement to Europe.

The 50% drop in the price of UK emission allowances this year has so far failed to generate any response from the UK government, despite concerns among industry and environmental groups that the low price will expose UK industry to the European Union’s carbon border price from 2026.

Source: Intercontinental Exchange

UK green finance and energy efficiency minister Lord Callanan told a UK ministerial roundtable last week that the government does not believe the EU will proceed with the Carbon Border Adjustment Mechanism (CBAM), despite the system having been officially launched on October 1.

Sources who attended the meeting on October 6 said that the UK government views the CBAM as posturing by the European Union and that it will not proceed to the implementation phase from 2026 when importers of selected materials will need to pay the cost of certificates covering the carbon emissions generated in the materials’ production.

From October 1 to the start of 2026 importers are only required to report on the carbon content of their imports. From 2026 they will need to also buy so-called CBAM certificates, priced at the prevailing EU Allowance price, representing the greenhouse gas emissions “embedded” in imports of steel and iron, cement, fertilisers, aluminium and electricity.

Importers of these materials from countries where a carbon price is in place will be able to set that cost against the price of CBAM certificates and pay a discounted levy.

With UK carbon permits having traded at parity with EU Allowances up to last September, the CBAM did not then represent a potential cost to UK exporters. However, planned reforms to the UK market were first delayed, and later were judged to be less ambitious than the EU market’s upgrades, which led to a plunge in UK Allowance prices.

UK permits currently trade at around £44.00/tonne, while EU Allowances are trading at €80.50. Under a CBAM mechanism, this would require UK exporters of the selected materials including steel and fertilisers to pay the difference between the UK and EU prices.

Last week’s roundtable meeting saw industry representatives and environmental campaigners call on the UK to beef up its reforms to the UK ETS, to bring it into line with the EU market and so boost UK prices back to parity.

They also called on the UK government to renew their efforts to link the UK market to the EU system, bringing economies of scale and a larger, more liquid market back to the UK.

Britain was a participant in the EU ETS between its launch in 2005 and 2021, when it left the EU market after Brexit and set up the UK ETS. But key differences between the two markets’ design are driving prices apart and risk complicating an eventual linkage between the two systems.

The UK market currently lacks a supply management mechanism to mop up any surplus allowances and maintain a steady reduction in supply, which are essential to drive investment in clean alternatives. Together with a decision to boost supply by more than 50 million permits between 2024 and 2027, UK permit oversupply has grown, contributing to falling prices.